With material inflation returning for the first time in years, investors are tasked with defending their portfolios against its erosive effects. Often, this has been done via investment in real estate, long touted as an effective hedging strategy in periods of rising prices, though why this has persisted as part of the investing canon bears repeating given the current environment.

How does real estate benefit from inflation?

#1: Rising input costs reduce supply.

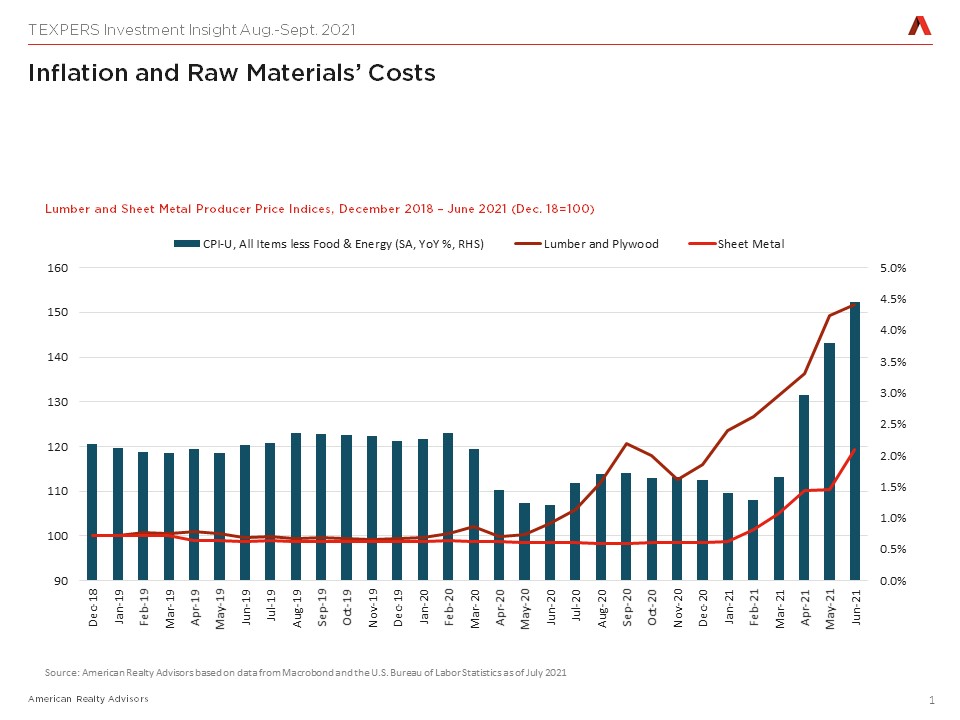

As prices rise, so too do the costs of raw materials (like lumber, plywood, sheet metal, and concrete) and labor (Figure 1); as a result, it becomes more difficult for new construction projects to “pencil” to meet developers’ target profits. This has the effect of postponing the delivery of new buildings (as developers may “wait out” price increases if they view the inflationary pressures to be temporary), ultimately reducing the amount of new supply added; this is particularly true in the multi-family and industrial sectors, where construction timelines are not as lengthy as office or retail and there is an ability to turn off the supply spigot more quickly.

#2: Increased demand drives rent growth.

With inflation the result of rising demand relative to supply across a bucket of industries, companies can charge more for their goods and services, necessitating them to hire more employees to service growing demand. At the same time, the demand for workers also rises, increasing wages. In this way, inflation tends to coincide with increased appetite for space from tenants.

