The Forecast for Fixed Income Returns – Better Than You Might Expect

We have reached a pivotal point in both the economic and monetary policy cycle, and uncertainty for fixed income is high. The key questions on every fixed income investor’s mind are 1) where are rates going, 2) what do returns look like, and 3) what approach is best?

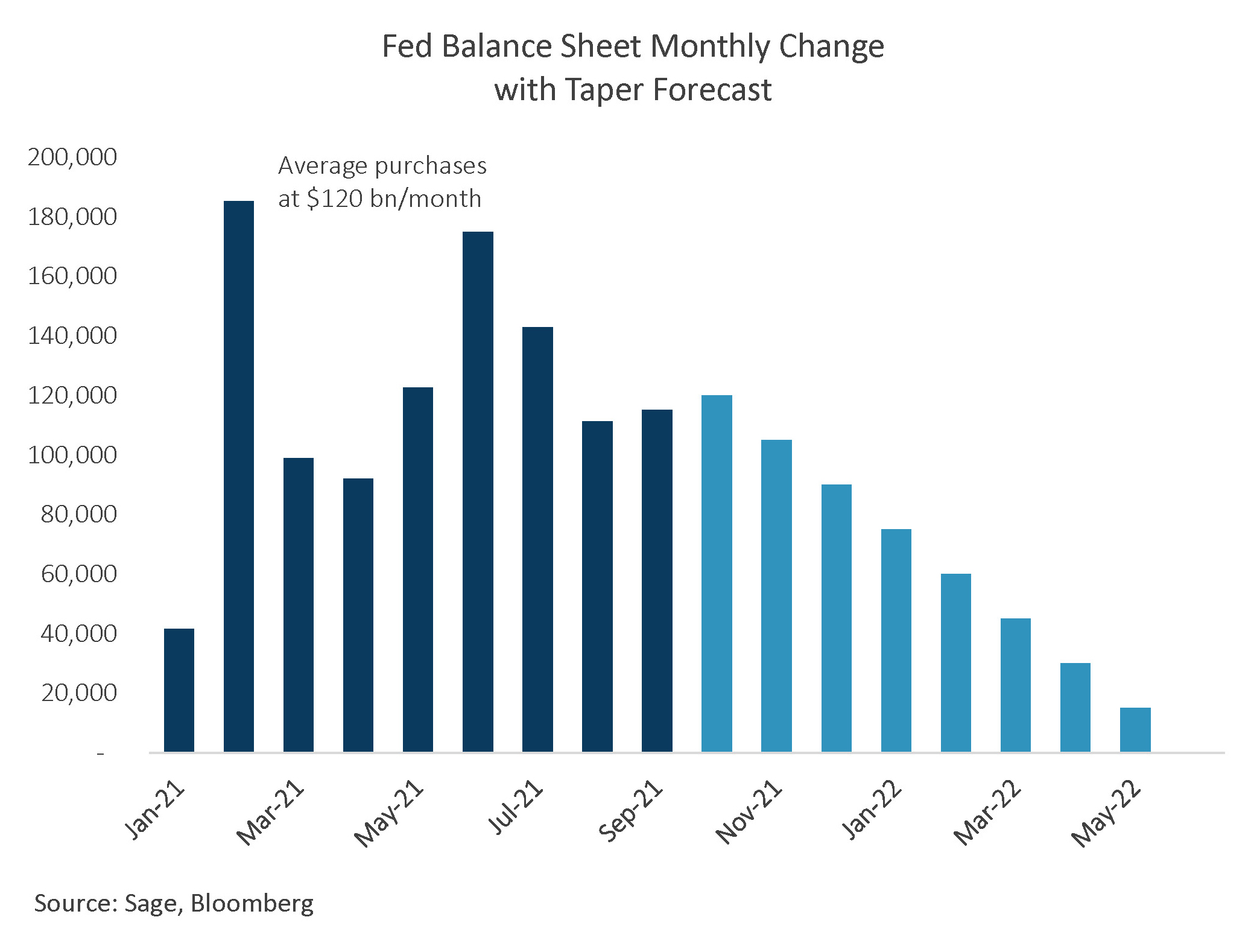

Where are rates going? The answer is up, but not by much more through year-end. Rates increased ahead of the Fed tapering its quantitative easing (QE) program this month.* Ten-year Treasury yields are currently around 1.6%, and since we don’t expect them to go much higher, one could say that most of the return damage for 2021 is done.

What about 2022? The bond market is currently pricing in an interest rate hiking cycle that will start in late 2022 and last several years. Because inflation remains high but global growth is past its post-pandemic peak, the market is pricing in a low terminal Fed funds rate of about 2.5%, which seems appropriate and implies long rates have a short climb to reach fair value.

