Even after strong performance in 2021, listed infrastructure stands to potentially benefit in 2022 from a favorable macro backdrop, investors’ search for inflation protection, and attractive valuations.

Inflation concerns putting a spotlight on the asset class

Inflation concerns putting a spotlight on the asset class

Global infrastructure stocks had a total return of 15.7% in 2021 as measured by the FTSE Developed Core Infrastructure 50/50 Index. Amid an environment of broad economic reopenings, top performers tended to be more economically sensitive companies, although certain secular growth names also performed well.

Sector performance varied widely within infrastructure. Midstream energy stocks, for instance, rose more than 30% in the year amid strong energy market fundamentals. Marine ports also significantly outpaced broad stocks, aided by an improving outlook for global trade.(1)

As 2022 progresses, we see potential for infrastructure to deliver another year of attractive returns, for two key reasons. First, the asset class has tended to outperform global equities during periods of both slowing growth (due to the relatively predictable cash flows associated with essential public services) and higher inflation, a macro environment we believe is likely to persist this year. (Inflation, which began 2021 at still-modest levels, jumped to a 40-year high by year-end as stimulus-driven demand met with supply-chain constraints.) Second, infrastructure could further benefit from investors’ increasing valuation consciousness, as relative valuations are currently attractive versus broader equities.

