Since mid-January risk markets have experienced elevated volatility and weakness due to fears of the Fed’s tightening policy. Market segments with the highest valuations and most perceived sensitivity to rates have suffered the worst, as many investors took gains after a sustained post-pandemic run. While it is important to not overreact to short-term swings, it’s also important to assess possible downside moves from here based on both technicals and fundamentals.

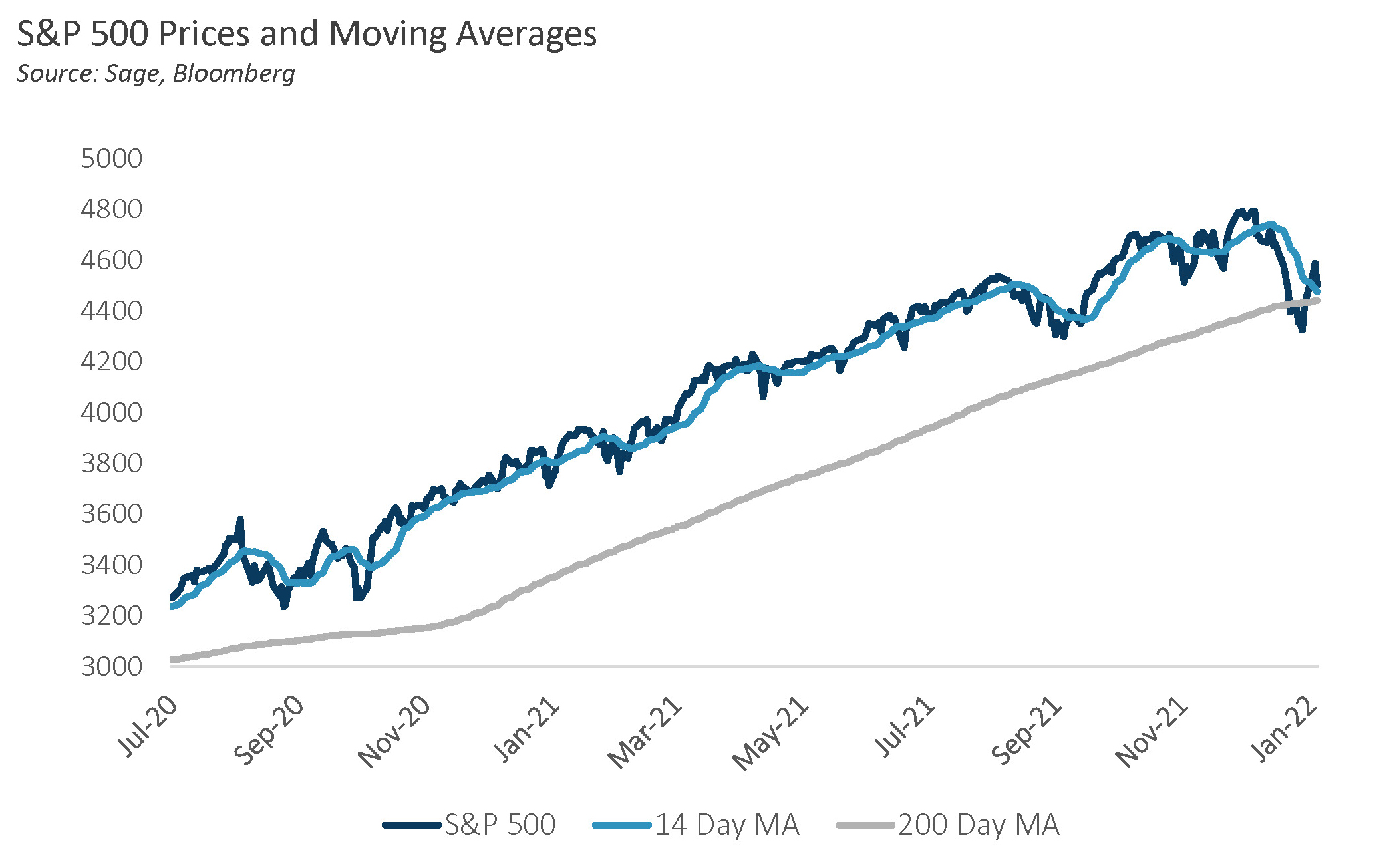

From a technical perspective, the S&P 500 briefly pierced trend level, possibly signaling a further drop if it can’t hold in the coming days. Major support around current levels suggests positive momentum if the S&P 500 can hold and move above 4,500. If the price doesn’t hold, technical support levels from here are 4,230 and 4,060 (which would be further downside of 6% and 10%).