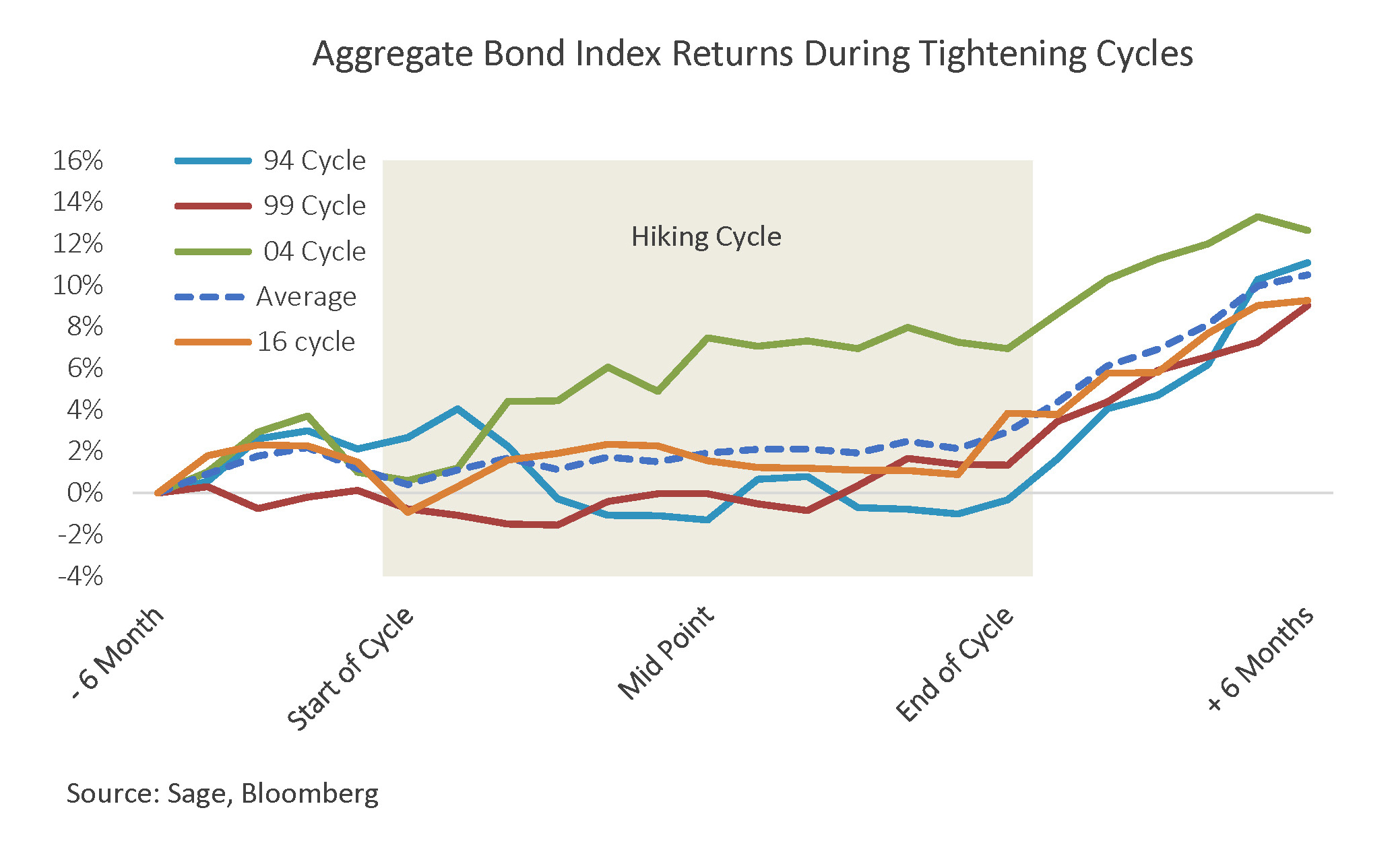

In terms of fixed income returns, previous cycles demonstrate that return damage is done early in the tightening cycle, and returns are stronger later in the cycle and very strong in the 6 months following the last interest rate hike. Current pricing and past return patterns imply low 0.0%-0.75% core fixed income returns over the next 12 months.

Bottom Line for Investors

The key to getting to 2%-3% fixed income returns over the longer term will be active management. For diversified fixed income investors, we expect strong fundamentals, robust earnings, and high liquidity to support spread levels. Active managers can generate positive returns over the intermediate term as allocations accrue yield at higher levels and volatility offers curve and sector opportunities.

We continue to have a defensive posture toward rates and a spread sector overweight geared to out-yield the index. In addition to a significant allocation in investment grade credit and MBS, we also carry a diversified allocation to less interest rate-sensitive, non-core markets that offer upside, including U.S. high yield, preferred stocks, and bank loan exposure.

*The QE program started in March 2020. QE refers to the way the Fed increases the U.S. money supply through the purchase of securities, mostly U.S. Treasuries. We expect the Fed to slowdown, or “taper,” the buying of these securities over most of 2022.

About the Author:Rob Williams is Director of Research at Sage Advisory. Disclosures:This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high-net-worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530. Sage Advisory is an Associate member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of Sage nor TEXPERS. These views are subject to change.Follow TEXPERS on Facebook, Twitter and LinkedIn for the latest news about Texas' public pension industry.