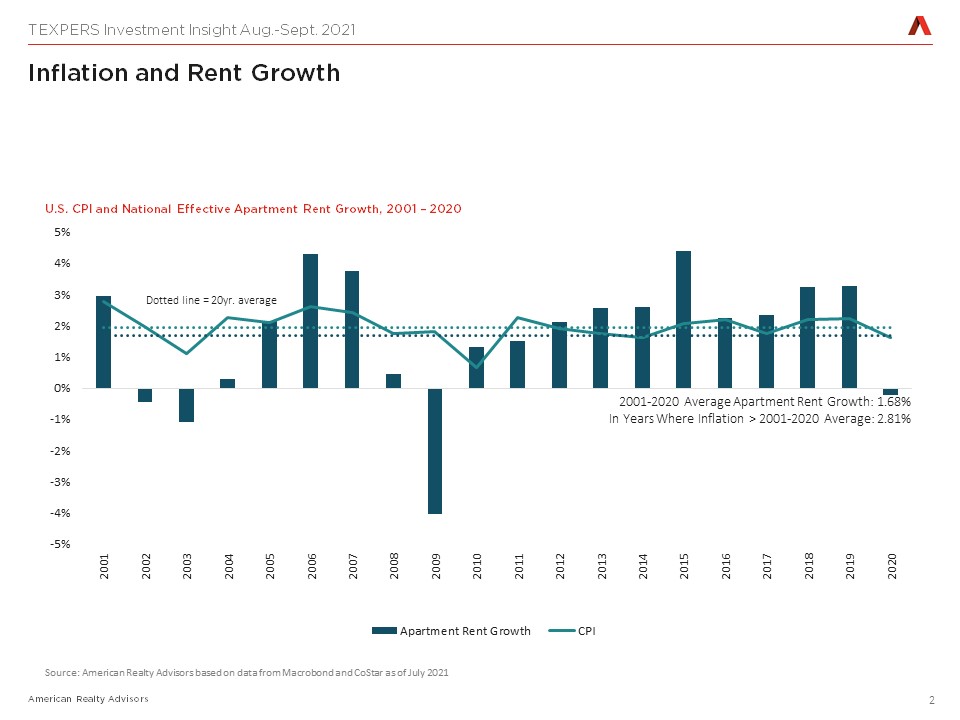

At the same time, inflation is curtailing supply, creating landlord-favorable conditions conducive to raising rents. Rent growth in the multi-family sectors embodies this nicely, as leases are renegotiated on a more frequent basis (typically every year), allowing landlords to capture inflationary upside in “real time”. Over the last twenty years, national apartment rents have grown by an average of 1.68%; however, in years where inflation surpassed its 20-year average, rent growth accelerated to 2.81%[1] (Figure 2). In other words, rent growth was 113 basis points higher when inflation was higher.

#3: Potential to unlock embedded NOI growth.

