|

|

|

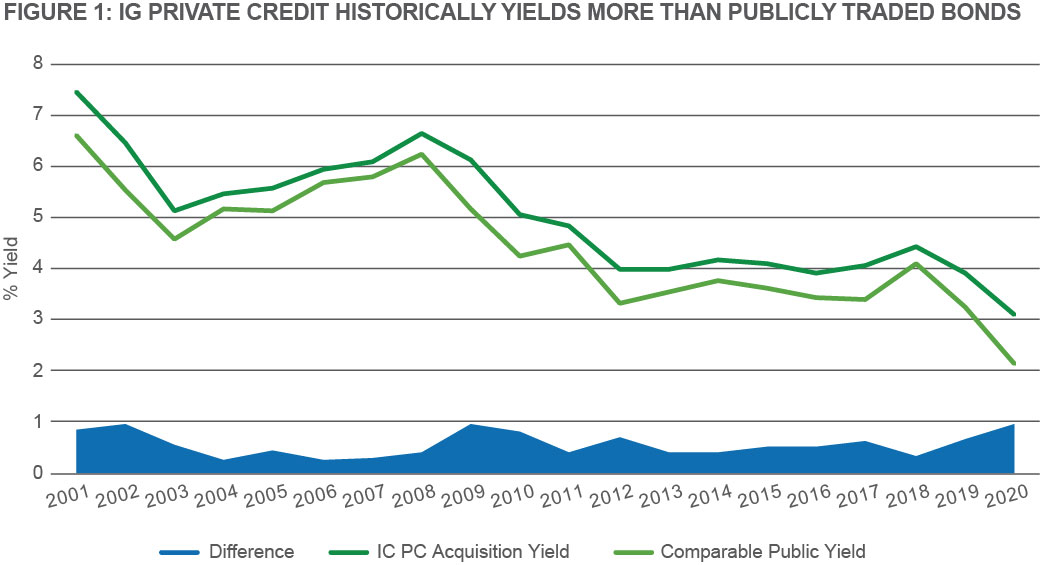

Source: Securian Asset Management, Inc., Factset and Merrill Lynch U.S. Corporate Master Index. As of 12/31/2020. Data spans from 12/31/2001 to 12/31/2020. IG PC Acquisition yield represents the weighted average acquisition yield of all securities purchased by Securian AM during each calendar year. Comparable Public Yield is the weighted average yield of all comparable public bonds to each security purchased by Securian AM in duration and sector (FIN, IND and UTIL). The public comparables were derived using Factset daily matrices beginning 09/01/2018, and Merrill Lynch U.S. Corporate Master Index spread matrix derived for the periods prior to 09/01/2018. For each year through 2008, this data includes all private placement securities and certain 144a structured securities purchased by Securian AM. The 144a securities were included because each security had a combination of one or more of the following characteristics that made them more similar to private placements rather than public bonds, lack of registration rights, collateral, covenants, non-DTC eligibility and/or amortization. Beginning in 2009, private placement securities include securities that are private placements only. |

