IRS Releases Updated Retirement Plan Contribution Limits for Defined Benefit Plans

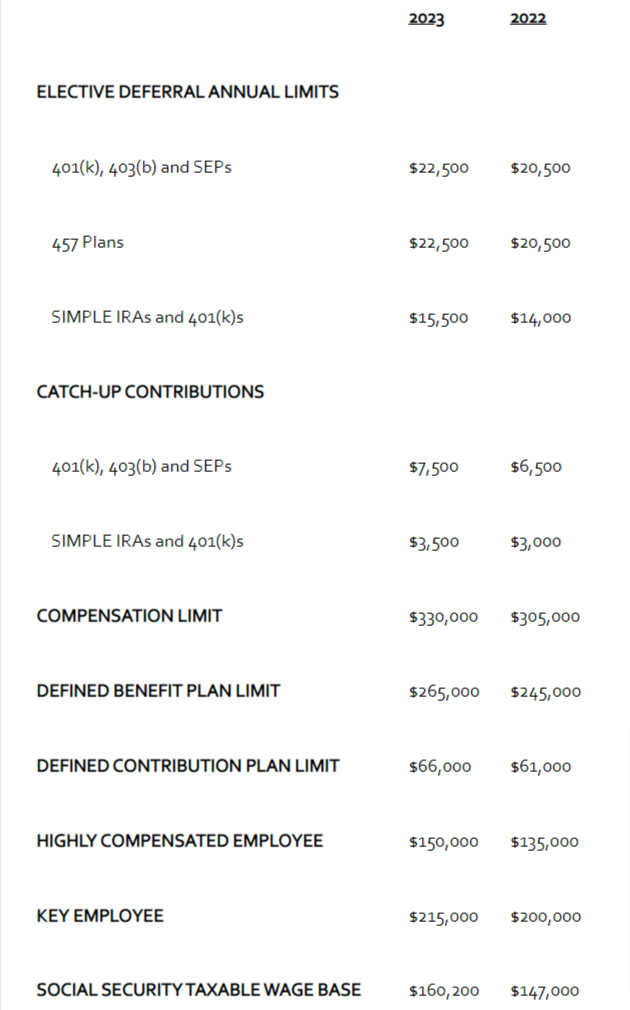

The federal tax provision that limits the amount of an "annual benefit" that an individual can receive from a tax-qualified defined benefit pension plan will increase from $245,000 in 2022 to $265,000 in 2023.

The Internal Revenue Service, on Oct. 21, 2022, issued technical guidance regarding cost‑of‑living adjustments affecting dollar limitations for pension plans and 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan as well as other retirement-related items for tax year 2023 in Notice 2022-55 posted on IRS.gov.

The defined Benefit Plan is section 415(b)(1)(A) of the Internal Revenue Code.

Download Notice 2022-55

This year's cost-of-living adjustments affected almost all IRS limits, including catch-up contributions. After releasing the updated amounts, plan sponsors should have all the information they need to complete their annual notices.

FOLLOW TEXPERS ON FACEBOOK, TWITTER, AND LINKEDIN FOR THE LATEST NEWS ABOUT TEXAS' PUBLIC PENSION INDUSTRY.