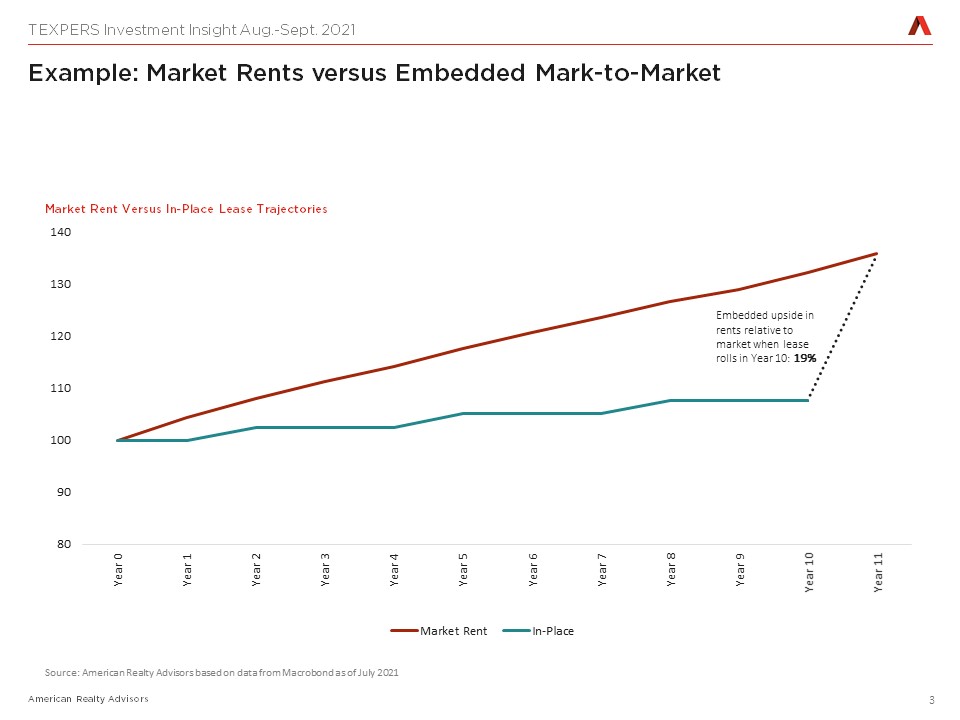

We’ve seen how, by virtue of shorter-term leases, multifamily rent growth can respond quite quickly to inflation - but what about the other property types, where lease terms are typically longer and generally have fixed-rate increases?

As market rents around a property rise by virtue of inflation, in-place rents (that is, the contracted rent being paid by a tenant) fall behind, increasing by pre-determined rates at regular intervals based on the terms of the lease that may lag the pace of inflation. This is demonstrated in the example in Figure 3, where market rents (denoted by the red line) rise with inflation at a rate of 3%/year; the blue line reflects a hypothetical 10-year lease where rents increase at a set 2.5% every 2 years. At the end of the lease term, in-place rents will be 19% below market. It is this catch-up delta (sometimes referred to as mark-to-market) that attracts investors who are willing to pay more for the potential to unlock these embedded future net operating income (NOI) gains, driving additional asset-level appreciation returns.

In fact, unlevered property total returns across all four core property types increase by an average of 129 basis points relative to their long-term average in years where inflation surpassed 2%, with roughly two-thirds of the added return upside coming via appreciation (with the remainder from elevated income returns).[2]

Any downside risks to real estate from inflation?

Of course, not every impact from inflation on the real estate asset class is necessarily positive (hence why so many of us spend so much time forecasting and analyzing when it will materialize); much of the risk is associated with how inflation effects benchmark yields and drives up the cost of borrowing.

Inflation is inherently challenging for portfolios because it erodes the value of absolute returns across asset classes. If you invest in a bond that provides a fixed nominal rate of return of 2% per year, and inflation progresses at 3% per year, the return on the bond is not keeping up with the rate of inflation and is actually producing a negative absolute return when adjusted for inflation. This means that bond yields rise to account for the added return necessary to offset the erosive effects of inflation.