Beneficial inflation characteristics

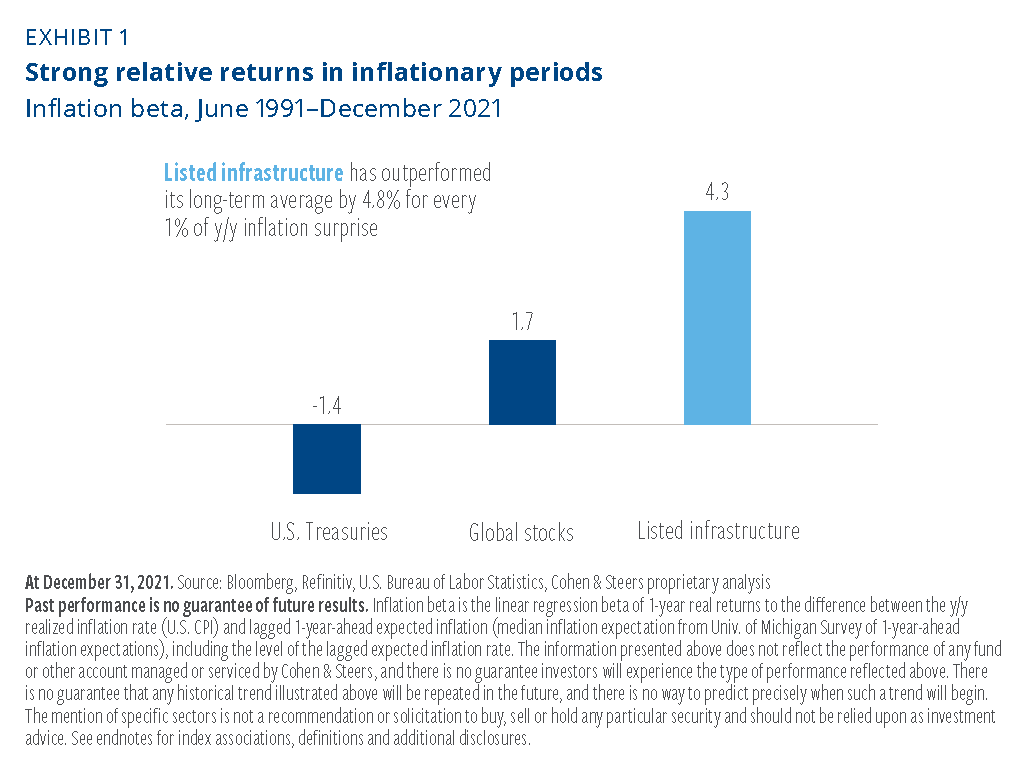

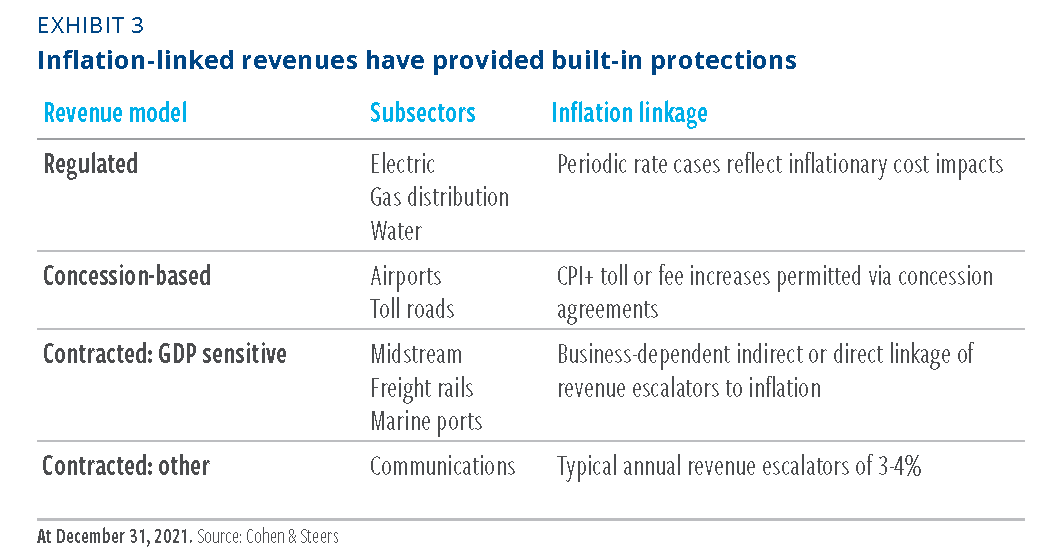

Infrastructure has historically delivered strong relative returns during periods of higher-than-expected inflation, compared with modest or negative relative performance for stocks and bonds (quantified in Exhibit 1 as “inflation beta”—the measure of outperformance of an asset class amid inflation surprise). This positive sensitivity has resulted from inflation-linked pricing mechanisms in many infrastructure pricing models, which provide for contractual adjustments to user fees. These adjustments may be based on fixed increases approximating inflation or on variable increases linked to consumer or producer price changes (see Exhibit 3). Furthermore, certain subsectors—particularly in transportation infrastructure—may benefit from rising throughput in a strong economy (which typically accompanies inflation).

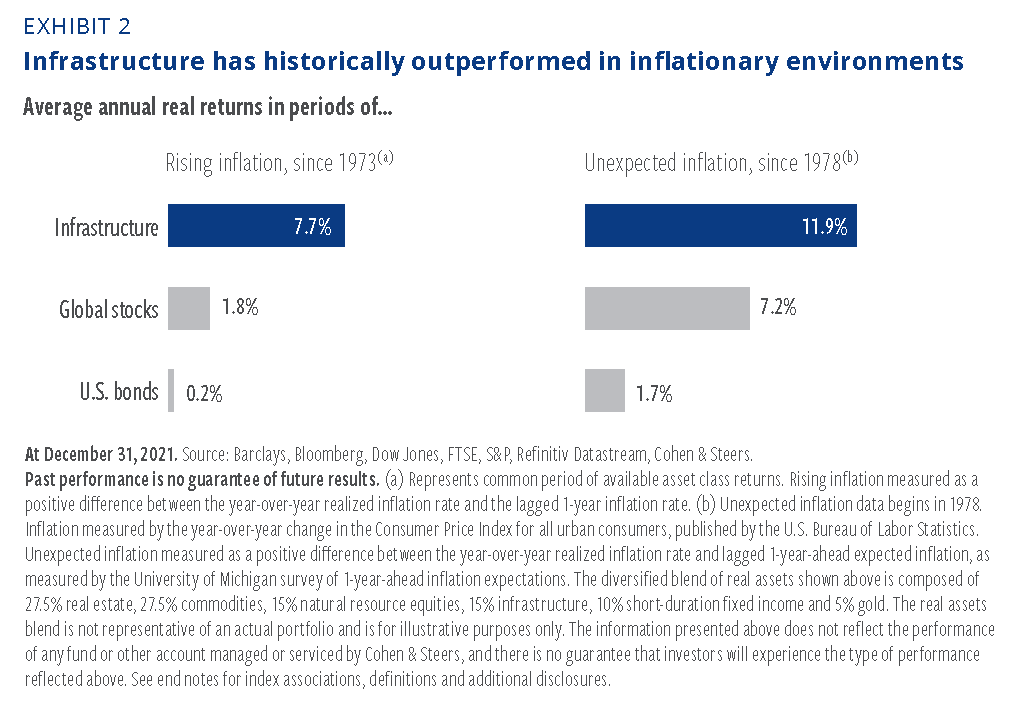

In addition to its relative outperformance, infrastructure has also often delivered more attractive absolute returns than stocks or bonds in periods of rising and unexpected inflation (Exhibit 2).