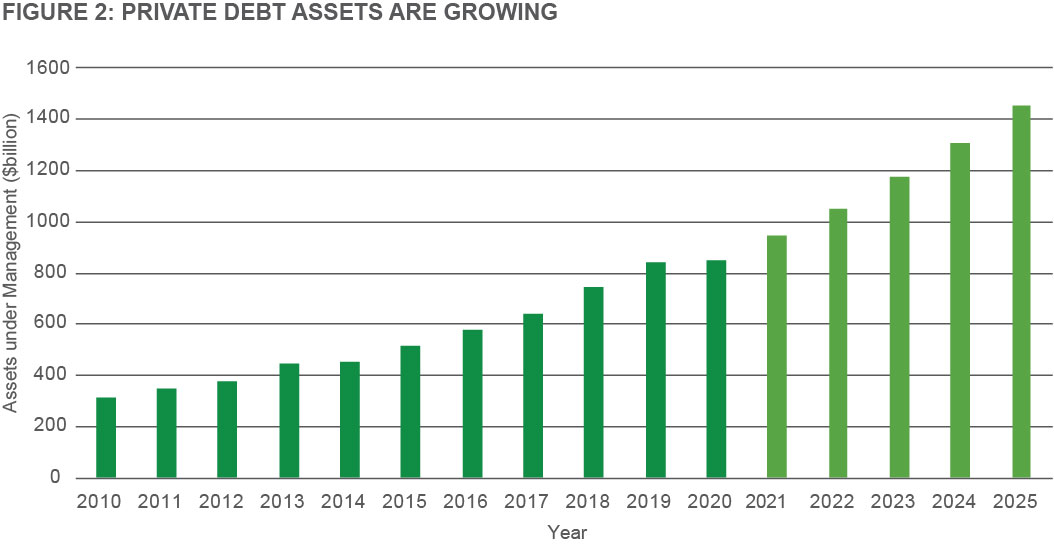

Institutional investors are looking for higher yields from their fixed income portfoliosFixed income investments are a large — and often the largest — asset class allocation in most institutional portfolios. For example, the Milliman 2020 Corporate Pension Funding Study shows that the fixed income allocation of the 100 largest corporate defined benefit pension plans in the United States averaged 49.1% of plan assets.1 A sizable allocation to core fixed income is generally a necessity for institutional investors that need liquidity and diversification. The Milliman study also noted that corporate defined benefit plans had an average expected rate of return of 6.5% for funding purposes.3 With publicly traded bond returns currently in roughly the 1% to 2% range, 2 these plans require double-digit returns from their remaining assets to achieve their funding goals - a difficult achievement to sustain over time, and one which generally requires taking on increased risk. Similarly, endowment funds must pay out approximately 5% of their average market value each year and lower yields will likely make it more difficult to reach that target. Investment grade private credit could provide a useful yield pickup over public bondsAs shown in Figure 1, investment grade private credit has historically delivered 0.4% to 1.0% higher yields than publicly traded bonds — at comparable levels of credit risk. Institutional investors seeking these higher yields have been migrating into private credit (both investment grade and other forms), which is expected to grow about 11% per annum for the next four years (Figure 2).4 |

|

Source: Preqin, Future of Alternatives 2025 as of 10/01/2020. 2020 figure is annualized based on data to October. 2021-2025 are Preqin’s forecasted figures. |

The investment grade private credit yield advantageThe IG private credit yield advantage stems from two key sources:

