2020 Developments in Securities Litigation Outside the US

While the world may have been on lockdown for most of 2020 due to the global COVID-19 pandemic, there were significant developments in non-U.S. securities litigation.

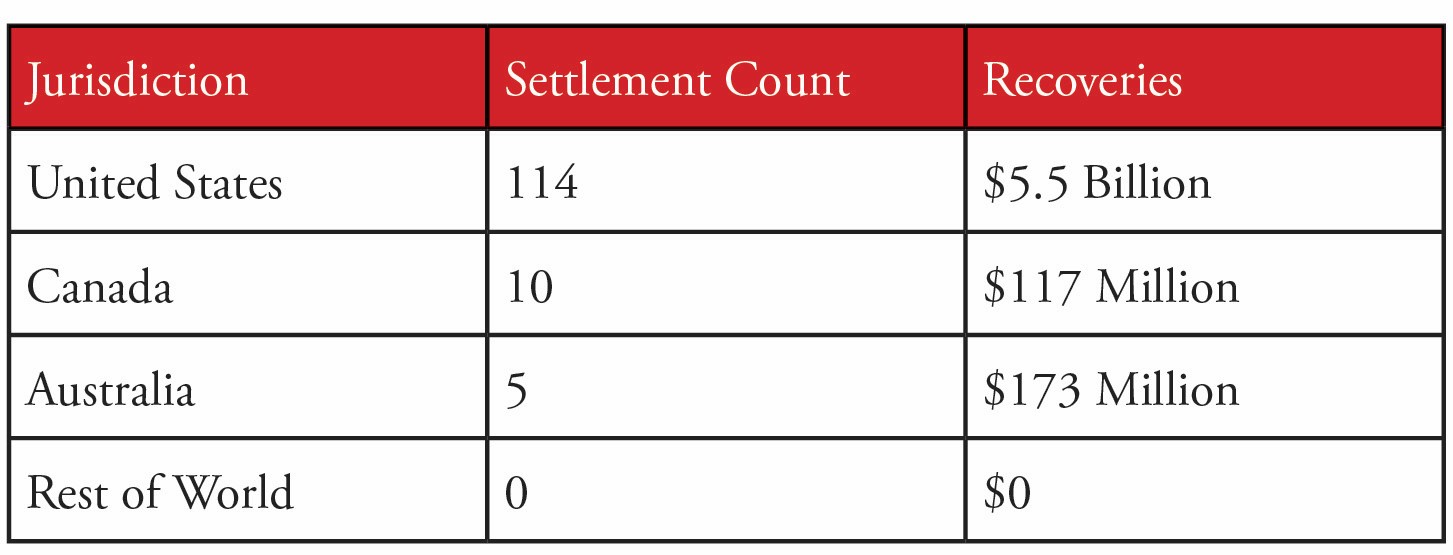

First, an overview of 2020 securities settlements provides important context:

As in prior years, the vast majority of securities litigation occurs within the United States, and investors should not focus on ex-U.S. litigation to the exclusion of U.S. litigation.

And, while Canada and Australia continue to be the primary jurisdictions outside the U.S. with the next-greatest cases filed and next-highest recoveries, the big surprise in 2020 was the lack of any settlements outside of the “Top 3” countries. Certainly securities fraud occurs outside these jurisdictions – Wirecard’s recent accounting scandal, dubbed the “Enron of Germany,” is but one example – but the laws and procedures elsewhere are still developing. As more claims progress through the German legal system in particular, the opt-in KapitalanlegerMusterverfahrensgesetz (“KapMuG”) procedure likely will be used more frequently, which should lead to the development of precedent that will provide important guidance for investors to aid in the decision of whether to opt in to German securities litigation and, if so, what the reasonable expectations of doing so are.