This favorable inflation sensitivity derives from structural factors found within the various subsectors, as shown in Exhibit 3.

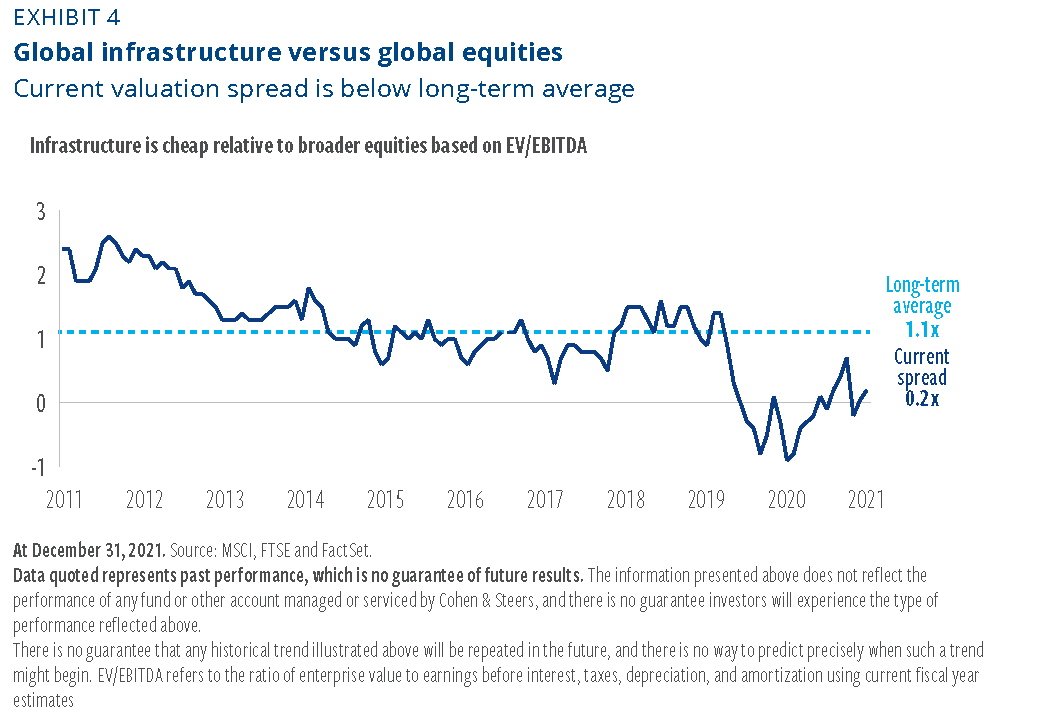

While investors may now be more willing to pay a premium to receive some inflation protection, infrastructure stocks actually ended 2021 trading at attractive valuations compared with stocks.

Values appear compelling looking at the spread or difference in share price multiples (Exhibit 4). On an enterprise value-to-cash flow multiple basis, listed infrastructure ended 2021 trading roughly in line with global equities—in sharp contrast to the asset class’s historical premium valuation. Any reversion to the average would imply a period of outperformance for infrastructure stocks.

