Right-Sizing Private Investments for the Evolving Pension

Most defined benefit (DB) plans—including public, multi-employer, and even frozen corporate plans—can benefit from private investment (PI) strategies. It is common knowledge that private investments offer important value in the form of increased expected investment returns, and that they can be instrumental in improving funded status. Despite this, many plan sponsors still abruptly cut off PI commitments or do not optimize their usage as the plan matures.

Understanding PI Strategies

PI strategies encompass three types of assets:

- Private equity (PE)

- Real assets

- Private credit

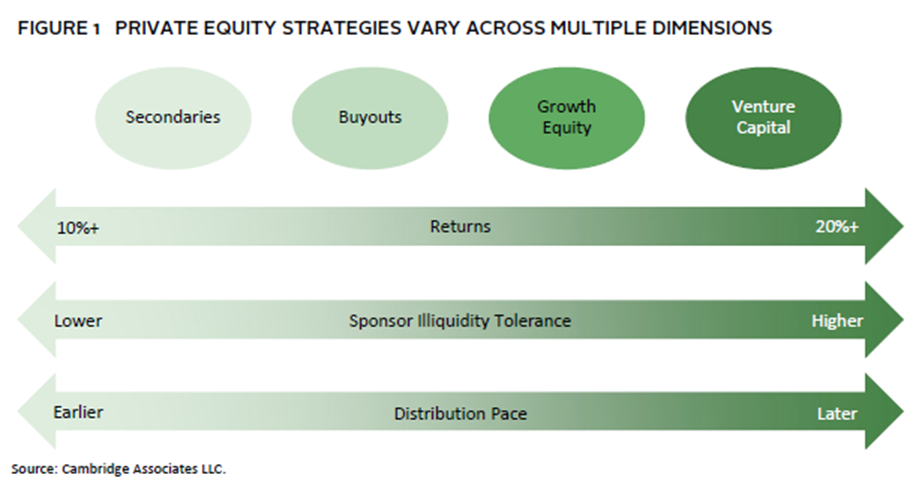

Private Equity. PE strategies focus on capital appreciation through investments in all types of businesses, from seed and early-stage start-ups (VC) to high growth companies achieving scale (growth equity) and mature companies with revenue and EBITDA (buyouts). PE structures typically have a fund life of 12-14 years. The types of PE strategies and their returns, illiquidity profiles, and distribution pace are presented for reference in Figure 1.

