From their peak earlier this year, the spot trucking rates have been in decline, marking a shift versus prior years. Given how impactful the inflation in shipping costs had been across the broader economy from 2020 to 2022, the recent change in trend has widespread implications for many companies.

Freight Rates Declining

Trucking is the largest input into shipping costs across the U.S. economy and accounts for an estimated 80% of total freight spending, according to the American Trucking Association.

For the goods that need to be shipped immediately by truck, the spot trucking rate serves as the prevailing price that shippers and trucking providers agreed upon. Changes in spot rates are impacted by a supply/demand imbalance of goods needing to be shipped, the available trucking capacity to do so, and fuel prices. A sustained change in the direction of spot rates historically has proved to be a leading indicator of the change in the direction of contractual rates as well.

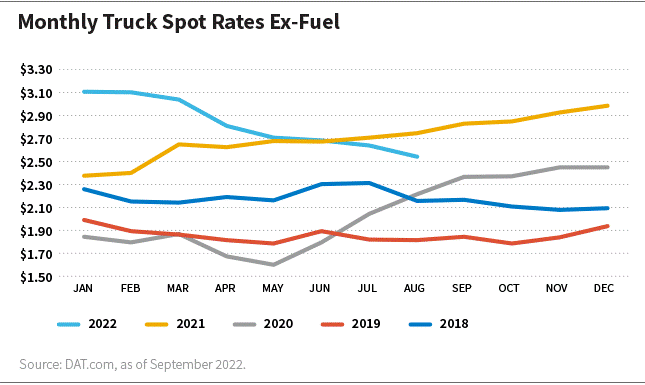

According to DAT Freight and Analytics, trucking spot rates increased by more than 100% from their trough in May 2020 to their recent peak in January 2022 (both including and excluding the cost of fuel), making trucking a major component of overall freight cost inflation for the U.S. economy.

In the first quarter of 2022, trucking spot rates were tracking up as much as 20% to 30% year-over-year, but they have been falling sharply since then. On a percentage basis, spot rates are now tracking down in the high single digits year-over-year and down in the high teens when excluding the cost of fuel.

Despite a significant appreciation in diesel prices in 2022, which has curtailed some of the trucking cost declines, we expect spot rates to continue to trend lower year-over-year. Even if the current cost of diesel (around $5.10 per gallon versus $3.35 a year ago) holds steady, year-over-year trucking spot rates are on track to be down in the high single digits year over year in the third quarter and down mid-teens to low-twenties on a percentage basis in the fourth quarter of 2022.

Looking ahead to 2023, the first quarter could see rates down more than 20%, based on our estimates. Excluding the cost of fuel, the year-over-year declines would be even more dramatic, potentially down more than 25% in the first quarter of 2023. All in, we believe trucking spot rates could fall 25% to 35% from their peak in early 2022 to their trough, potentially by the end of 2023.

What’s Going On?

Unlike in normal boom-and-bust trucking cycles, the initial downtick in trucking spot rates in 2022 appears to have been mostly demand-driven. Normally, there is an influx of trucking supply that is chasing higher rates, within 6 to 12 months of the initial rate increases. However, this time, based on recent publication of new truck sales and orders from ACT Research, it appears that trucking supply had been growing at much more modest rates than in prior cycles, until recent months, when new truck sales began to accelerate.

To understand these supply-demand dynamics, recall that over the past two years we saw a surge in freight-cost inflation driven by a number of factors. An overall increase in consumer income from stimulus checks, coupled with a strong recovery in employment, drove consumer goods demand to record highs. During the pandemic much of that spending shifted away from services, like travel, concert attendance, and restaurant dining, and toward goods, like furniture, electronics, and home improvement products. As a result, retailers rushed to restock their shelves to meet the unexpected surge in demand, starting in the summer of 2020. However, the additional trucking supply needed to transport these goods was not available, as production of heavy-duty trucks was constrained by a shortage of parts, including semiconductors (as we saw in the automotive industry as well). This combination led to a significant increase in spot rates over the past two years.

According to ACT Research, recent months have shown an uptick in new truck sales above normal replacement levels, yet the order backlogs for original equipment manufacturers (OEMs) remain stretched, indicating further potential supply that could be added to the market, which may help relieve the cost pressures. In addition, if consumer spending were to “normalize” to the pre-COVID mix of consumption between goods and services, an incremental 10% to 20% of freight demand could be removed from the system. This would further help alleviate the recent freight cost pressure for the shippers, especially if the supply of new trucks continues to grow.

Investment Implications

It’s important to note that demand for trucking is more volatile than the overall economy due to the “bullwhip effect” of inventory movement. Therefore, not every downturn in freight demand necessarily leads to a broader economic recession. However, it does typically coincide with at least decelerating gross domestic product (GDP) growth, as inventories transition from being additive to GDP to being neutral or detracting, as seen in data from the first and second quarters of 2022.

Moreover, in our opinion, the fall in spot rates should meaningfully curtail the pricing power of transportation providers in the second half of 2022 and 2023, and that could benefit shippers by reducing their costs. For companies with stable revenue streams unaffected by swings in consumer and industrial demand, margin relief from falling transportation costs should begin in the second half of 2022 and carry into 2023.

About the Author: Yan Krasov, CFA, partner, is a research analyst at William Blair Investment Management. He focuses on U.S. large-cap industrials and healthcare companies. Before joining William Blair in September 2006, Yan spent four years at JPMorgan Securities in Chicago, where he began his career in the firm’s institutional equity sales and private client services groups. He is a member of the CFA Institute and the CFA Society Chicago. In addition, he holds the SASB Fundamentals of Sustainability Accounting (FSA) credential. Yan received a B.S. in speech and economics from Northwestern University and an M.B.A. from the University of Chicago’s Booth School of Business. Disclaimer: William Blair is an Associate Advisor Member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of William Blair or TEXPERS. These views are subject to change.

About the Author: Yan Krasov, CFA, partner, is a research analyst at William Blair Investment Management. He focuses on U.S. large-cap industrials and healthcare companies. Before joining William Blair in September 2006, Yan spent four years at JPMorgan Securities in Chicago, where he began his career in the firm’s institutional equity sales and private client services groups. He is a member of the CFA Institute and the CFA Society Chicago. In addition, he holds the SASB Fundamentals of Sustainability Accounting (FSA) credential. Yan received a B.S. in speech and economics from Northwestern University and an M.B.A. from the University of Chicago’s Booth School of Business. Disclaimer: William Blair is an Associate Advisor Member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of William Blair or TEXPERS. These views are subject to change.