Bitcoin's Evolution as an Inflation Hedge and Currency

2021 was an impressive year for crypto as the market, led by Bitcoin, expanded to a market cap of roughly $3 trillion, up from $800 billion at the start of the year. Bitcoin itself was able to maintain a market capitalization of over $1 trillion for several months and stands at approximately $1.1 trillion at the time of writing. While its price action throughout the year was well documented by the media, its adoption as an inflation hedge and as a currency were overlooked.

Inflation Hedge

With CPI posting consecutive hot prints, it is becoming increasingly clear that the inflation we are experiencing is not transitory. Investors are understanding this, but are encountering a Fed that seems reluctant to raise rates to fight this, leading to the possibility of sustained, and even higher, inflation in the future. To combat this, investors are turning to assets such as Bitcoin, that they consider inflation hedges.

Bitcoin is an inflation hedge largely due to its scarcity stemming from its fixed supply and programmable, transparent issuance schedule. There can only ever be 21 million BTC outstanding. While some, like JPMorgan Chase CEO Jamie Dimon, have questioned whether the 21 million cap is real, it is actually defined in the Bitcoin protocol code, meaning it is as good as set in stone. Moreover, Bitcoin's issuance schedule is also coded and publicly available. Bitcoin emissions, or rewards to miners for verifying transactions, are halved approximately every 4 years, per Bitcoin's code. Currently, Bitcoin's annual inflation rate stands at approximately 1.8% and will only continue to decrease over time. Such properties make Bitcoin an appealing inflation hedge, and given its portability and minimal storage costs, it can be seen as a superior alternative to gold.

An increasing number of institutional investors agree that Bitcoin is a compelling inflation hedge. Notable investors such as Paul Tudor Jones and Stanley Druckenmiller have highlighted Bitcoin's role as a store of value. Moreover, family offices, endowments, and pensions have all started investing in Bitcoin, including major ones such as Soros Fund Management. At CrossTower, we can also attest many macro hedge funds are involved with Bitcoin, based on our conversations with them. Bitcoin is becoming seen globally as a compelling store of value and inflation hedge, and its price appreciation this year likely reflects that.