AUSTRALIA

In addition to having the second largest aggregate recoveries outside the U.S. in 2020, Australian securities litigation saw many new developments, mostly in response to the COVID-19 pandemic. In May 2020, the Australian federal government temporarily raised the threshold for breaching disclosure provisions of the Corporations Act 2001 (Cth) to circumstances where information was withheld with knowledge that it would, or recklessness or negligence as to whether it would, have a material effect on the price or value of an entity’s securities. In July 2020, the federal government added a licensing requirement for third-party litigation funders requiring funders to register and operate each litigation funding scheme as a managed investment scheme in accordance with various legislative requirements. Together, these efforts are expected to decrease securities case filings in Australia over the short term.

The ongoing issue of whether (and if so, when) a court can issue a common fund order finally reached the High Court of Australia, which held that common fund orders are not permissible under either federal or New South Wales law. (A common fund order requires the plaintiff’s costs to be shared by all group members.) Without a common fund order, only those investors who sign a funding agreement are members of the class. While the Victorian Parliament has already passed a bill authorizing common fund contingency fees in class actions, institutional investors should nonetheless ensure they have a monitoring system in place to be timely alerted of Australian securities cases and their financial exposure to the alleged wrongdoing, as well as qualified counsel to assist with the assessment of such cases and the key considerations for active involvement in Australia.

Lastly, Australia experienced its first defense judgment after trial in a securities fraud class action against engineering services company Worley Limited which had alleged Worley lacked a reasonable basis for its 2013-2014 budget and forecasts, especially in light of subsequent downgrades. On October 22, 2020, Australian Federal Court Justice Jacqueline Gleeson entered judgment dismissing the case, finding that while the basis for the downgrade was “plainly open to question” and that Worley’s budget may have been “overly optimistic,” she was not persuaded that the forecast lacked “reasonable grounds.” Justice Gleeson also awarded costs to Worley. The Worley litigation was first filed in October 2015, making it one of the longest running securities class action cases in Australia. This result is subject to appeal.

CANADA

On July 8, 2020, the first major changes to Ontario’s class action legislation since the Class Proceedings Act, 1992 (the “CPA”) was enacted almost 30 years ago received Royal Assent. The Smarter and Stronger Justice Act (“SSJA”) amendments modify the core of the CPA to include additional requirements for class action certification (the test by which Ontario courts determine which cases will become class actions) that more closely resemble class certification requirements in the U.S. Notably, in encouraging early resolution of cases, the SSJA requires that motions to strike and to determine dispositive legal issues must be heard before certification. Additionally, the SSJA requires mandatory “superiority” and “predominance” tests at certification; the class action must be “superior to all reasonable available means” and the common issues must “predominate over any questions affecting only individual class members.” Of course, it remains to be seen how the Ontario courts will interpret the new certification test.

CHINA

In a white paper jointly published with Chinese law firm JunHe, the global insurance company AIG announced that China’s recently passed “New Securities Law” enables a “US-style class action environment.” While it is true that China’s New Securities Law provides for specific provisions on securities class actions, including an opt-out mechanism, a closer examination reveals a procedural mechanism for collective action more akin to a Dutch Stichting (Foundation) rather than a U.S. class action.

First, the New Securities Law changes the IPO process from “approval based” to “registration based.” In doing so, China moves from a subjective to an objective determination of whether the applicant meets the requirements to register for an IPO.

Second, the New Securities Law introduces a disclosure regime that builds on the prior requirements to provide “real, accurate, and complete” information, and now requires issuers to provide “concise, clear, and easy-to-understand” information to investors. Additionally, multi-listed issuers must synchronize disclosure of information both overseas and domestically in China. Lastly, the New Securities Law provides for significantly increased fines from the regulator for non-compliance.

Importantly, Article 95 of the New Securities Law allows for a representative to participate in legal proceedings on behalf of investors when an issuer runs afoul of the new requirements (i.e., an allegation is made regarding misrepresentation, insider trading, or market manipulation), and also creates a mechanism for investors to opt out of that representative litigation. While those characteristics are common to U.S. class actions, there are some major differences. The representative can only be an investor protection organization with over 50 members – it cannot be an individual investor as in the United States. It is unclear whether there is cost-shifting, and also whether contingent fees are allowed.