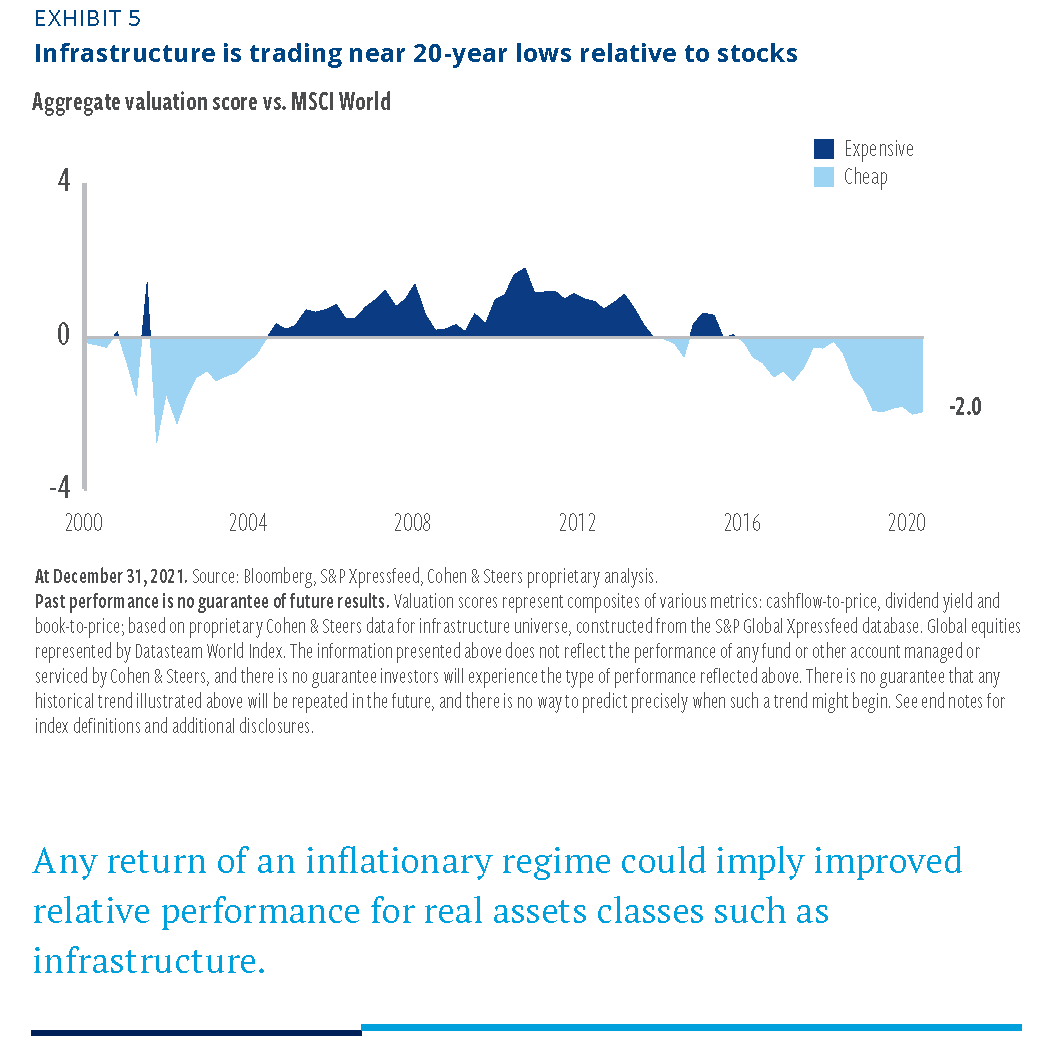

And because of the repeated and unprecedented disinflation surprises of the 2010s, which negatively affected returns for infrastructure and other real assets, valuations are historically attractive relative to equities.

These historically attractive valuations occur at a time, we believe, when infrastructure is well-positioned to benefit from continued healthy economic conditions and strong inflation protections. Longer-term, secular trends such as the digital transformation of economies and the transition to clean energy will potentially be significant drivers of infrastructure returns.

Positioning: A balanced sector approach

Heading into the new year, we are seeking to maintain a balanced portfolio, with a cyclical orientation complemented by more-defensive assets. We are keeping a close eye on the path of new virus variants and their potential impact on global economic activity.

Subsector spotlights

-

Freight rails: We favor North American freight rails, where demand and corresponding volume growth remain strong, driven by heightened e-commerce use, inventory restocking, and onshoring of industrial activity. Demand remains robust and supply chain issues are gradually being alleviated. With rails now trading below the S&P on relative price-to-earnings ratios, we see a nice setup forming for rails in 2022, with the potential for increased earnings as well as P/E multiple expansion.

-

Midstream Energy: Our outlook in 2022 remains supportive for the sector. In addition to what we see as an attractive macro backdrop and commodity price environment, the midstream space has benefited from markedly improved balance sheets in the last several years. We believe midstream has gone “back to the basics” and currently offers an attractive and well covered distribution, and should benefit from increasing cash returns to shareholders over time.

-

Electric Utilities: While we continue to favor electric utilities with renewables exposure, we are cautious toward the sector broadly, as economies continue to strengthen on the cyclical recovery and as central banks embark on policy normalization. This is an environment where defensive sectors, such as utilities, tend to lag, as was the case in 2021. With expectations that interest rates will slowly grind higher, we are comfortable maintaining this stance.

-

Toll Roads: The subsector remains vulnerable to near-term mobility restrictions as a result of virus variant developments; however, we anticipate the outlook for toll roads to improve as the year progresses, and as passengers opt for vehicle travel over mass-transit options in select regions.