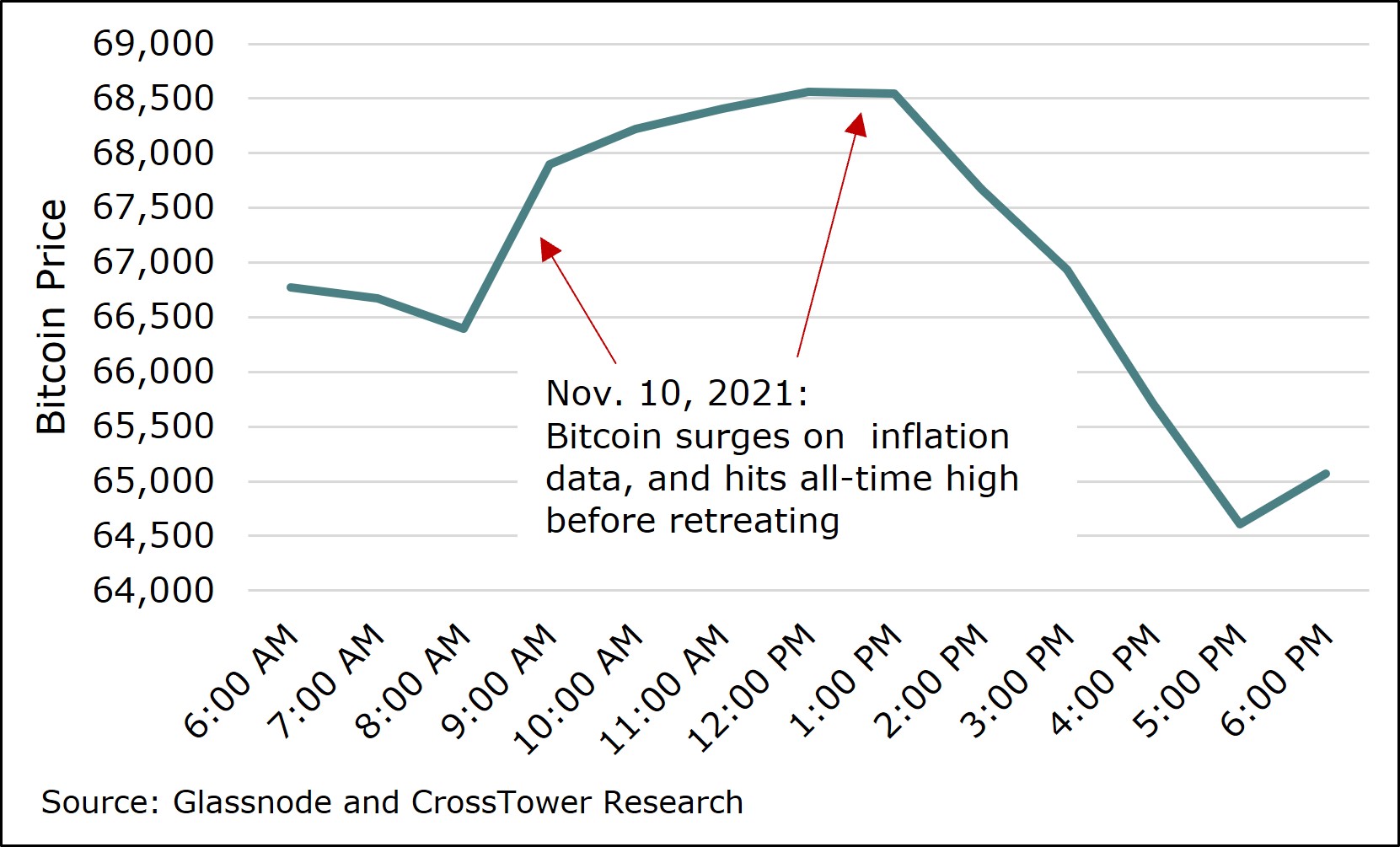

The growing acceptance of Bitcoin as an inflation hedge was on display on November 10, 2021, as CPI data for October showed an increase of 6.2% YoY. Bitcoin was bid up heavily shortly after the data was released, surging to record highs, indicating that investors are seeing an attractive asset in light of inflation.

Exhibit 1. Bitcoin Price Action Following CPI Print on November 10, 2021

Currency

While much attention has been on Bitcoin's role as an inflation hedge, or otherwise its properties as digital gold, there was also considerable traction in 2021 with its role as a currency. Given Bitcoin's technical restrictions (capacity for roughly 7 transactions per second) its base layer is best suited for settlements, while layers that are built on top of it, such as the Lightning Network, are more suitable for everyday payments, given significantly greater transaction capacity and lower fees. While the Lightning Network is still not ready for the mainstream, it has been in development the past few years and has seen explosive adoption in 2021.

