How Rising Interest Rates and Stock Valuations Are Linked

Interest rates in the US have recently begun to move higher after having collapsed last year following the onset of the COVID-19 pandemic. While there are numerous contributors to the move higher in interest rates, the primary catalysts are the expected increase in US Treasury issuance in order to fund the stimulus and the slow reopening of the US economy which may lead to increased economic growth. Given this backdrop, we look to explore the potential ramifications of higher US interest rates on equity prices and the resulting implications for client portfolios.

The Relationship

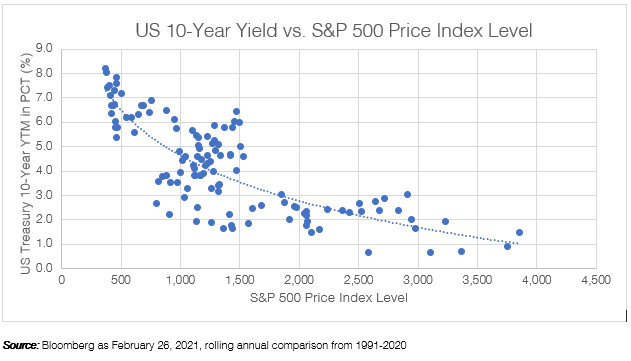

Historically, US interest rates rise as investors price in the potential for future economic growth.. Based on historical observation, stock prices and interest rates have generally had an inverse relationship. Said plainly, as interest rates move higher, stock prices tend to move lower. We can see in the chart below that since 1991, the regression relationship between stocks and bonds has been negative with the S&P 500 Index falling in value as the US Treasury 10-Year yield to maturity rises. To understand how this negative relationship works, we need to dive deeper into how stocks are valued at the company level.

Stock Valuations

There are two primary factors in determining the relationship between stocks and interest rates. The first relates to how investors value companies. This valuation equation is basic in nature and is simply the sum of the company’s estimated future cash flows (numerator) discounted by the company’s cost of capital (denominator). The company’s cost of capital is usually a spread (additional yield) over US Treasury rates and is adjusted based on the credit worthiness of the borrower. Following this formula, lower US Treasury rates will typically result in a lower cost of capital (denominator) for a company, which then results in a higher present value of its stock price.

The second factor impacting stocks and interest rate relationships is the availability of competing (alternative) investment opportunities. As interest rates fall, investors normally seek out higher returning assets (investment opportunities) in order to compensate for the lack of potential future returns in bonds. Conversely, as interest rates begin to rise, investors who may be more risk-adverse may seek the safety of bonds as yields become more competitive when compared to stocks.

The Market

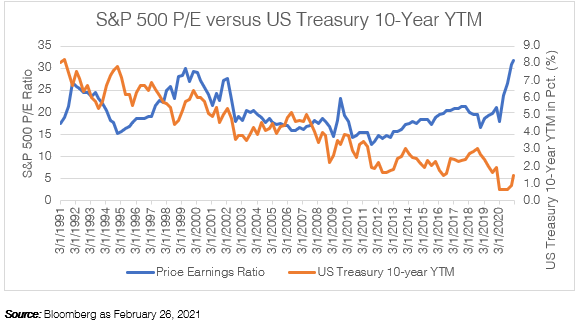

In thinking about where we are today, it’s helpful to take a step back and consider how the relationship between stocks and bonds has fared over time. Looking at the chart below, we can see that the connection between stock valuations as measured by the S&P 500 Index price to earnings ratio (P/E) and the US Treasury 10-Year yield to maturity have not always moved in lock step. Directionally, US interest rates have been broadly declining since the early 1990s, which should have resulted in consistently higher stock valuations if their inverse relationship was perfect. However, idiosyncratic events such as the “internet bubble” in 2001 and the “Great Financial Crisis” in 2008 resulted in lower stock prices.

In an effort to jumpstart the economy in 2009, the global central banks enacted significant monetary policy changes that dramatically lowered most major developed market interest rates resulting in higher stock valuations. Then, beginning in 2013, the Fed began the process of reducing its open market bond purchases, Quantitative Easing, which resulted in higher US interest rates. This period is known as the “taper tantrum” since it drove bond yields higher but left stock valuations relatively unchanged. Next, beginning in late 2016, the Fed began slowly raising the Fed Funds rate in an attempt to normalize interest rate markets. Finally, in late 2018, as bond yields became more attractive to investors, we can see there was a rotation out of stocks and into bonds resulting in lower stock valuations.

Since the first quarter of last year, the world is a very different place than what it was before. Following the onset of the pandemic, global interest rates declined significantly as central banks moved aggressively to lower interest rates and started increasing their bond purchase programs to keep the global economy from stalling. Importantly, since the beginning of 2021, the number of cases of COVID-19 globally have fallen, primarily due to the rollout of vaccines and therapeutics.[1] As a result, economic activity has increased and investors are now pricing in higher economic growth and rising inflation in the future, and as such are demanding higher interest rates to compensate for the additional risk.