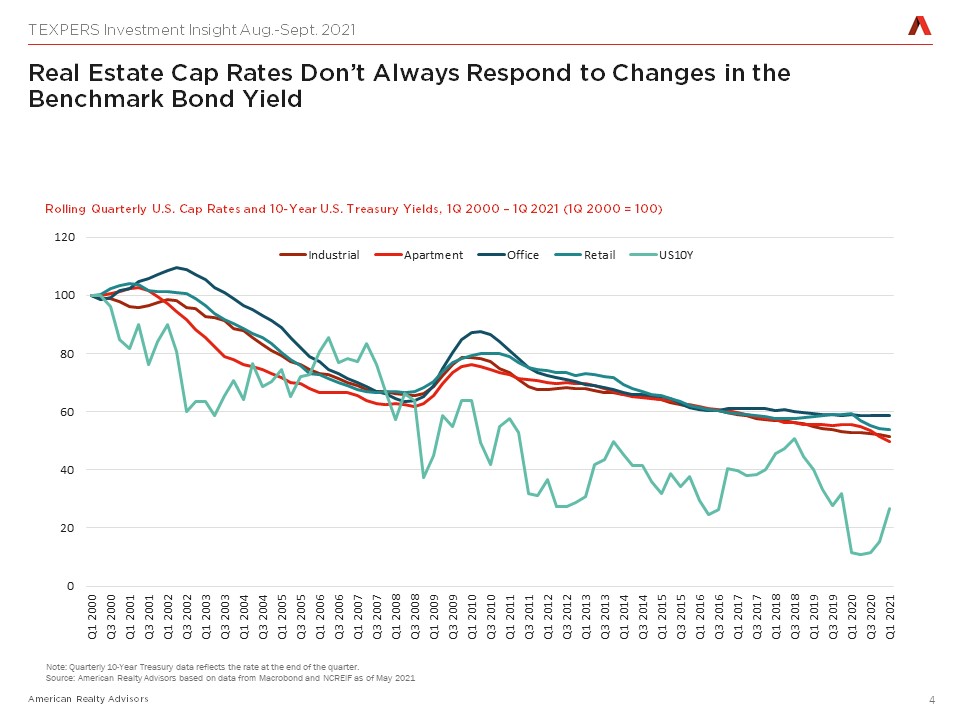

One of the most common mechanisms investors use for evaluating the relative attractiveness of real estate is the yield/ cap rate spread to long-term government bonds. This is because long-term government bonds represent the risk-free rate of return an investor can achieve – thus, any other investment should offer a relative yield premium above that to account for added risk. If the spread, or premium, gets too small, the asset class is generally viewed as being less attractively priced compared to bonds and if it’s higher, it looks more attractive on a relative basis. Should bond yields rise to offset rising inflation, the relative attractiveness of real estate diminishes by virtue of comparison to a higher bond yield.

To compensate, there is an expectation that real estate cap rates rise (or in other words, the prices paid for real estate soften) to maintain an acceptable spread. However, short-term fluctuations in the benchmark bond rate have historically proven not to create upward movement in real estate cap rates, suggesting other forces (like capital appetite for the asset class) can more than offset potential value erosion purely as a function of relative pricing (Figure 4).

A case for real estate in rising price environments

Whether investors believe we are entering a new inflationary paradigm post-pandemic or that current price increases are more transitory in nature, the characteristic drivers of real estate mean that it can be an effective hedge in either scenario, in addition to all of the longstanding reasons it has earned a place in mixed-asset portfolios.

American Realty Advisors, LLC is an Associate Advisor Member of TEXPERS.

The information in this article is as of August 5, 2021, and is for your informational and educational purposes only, is not intended to be relied on to make investment decisions and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This article expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this article has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based.

About the Author Sabrina Unger, Managing Director, is the Head of Research & Strategy at American Realty Advisors and is responsible for leading the firm’s research initiatives and working closely with the firm’s Investment and Portfolio Management teams in developing investment analysis in support of new acquisitions and strategy implementation. Ms. Unger is also a member of the firm’s Investment Committee. Prior to joining ARA, Ms. Unger was a member of the Global Research team at Invesco Real Estate, charged with developing global portfolio strategies as well as authoring numerous thought leadership papers and contributing to the firm’s House View. Before that, she held positions as a member of the research team at Clarion Partners and as a top strategist for a sports entertainment company’s real estate divisions. She has been published in leading industry publications, including Real Assets Adviser, and the research publications of ANREV (Asian Association for Investors in Non-Listed Real Estate Vehicles) and AFIRE (The Association of Foreign Investors in Real Estate). Ms. Unger holds a bachelor’s degree from Southern Illinois University Carbondale and a master’s degree from DePaul University and has completed certificate coursework at both New York University and the London School of Economics.

Sabrina Unger, Managing Director, is the Head of Research & Strategy at American Realty Advisors and is responsible for leading the firm’s research initiatives and working closely with the firm’s Investment and Portfolio Management teams in developing investment analysis in support of new acquisitions and strategy implementation. Ms. Unger is also a member of the firm’s Investment Committee. Prior to joining ARA, Ms. Unger was a member of the Global Research team at Invesco Real Estate, charged with developing global portfolio strategies as well as authoring numerous thought leadership papers and contributing to the firm’s House View. Before that, she held positions as a member of the research team at Clarion Partners and as a top strategist for a sports entertainment company’s real estate divisions. She has been published in leading industry publications, including Real Assets Adviser, and the research publications of ANREV (Asian Association for Investors in Non-Listed Real Estate Vehicles) and AFIRE (The Association of Foreign Investors in Real Estate). Ms. Unger holds a bachelor’s degree from Southern Illinois University Carbondale and a master’s degree from DePaul University and has completed certificate coursework at both New York University and the London School of Economics.