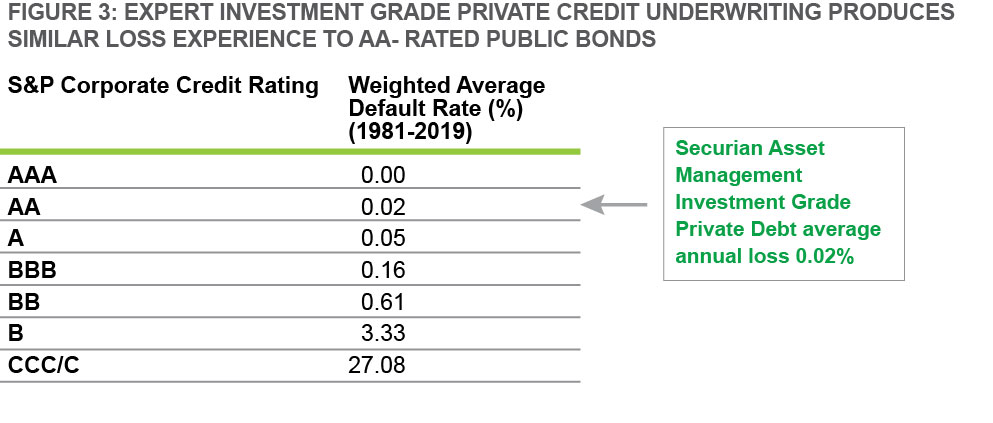

Because IG private credit is not publicly traded, it is less liquid than public bonds (although a secondary market does exist). In return for this reduced liquidity, investors require a higher yield. Given the lower liquidity, most institutional investors use IG private credit as a complement to their liquid core fixed income portfolio, not as a substitute, and typically hold their positions to maturity. An IG private credit portfolio constructed with a custom duration maximizes the liability-matching requirements of some institutional investors, such as life insurance companies and pension plans. Negotiated private credit covenants are also additive to the total return. IG private credit contains covenant packages and/or security that help limit downside risk, allowing institutional investors to hold the assets to maturity. Such covenants may include seniority in the capital structure, limits on leverage, restrictions on asset sales and requirements to maintain minimum coverage ratios. Issuers of IG private credit appear willing to accept such covenants in exchange for access to long-term capital tailored to meet their needs. Covenant packages generate additional income through waiver or amendment fees, increased interest, and prepayment fees. In our experience, such additional income has averaged approximately 30 additional bps per annum.5 The underlying covenants and security offered in IG private credit also offer downside protection, as discussed below. IG private credit risk can be strictly containedInvestment grade private credit risk is tightly managed at both the individual bond level and the portfolio level. Strict underwriting is essential to ensure strong protection. An experienced team, including credit analysts and dedicated legal staff, is necessary to ascertain the creditworthiness of each issuer; to correctly price the credit and its unique provisions; and to properly structure the bond covenants. Covenants provide protection via “early warning” steps such as limiting leverage and protection from event risk. A well-constructed portfolio of IG private credit could result in very low loss rates. As there is no standard benchmark index for IG private credit, a strong portfolio can be built based on portfolio needs and underwriting requirements. In our own experience at Securian AM, our IG private credit loss rate since 2003 has averaged only 2 bps per year — essentially equivalent to the loss rate on AA-rated public bonds (Figure 3).6 |

|

Source: “Default, Transition, and Recovery: 2019 Annual Global Corporate Default and Rating Transition Study,” S&P Global Ratings, April 29, 2020, ttps://www.spglobal.com/ratings/en/research/articles/200429-default-transition-andrecovery-2019-annual-global-corporatedefault-and-rating-transition-study-11444862. Securian Asset Management, Inc., average annual loss data as of December 31, 2020. |

