The Case for U.S. Hydrocarbons During Today's Energy Crisis

It’s hard to miss recent news headlines about the “global energy crisis.” Resilient global demand and a lack of sufficient available supply have created an energy crunch that has pushed up global energy prices. Soaring oil, natural gas, and coal prices are happening just as the winter heating season approaches in the Northern Hemisphere and as rising inflation poses an increasing risk to global economic growth.

In our opinion, the current energy crunch highlights an important reality—the transition to renewables as the main source of power generation will take decades, requiring significant investment to overcome the intermittency of wind and solar power. In the meantime, the world will need affordable and reliable energy for critical functions—access to heating in the winter can literally mean life or death. We believe U.S. hydrocarbons are the single most compelling source of affordable and reliable energy, not only in the U.S. but also globally. Here are three reasons why.

U.S. HYDROCARBONS ARE ARGUABLY THE WORLD’S MOST AFFORDABLE TRADITIONAL FUEL SOURCE

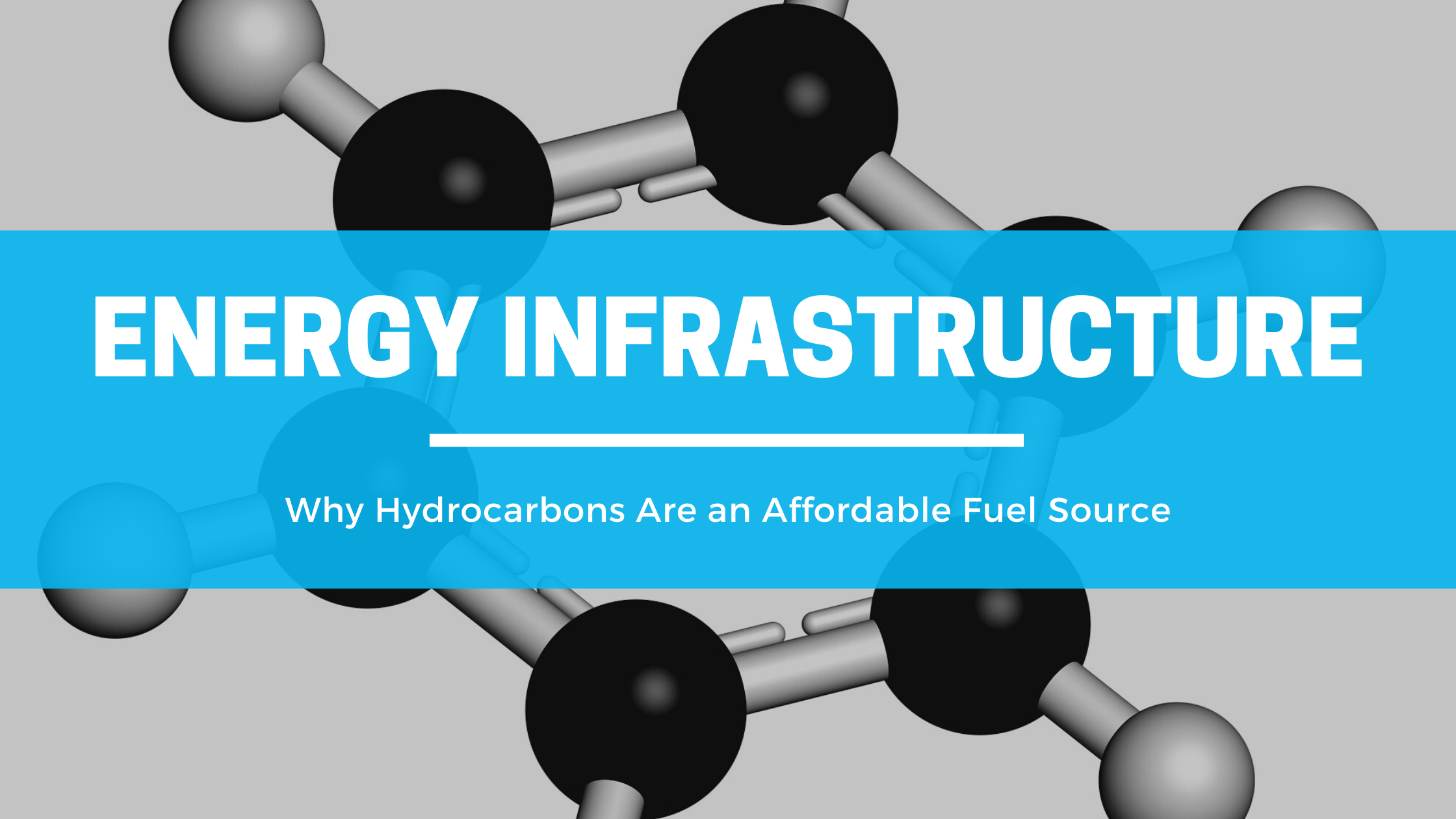

The U.S. has large quantities of natural resources and today is a net exporter of both petroleum and natural gas. An important attribute of U.S. oil production is its cost advantage. Many OPEC members—primarily those in the Middle East—use proceeds from their state-owned oil assets to balance fiscal budgets. Each year, the International Monetary Fund (IMF) estimates the price of oil needed for these countries to pay for their social programs and balance their budgets. As the chart below shows, these prices can vary widely but they tend to be between $60-$80 per barrel (/bbl) for most of the larger producers—most notably $76/bbl for Saudi Arabia.