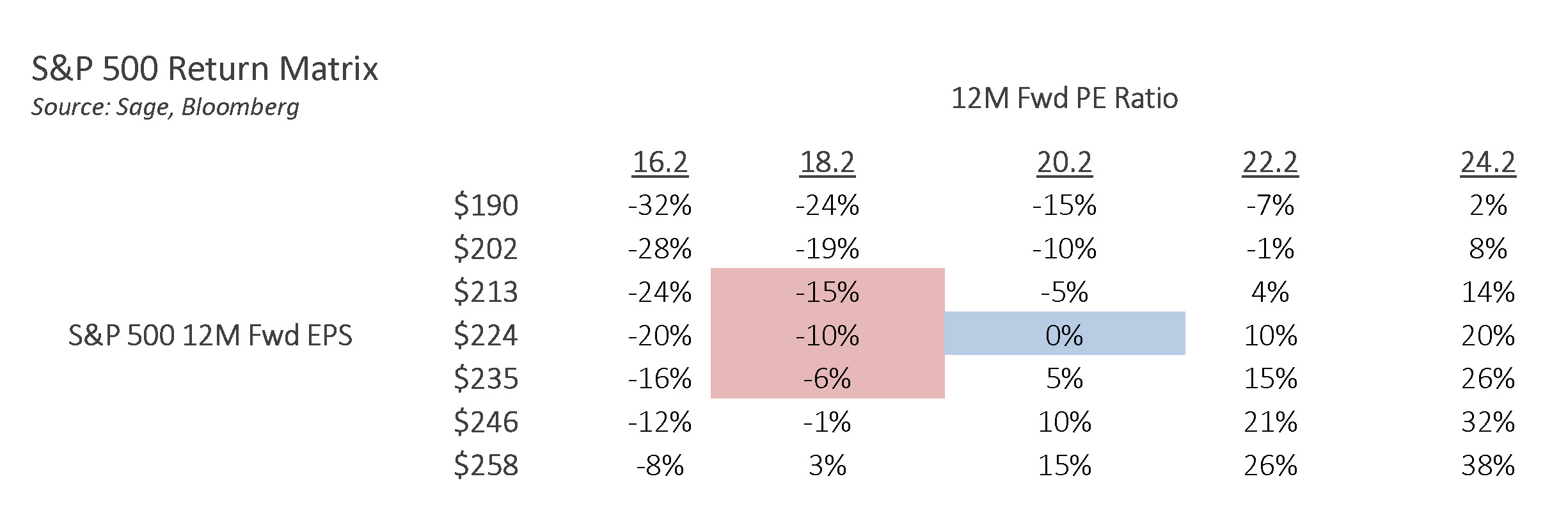

From a fundamental perspective, we find an earnings and price-to-earnings (P/E) matrix useful in looking at possible scenarios. Current pricing around 4,500 (highlighted in blue below) has the S&P 500 trading at a 20.2 forward multiple based on forward earnings of $224. If markets begin to demand more attractive valuations due to macro risks and/or expected earnings disappointments caused by inflation and higher rates, we can see the corresponding downside vs. current pricing under various scenarios. Our view is that clearly, another 5% to 10% downside is easily possible given momentum, technical indicators, and macro concerns, but at that point we would see value and expect some upside opportunities.