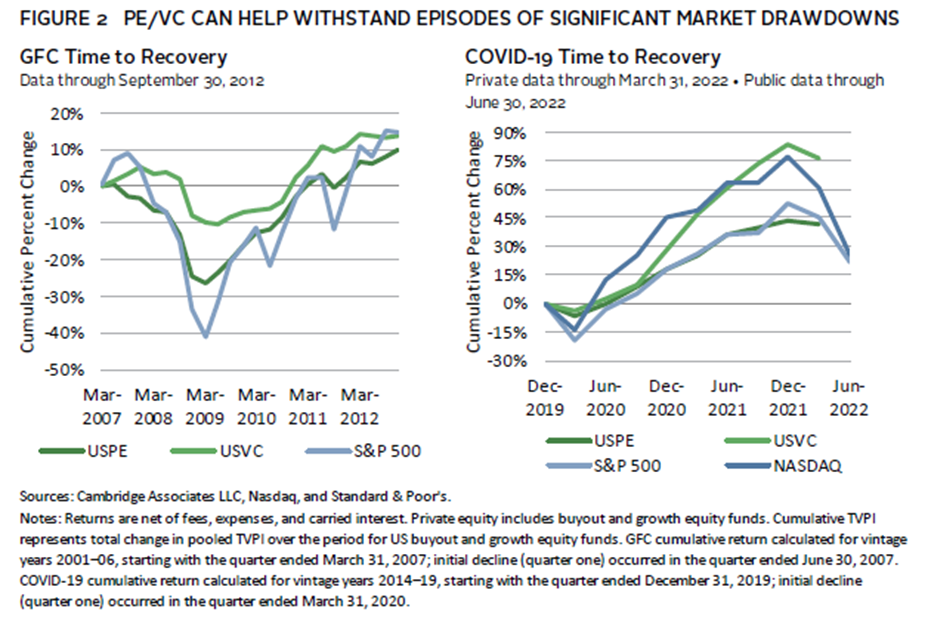

PE/VC strategies also have the capacity to help pension portfolios better withstand episodes of market volatility. Based on data from major equity market drawdowns over the past 25 years, buyouts and VC have experienced less severe drawdowns compared to public market equivalents (Figure 2). This lower volatility and valuation smoothing effect can be valuable for a plan that is sensitive to funded status volatility and whose sponsors wish to maintain or improve funding status.

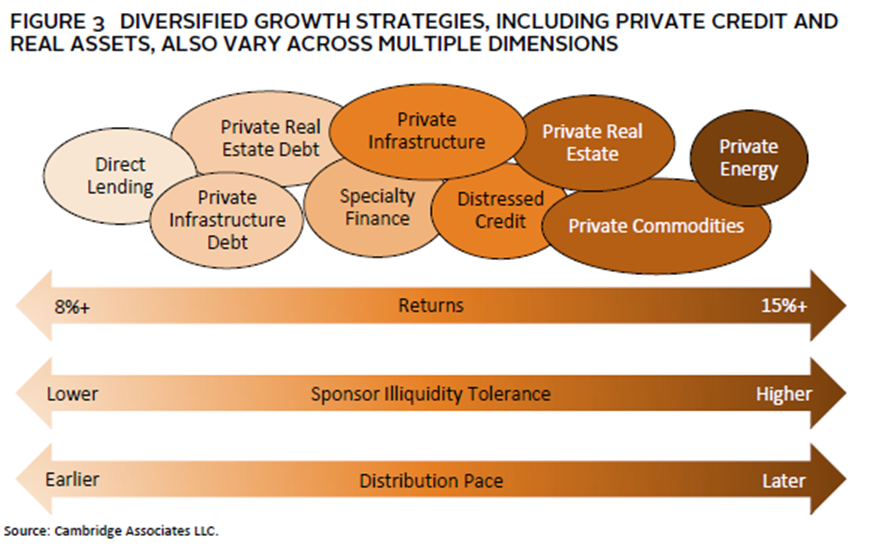

Private Credit. Private credit contributes to a total pension portfolio by providing higher returns than traditional fixed income and possibly hedge funds. Thus, we categorize it as diversified growth (Figure 3). It can also help diversify total plan risk because, unlike equity investments, many credit strategies are not dependent on capital appreciation for returns. Many private credit strategies carry floating interest rates, which can help to counterbalance the duration risk of traditional fixed rate credit that is present in many corporate DB plans and act as an inflation hedge as nominal rates rise.

Private Real Assets. Private real assets strategies can be similar to private credit in that they can provide both income as well as capital appreciation, depending on the strategy. As a result, we would also categorize private real assets under diversified growth (Figure 3). However, the underlying assets include tangible real assets, such as office buildings and multi-family residential units, infrastructure projects (i.e., airports and power plants), and commodities (i.e., oil & gas fields, mining, and timber). Given the variation of the types of underlying assets, return and risks differ greatly. Similarly, the terms and structures of real assets funds vary by strategy. These allocations are differentiated in their potential to deliver portfolio growth and diversification benefits during high inflationary periods. These characteristics can be particularly meaningful for plans with a large active population.

Key Inputs: Formulating the Right PI Program

Plan sponsors looking to determine what PI strategies might be right for them should consider a range of closely linked factors. These include:

Liquidity Needs. Given the illiquid nature of most PI strategies, developing a clear understanding of a plan's liquidity needs and determining where the plan is in its lifecycle are important first steps in deciding how private investments might be allocated within the portfolio. Most pensions—except those actively engaged in termination—may be able to tolerate some level of illiquidity,[1] which can be expressed in the form of an allocation to private investments.