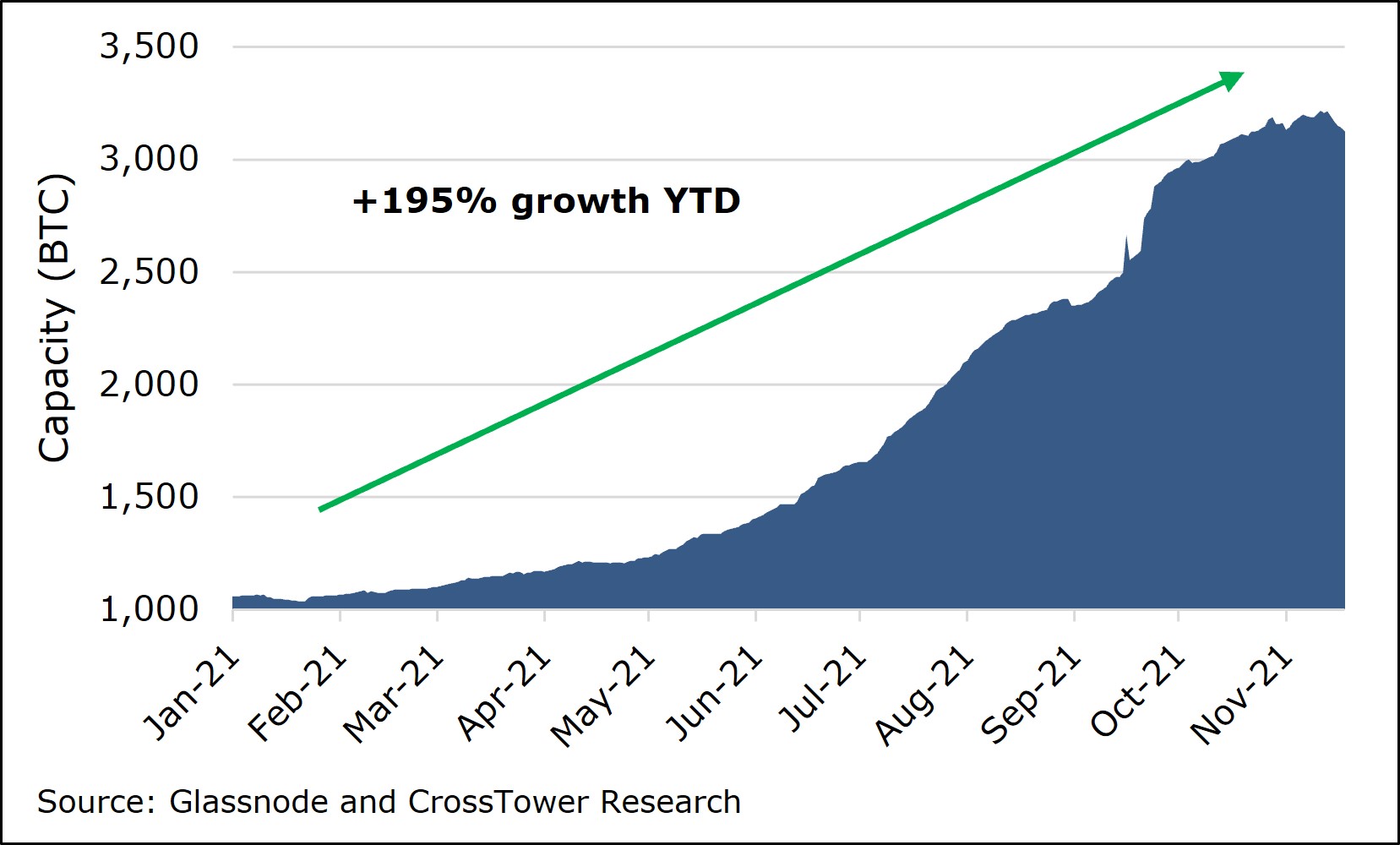

Lightning Network capacity, a measure of Bitcoin liquidity on the network, stands above 3,000 BTC ($180 million equivalent) as of November 2021, up from 1,000 BTC at the end of 2020, a nearly 200% increase. This has been accompanied by a surge in nodes, which allow users to connect and interact with the Lightning Network and Bitcoin blockchain. The increase in Lightning Network capacity has been partly attributed to products that simplify the process of setting up a node and getting onboarded to Lighting. The bottom line is that people are increasingly exploring Bitcoin as a currency, not just as a store of value. While it is difficult to gauge the amount of transaction volume on the Lightning Network given that payment channels between users can be private, volume has been estimated to be multiples of the liquidity in payment channels/the network.[i]

Exhibit 2. Lightning Network Capacity

With its adoption of Bitcoin as legal tender in September 2021, El Salvador has emerged as a live test of how Bitcoin could function as a currency. Its Chivo wallet application, which utilizes the Lightning Network, allows its users to make everyday purchases denominated in BTC. As of October 2021, roughly 3 million users downloaded the Chivo wallet, according to El Salvador President Bukele. While it is still too early to tell how well Bitcoin payments are being adopted in El Salvador, it is a remarkable advancement in the usage of Bitcoin.

Bitcoin will eventually come to reflect both its value as a store of value, including its properties as an inflation hedge, as well as its role as a currency. The adoption on those fronts is accelerating, and it will be exciting to see how these narratives further develop in 2022.

Sources[i] Galaxy Digital Research Report: In Search of Scaling DisclaimerCrossTower Inc. provides this content for general information purposes, to better inform you on your digital asset investment journey. We do not provide investment recommendations or provide tax advice. Please consult your investment professional or tax advisor if you require assistance in these areas. About the Author Martin Gaspar is a research analyst at CrossTower and has several years of experience in conducting fundamental research and cryptocurrency analysis. Prior to joining CrossTower, Martin was a fixed income research analyst at Wells Fargo Securities, where he helped support traders, salespeople, and buy-side clients through his actionable investment recommendations. He has a passion for crypto and has followed the space extensively since 2012. Martin holds a BA from Colorado College, where he graduated with Distinction in Economics.

Martin Gaspar is a research analyst at CrossTower and has several years of experience in conducting fundamental research and cryptocurrency analysis. Prior to joining CrossTower, Martin was a fixed income research analyst at Wells Fargo Securities, where he helped support traders, salespeople, and buy-side clients through his actionable investment recommendations. He has a passion for crypto and has followed the space extensively since 2012. Martin holds a BA from Colorado College, where he graduated with Distinction in Economics.

CrossTower is an Associate member of TEXPERS. The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of CrossTower nor TEXPERS, and are subject to revision over time. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about Texas' public pension industry.