Conclusion

Investors’ ability to maximize their returns by strategically participating in U.S. securities litigation should remain the primary focus, while ensuring a system exists to timely assess the merits of active participation in non-U.S. securities litigation.

About Nathan W. Bear

Nathan Bear is a partner in Robbins Geller Rudman & Dowd LLP’s San Diego office. He has been part of Robbins Geller litigation teams which have recovered over $1 billion for investors, including In re Cardinal Health, Inc. Sec. Litig. ($600 million) and Jones v. Pfizer Inc. ($400 million). In addition to initiating securities fraud class actions in the United States, Bear possesses direct experience in Australian class actions, potential group actions in the United Kingdom, settlements in the European Union under the Wet Collectieve Afwikkeling Massaschade (WCAM), the Dutch Collective Mass Claims Settlement Act, as well as representative actions in Germany utilizing the Kapitalanlegermusterverfahrensgesetz (KapMuG), the Capital Market Investors’ Model Proceeding Act. In Abu Dhabi Commercial Bank v. Morgan Stanley & Co. Inc., he was a member of the litigation team which achieved the first major ruling upholding fraud allegations against the chief credit rating agencies. That ruling led to the filing of a similar case, King County, Washington v. IKB Deutsche Industriebank AG. These cases, arising from the fraudulent rating of bonds issued by the Cheyne and Rhinebridge structured investment vehicles, ultimately obtained landmark settlements – on the eve of trial – from the major credit rating agencies and Morgan Stanley. Bear maintained an active role in litigation at the heart of the worldwide financial crisis, and pursued banks over their manipulation of LIBOR, FOREX, and other benchmark rates. Additionally, he represents investors damaged by the defeat device scandal enveloping German automotive manufacturers, including Volkswagen, Porsche, and Daimler. Bear earned his juris doctor from the University of San Diego School of Law and his bachelor's degree in Political Science from the University of California, Berkeley.

Nathan Bear is a partner in Robbins Geller Rudman & Dowd LLP’s San Diego office. He has been part of Robbins Geller litigation teams which have recovered over $1 billion for investors, including In re Cardinal Health, Inc. Sec. Litig. ($600 million) and Jones v. Pfizer Inc. ($400 million). In addition to initiating securities fraud class actions in the United States, Bear possesses direct experience in Australian class actions, potential group actions in the United Kingdom, settlements in the European Union under the Wet Collectieve Afwikkeling Massaschade (WCAM), the Dutch Collective Mass Claims Settlement Act, as well as representative actions in Germany utilizing the Kapitalanlegermusterverfahrensgesetz (KapMuG), the Capital Market Investors’ Model Proceeding Act. In Abu Dhabi Commercial Bank v. Morgan Stanley & Co. Inc., he was a member of the litigation team which achieved the first major ruling upholding fraud allegations against the chief credit rating agencies. That ruling led to the filing of a similar case, King County, Washington v. IKB Deutsche Industriebank AG. These cases, arising from the fraudulent rating of bonds issued by the Cheyne and Rhinebridge structured investment vehicles, ultimately obtained landmark settlements – on the eve of trial – from the major credit rating agencies and Morgan Stanley. Bear maintained an active role in litigation at the heart of the worldwide financial crisis, and pursued banks over their manipulation of LIBOR, FOREX, and other benchmark rates. Additionally, he represents investors damaged by the defeat device scandal enveloping German automotive manufacturers, including Volkswagen, Porsche, and Daimler. Bear earned his juris doctor from the University of San Diego School of Law and his bachelor's degree in Political Science from the University of California, Berkeley.

Robbins Geller Rudman & Dowd LLP is an Associate member of TEXPERS. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of Robbins Geller Rudman & Dowd LLP nor TEXPERS. Views are subject to change over time. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about the public pension industry in Texas.