What does this all mean?

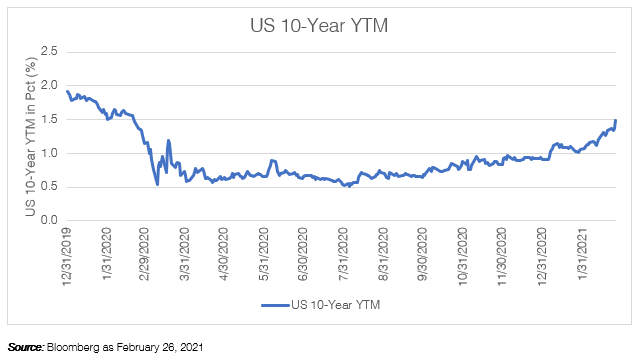

The relationship between stocks and bonds is complex. What we do know is that interest rates are a component of the stock valuation equation and an indicator of investors’ risk appetites in the marketplace. In looking at the chart below, the magnitude of the recent move higher in interest rates is significant and a trend to be aware of. Since the recent low in early August at roughly 0.50%, the US Treasury 10-Year yield-to-maturity has increased nearly 100 basis points, trading near 1.5%. Despite this, in relative terms US interest rates remain low by historical measures.

If interest rates continue to slowly move higher, it suggests the economy is continuing to improve and that environment could be beneficial to stocks as companies are able to grow their earnings. What we are watching for is a dramatic move higher in interest rates that results in increased stock market volatility as investors reprice company valuations. While we do not know or predict the future movement of interest rates, given the potential implications of rapid shifts and the need to protect portfolios, we believe it may be appropriate for investors to consider evaluating their current asset allocation positioning relative to their strategic targets since it’s never a bad time to assess current market risks relative to a portfolio’s long-term objectives.

Appendix

1. Bloomberg, February 24, 2021

About Philip Schmitt

Philip Schmitt is a research director at AndCo. He serves client needs by conducting investment manager due diligence within the public and private fixed income markets. Schmitt also oversees the firm's capital markets research. He has more than 20 years of investment research experience covering many areas of investment oversight and due diligence, providing leadership and effective management across numerous active fixed income and multi-asset disciplines. Schmitt has technical and functional experience in asset classes including corporate and government debt, as well as advanced asset allocation portfolio construction. Prior to joining AndCo, Schmitt was a senior associate director with Verus Investments. During his time there, Schmitt was charged with researching, analyzing and managing numerous fixed income and multi-asset strategies. The investment process utilized a combination of fundamental analysis and quantitative tools to construct, identify and manage disciplined portfolios. Schmitt has a bachelor's degree in Economics from Portland State University and a MBA from the University of Portland. He is a CAIA Level II candidate as well as a CFA Level II candidate.

Philip Schmitt is a research director at AndCo. He serves client needs by conducting investment manager due diligence within the public and private fixed income markets. Schmitt also oversees the firm's capital markets research. He has more than 20 years of investment research experience covering many areas of investment oversight and due diligence, providing leadership and effective management across numerous active fixed income and multi-asset disciplines. Schmitt has technical and functional experience in asset classes including corporate and government debt, as well as advanced asset allocation portfolio construction. Prior to joining AndCo, Schmitt was a senior associate director with Verus Investments. During his time there, Schmitt was charged with researching, analyzing and managing numerous fixed income and multi-asset strategies. The investment process utilized a combination of fundamental analysis and quantitative tools to construct, identify and manage disciplined portfolios. Schmitt has a bachelor's degree in Economics from Portland State University and a MBA from the University of Portland. He is a CAIA Level II candidate as well as a CFA Level II candidate.

This article represents AndCo Consulting’s proprietary material and has been prepared for use within TEXPERS’ “Investment Insights” publication. Any reproduction or reuse of the article without the express written consent of AndCo is strictly prohibited. This document is being provided solely for informational and educational purposes and should not be regarded as investment advice or as a recommendation regarding any particular course of action and additionally is not intended to provide, and should not be relied upon, for legal, tax, or accounting advice. AndCo is a Consultant member of TEXPERS. Any securities cited are for illustrative purposes only. References herein do not constitute a recommendation to buy, sell or hold such securities. The material provided herein is valid as of the date of distribution and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after such date. This document may contain opinions, observations, projections or forward-looking statements which are subject to various uncertainties whereby the actual outcomes or results could differ from those indicated. Certain information is based on sources and data believed to be reliable, but AndCo cannot guarantee the accuracy, adequacy, or completeness of the information. The source for all data, charts and graphs is AndCo Consulting unless otherwise stated. AndCo Consulting is an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). Registration as an investment adviser does not constitute an endorsement for the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.

Follow TEXPERS on Facebook, Twitter, and LinkedIn and visit its website for the latest news about the public pension industry in Texas.