Funded Status. Both fully funded and underfunded pension plans can benefit from a PI allocation. Underfunded plans in need of high-return opportunities to close their funding gap—and with the appropriate risk and illiquidity tolerance—can consider PE, especially if they have an open plan with a long-time horizon. Plans that are approaching—or looking to maintain—fully funded status may be better served by private credit and real asset allocations, as these can provide interim cash flows needed to meet benefit payouts, as well as offer some incremental returns along with inflation hedging characteristics.

End-Game Planning. For frozen plans or increasingly more highly funded plans, the end game is an important consideration for many corporate sponsors. If a plan termination or larger risk transfer[2] transaction is a more intermediate goal (i.e., five years out), certain private credit strategies can offer the advantage of shorter maturities, as well as the more income-oriented characteristics that may be appropriate in the final stages of a plan’s lifecycle.

Pension Plan PI Allocation: A Case Study

Client: A recently frozen corporate DB plan that is approximately 80% funded.

Challenges include:

- Need for additional contributions

- Increasing expenses

- Historical PI program was over-diversified with fund-of-funds and mediocre results. Future commitment to PI is in question

Goal(s):

- Improve funded status

- Refit existing PI allocation to meet the plan’s current needs

Solution: In this situation, PI should remain a part of the portfolio, but new commitments should be tailored towards a more mature liability stream. Some PI strategies with particularly long investment horizons and a more diversified and numerous manager approach—early-stage venture capital for example—may need to be cut back. The excess commitment budget from a more consolidated PE allocation should instead be tilted towards the addition of income-oriented strategies such as private credit to meet more near-term liabilities. Certain private real asset strategies such as real estate and private infrastructure could also be attractive to further diversify returns from equity valuations and/or generate yield. PE secondaries strategies may also be able to provide more liquid, shorter duration return opportunities that simultaneously enhance overall portfolio diversification.

Kelly Jensen is a Senior Investment Director with Cambridge Associates who works with plan sponsors to build customized private investment portfolios. Her expertise extends to private investments, including private equity, venture capital, private credit, real estate, and natural resources. In addition to her work with clients, Kelly leads due diligence efforts across private asset classes.

Kelly Jensen is a Senior Investment Director with Cambridge Associates who works with plan sponsors to build customized private investment portfolios. Her expertise extends to private investments, including private equity, venture capital, private credit, real estate, and natural resources. In addition to her work with clients, Kelly leads due diligence efforts across private asset classes.  Ming Yan is an Investment Managing Director with Cambridge Associates. Ming has over 15 years of investment experience and serves in full discretionary and non-discretionary capacities, overseeing investment portfolios totaling over $20 billion. She works with various institutional investors, including corporate, public, and non-profit plan sponsors; foundations; healthcare institutions; and other investors with multi-asset pools. She is involved in developing overall portfolio strategy, manager sourcing and selection across private and public asset classes and partnering with clients to set investment policy and implement investment decisions. Disclosure: Cambridge Associates is a Consultant Member of TEXPERS. The views expressed are those of the authors and do not necessarily represent those of Cambridge nor of TEXPERS.

Ming Yan is an Investment Managing Director with Cambridge Associates. Ming has over 15 years of investment experience and serves in full discretionary and non-discretionary capacities, overseeing investment portfolios totaling over $20 billion. She works with various institutional investors, including corporate, public, and non-profit plan sponsors; foundations; healthcare institutions; and other investors with multi-asset pools. She is involved in developing overall portfolio strategy, manager sourcing and selection across private and public asset classes and partnering with clients to set investment policy and implement investment decisions. Disclosure: Cambridge Associates is a Consultant Member of TEXPERS. The views expressed are those of the authors and do not necessarily represent those of Cambridge nor of TEXPERS.