Event Organizers Recruiting Roster of Industry Thought Leaders for Professional Development

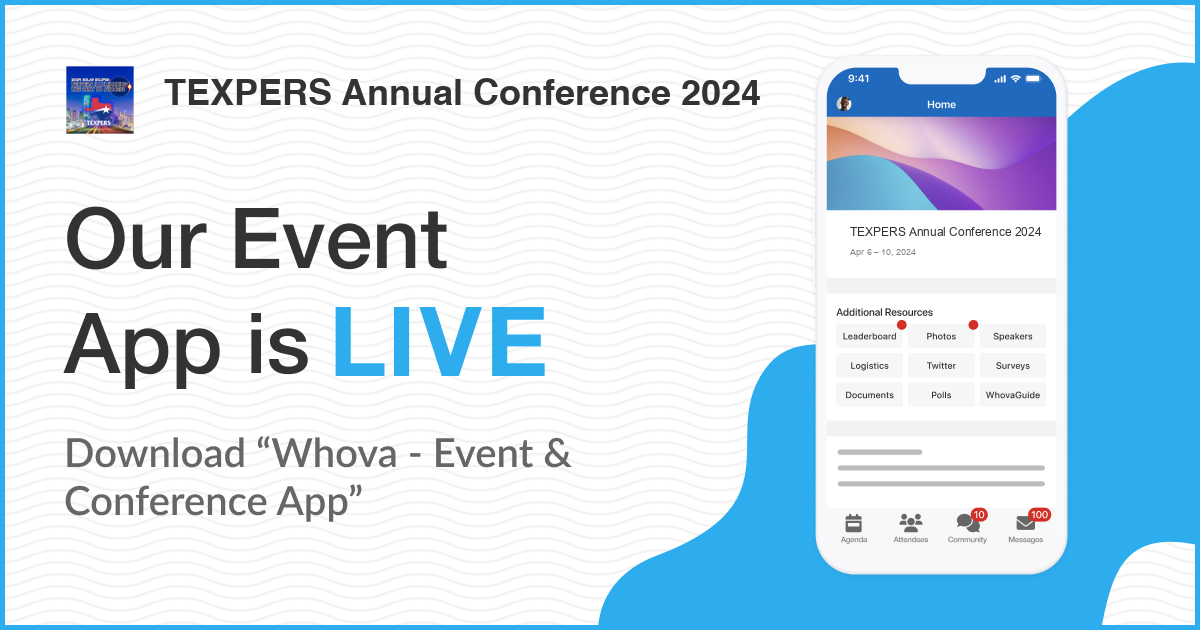

Among the distinguished speakers for the TEXPERS 2024 Annual Conference, April 7-10 in Dallas, Texas, one name shines brightly in economic analysis: Mariam Yousuf, Business Economist at the Federal Reserve Bank of Dallas. Scheduled to take center stage on April 10, 2024, from 10 to 10:35 a.m. in the Reunion Ballroom on the Lobby Level, Yousuf will deliver an economic update, drawing from her expertise in dissecting regional economic dynamics.