U.S. producers, on the other hand, drill for profitability. Their break-even prices for wells drilled—the amount per barrel they must charge to cover costs—are much lower than the fiscal break-even prices of the state-sponsored exporters in the chart above. Most producers in the top-tier U.S. shale regions can profitably drill at prices as low as $50/bbl.

THE U.S. HAS A VAST ENERGY INFRASTRUCTURE NETWORK

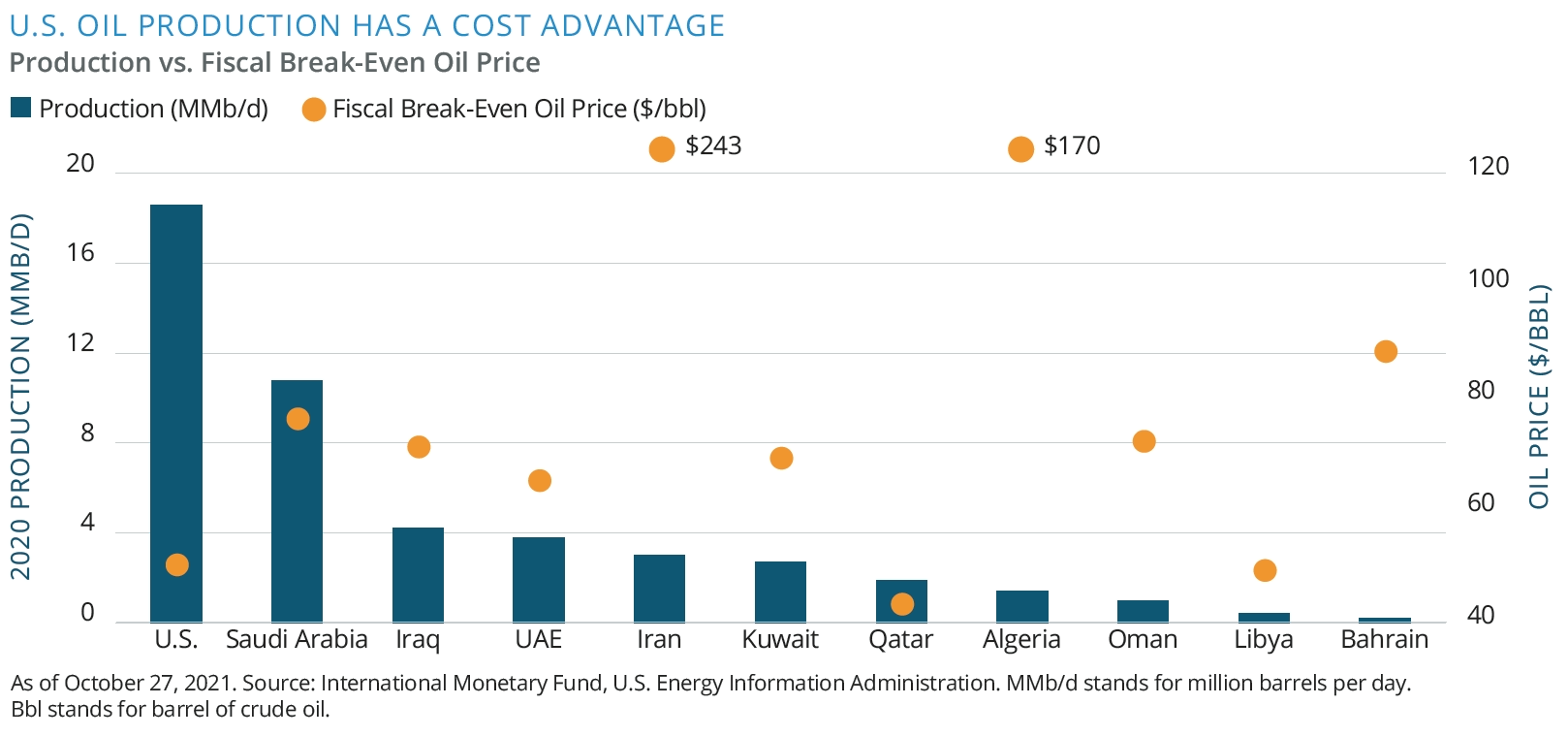

In addition to its natural and economic resources, the U.S. also possess an enviable infrastructure advantage. In fact, as illustrated below, the U.S. has well over 2 million kilometers of hydrocarbon pipelines underground, compared to just 11,000 for Saudi Arabia and 250,000 for Russia, the next two largest global producers.

This infrastructure advantage makes the U.S. an attractive global supplier, offering more reliable supply. The U.S. pipeline network covers vast regions of the country and can provide multiple outlets from virtually any basin into ports and docks across the country. This vast energy network is partly why numerous international counterparties over the last several years have been attracted to helping build out the U.S.’s liquefied natural gas export facilities, so much so that the U.S. has become the predominant source of new liquified natural gas (LNG) supply in recent years.

THE U.S. IS A FRIENDLY PARTNER FOR GLOBAL ECONOMIES

U.S. producers, on the other hand, drill for profitability. Their break-even prices for wells drilled—the amount per barrel they must charge to cover costs—are much lower than the fiscal break-even prices of the state-sponsored

pipeline network covers vast regions of the country and can provide multiple outlets from virtually any basin into ports and docks across the country. This vast energy network is partly why numerous international counterparties over the last several years have been attracted to helping build out the U.S.’s liquefied natural gas export facilities, so much so that the U.S. has become the predominant source of new liquified natural gas (LNG) supply in recent years.

Energy exporting countries stand to benefit monetarily from favorable fundamentals and high prices, but controlling the resource offers geopolitical benefits as well. It enables the leaders of oil-exporting countries (in many cases, effective authoritarians) to exercise geopolitical influence. It’s no wonder, then, that we have seen recent Bloomberg News headlines like: “Russia Offers to Ease Europe’s Gas Crisis, With Strings Attached.” The U.S., a democracy, can arguably be considered a friendlier global partner.

Geopolitics can also significantly affect supply reliability and prices. The most notorious recent example of this: the September 2019 drone attack on the Abqaiq and Khurais oil processing facilities in Saudi Arabia. The immediate response to the attack was a 20% surge in crude oil prices, the largest surge since the 1990 Invasion of Kuwait.[1] Two weeks later, Bloomberg News reported that output was still a staggering 1.8 million barrels per day below pre-attack levels. In addition to these attacks, in recent years, several oil tankers have been attacked or seized in the Strait of Hormuz—a conduit for one-fifth of the world’s oil exports.[2]

These actions highlight a stark contrast to the stability of the U.S. infrastructure base and the Gulf of Mexico. The U.S. is not immune to issues that can cause temporary regional dislocations; consider recent hurricanes and the Colonial Pipeline cyberattack. Yet the country’s relative geopolitical stability along with its breadth of resources and associated infrastructure usually limit the adverse impacts of those events.

THE INVESTING IMPLICATIONS

Today’s energy crunch illustrates the fallacy of various efforts in recent years to hinder oil and gas infrastructure development with the aim of reducing reliance on traditional fuel sources. The world is now experiencing a moment of reckoning that indicates that if you keep a U.S. barrel in the ground, that barrel is still needed; you just have to get it elsewhere at a higher price. Due to its affordability, infrastructure and geopolitical advantages, the U.S. remains a crucial global supplier of hydrocarbons, and we believe stakeholders in global economies that recognize these advantages should act logically to incentivize U.S. producers to grow market share over time. Such an outcome would be beneficial to energy infrastructure companies that collect, move and export U.S. oil and gas.

ABOUT THE AUTHORS:Boran Buturovic – Director, Portfolio Manager, Energy Infrastructure Securities Boran Buturovic has 12 years of industry experience and is a Portfolio Manager on the Public Securities Group's Energy Infrastructure Securities team. He is responsible for conducting MLP and infrastructure research and analysis. Prior to joining the firm in 2014, he was an Associate with UBS Investment Bank, focusing on midstream and MLPs. Boran started his career with Ernst & Young in their Assurance practice. Boran holds a CPA license in the state of Texas and he earned Bachelor of Business Administration and Master in Professional Accounting degrees from The University of Texas at Austin. Joe Herman – Director, Portfolio Manager, Energy Infrastructure Securities Joe Herman has 12 years of industry experience and is a Portfolio Manager on the Public Securities Group's Energy Infrastructure Securities team. He is responsible for conducting MLP and infrastructure research and analysis. Prior to joining the firm in 2014, he was an Equity Research Associate with Tudor, Pickering, Holt & Co., focusing on midstream and MLPs. Prior to that, he was an Investment Banking Analyst at UBS Investment Bank. Joe earned a Bachelor of Business Administration degree with majors in Business Honors and Finance and a Bachelor of Arts degree with majors in Plan II Honors and History from The University of Texas at Austin. DISCLAIMER: Brookfield Public Securities Group is an Associate Member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of TEXPERS nor Brookfield. These views are subject to change.