|

In the event that a default occurs, private credit holders typically receive higher recoveries than public bondholders. This stronger outcome is due both to private credits’ contractual seniority in the issuer capital structure as well as the strong covenants in IG private credit. A well-diversified IG private credit portfolio provides additional risk protection. Investment grade private credit issuers come from all major industries, both domestic and foreign, allowing an institutional investor to build a well-diversified portfolio. Many issuers do not issue public bonds, so a private credit portfolio also diversifies an institution’s overall fixed income portfolio. An IG private credit portfolio can also be diversified by tenor and other structural factors. Private credit managers are not constrained by index allocation weights. Unlike corporate bond indices, which give indexers the perverse incentive to raise exposure to the largest — and usually most levered and risky — issuers, IG private credit managers need not measure their portfolios against any benchmark sectors or borrower weights. IG private credit managers are free to build their version of an optimal portfolio to meet an investor’s needs. IG private credit doesn’t face the “fallen angel” forced selling issueWhen IG public bonds are downgraded below a BBB rating, forced selling can cause immediate sharp mark-to-market valuation declines. The investment guidelines for most publicly traded bond portfolios, such as those for index funds, require the investment manager to sell a bond whenever the issuer fails to maintain a required minimum credit rating. In the case of publicly traded bonds that fall below investment grade — the so-called “fallen angels” — such forced selling to opportunistic high-yield bond managers often causes the market price of the bond to fall dramatically. Institutional investors holding these fallen angels can incur significant losses upon the next mark to market. In one recent study, the performance drag between fallen angels and investment grade bonds in the first half of 2020 was as much as 1300 bps.7 By contrast, IG private credit is not subject to forced selling. In addition, as a private asset class, IG private credit is generally marked to market monthly rather than daily, resulting in much smoother changes in valuation. The “sweet spot” for investment grade private credit transactionsAn investment manager willing to invest $40-$100 million in an IG private credit transaction on behalf of its clients is in the “sweet spot.” A manager can assemble a well-diversified portfolio via such mid-sized investments, where the manager can take all of a mid-sized bond opportunity or can participate meaningfully as one of a number of investors in a much larger transaction. The manager can also take advantage of smaller opportunities that attract fewer lenders, thus potentially obtaining even better terms for its clients. Access to new investments is a key requirement for building well-diversified IG private credit portfolios. A manager making mid-sized allocations is large enough to be called by investment bankers seeking lenders for their corporate clients, by private equity managers seeking financing for their portfolio companies, and by peers offering exclusive access to club deals. An established network of investment bankers, private equity managers and peers, along with a solid reputation for efficient and fair practices, is essential to move from potentially being called to definitely being invited to a seat at the table for a new private bond issue. IG private credit managers with a financial institution parent have a real advantage. For example, at Securian AM our IG private credit clients invest alongside Securian Financial Group, Inc., benefitting from our parent’s consistent presence in the market and its favored access to attractive transactions. This also ensures a strong alignment of interests with our clients. Investing in the “sweet spot” allows customized portfolios to meet specific client needs because of the large number of opportunities managers can access when they make placements in the mid-range. For example, a portfolio for pension funds with long-term liabilities can be assembled to have longer duration, while a shorter duration portfolio can be customized for property and casualty insurers whose liabilities tend to be much shorter. Institutional investors with liquidity needs can still benefit from a complementary allocation to IG private creditInstitutional investors can generally set aside a portion of their portfolios for less liquid investments. With the possible exception of a pension plan or other institution that is being liquidated, most institutional investors do not require 100% liquidity. After covering their liquidity needs with an allocation to core fixed income, it may make sense for them to benefit from the illiquidity premium included in IG private credit yields through a complementary allocation. The lower liquidity of IG private credit is partially offset by the higher income it generates. Institutions needing a long-term reliable stream of current income may therefore be well-served by holding IG private credit to maturity. We have seen life insurers use this approach for many years. For these reasons, we recommend IG private credit be viewed as a “buy and hold” mandate even though there is an active secondary market for well-covenanted issues. A well-managed IG private credit allocation could add value to most institutional portfoliosBuying and holding investment grade private credit to maturity could provide a reliable income stream that can complement a core fixed income portfolio and help meet almost every institution’s needs:

Most institutional investors can reap these benefits by working with a skilled, experienced IG private credit investment management organization that includes solid underwriting and legal talents and access to a well-developed deal sourcing network. |

| Sources: 1. Wadia, Zorast; Perry, Alan and Clark, Charles. “2020 Corporate Pension Funding Study.” Milliman White Paper, April 2020.2. As of January 8, 2021, the yield on the Bloomberg Barclays US Aggregate Bond Index was only 1.21% and the yield on the Bloomberg Barclays US Corporate Triple-B-rated Index was 2.14%. Source: Wall Street Journal.3. Sielman, Rebecca. “2020 Public Pension Funding Study.” Milliman White Paper, December 2020.4. Preqin, Future of Alternatives 2025.5. Source: Securian Asset Management, Inc.6. “Default, Transition, and Recovery: 2019 Annual Global Corporate Default and Rating Transition Study,” S&P Global Ratings, April 29, 2020,7. Scozzafava, Bernie. “Despite Some Fallen Angels, Corporate Bond Investors Have Heaven on Their Minds.” Parametric August 3, 2020, Sources: Securian Asset Management, Inc, Bloomberg, Factset, Merrill Lynch U.S. Corporate Master Index, Milliman, Wall Street Journal, Preqin, S&P Global Ratings, Parametric, Bloomberg. |

|

Securian Asset Management, Inc., a subsidiary of Securian Financial Group, Inc., is an Associate member of TEXPERS. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this article has been developed internally and/ or obtained from sources believed to be reliable; however, Securian Asset Management, Inc., does not guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Any forward-looking statements speak only as of the date they are made, and Securian Asset Management, Inc., assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated. This material may not be reproduced or distributed without the express written permission of Securian Asset Management. Follow TEXPERS on Facebook, Twitter and LinkedIn as well as visit our website for the latest news about Texas' public pension industry. |

Jun

29

Share this post: