Emerging Market Equities: Four Reasons for Optimism in 2022

Emerging markets endured a challenging 2021, dragged down mostly by China and South Korea, which represent close to half the index. But the developing world is diverse, and many individual countries did well. We expect improvement on several fronts in 2022, and the outperformance of EM over developed markets in January—despite turbulent market performance—is also encouraging.

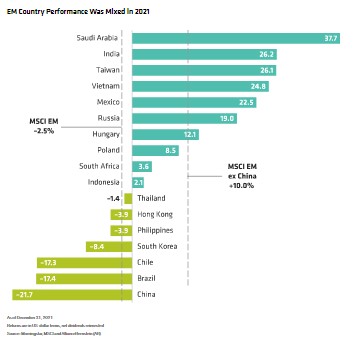

The MSCI Emerging Markets Index fell 2.5% in US-dollar terms last year. In contrast, the MSCI World Index gained 18.5%, helped by strong US returns.

Still, EM closed 2021 having navigated myriad COVID-19-related economic pressures throughout the year, including swift rounds of monetary policy tightening in some countries. Slower growth and regulatory uncertainty in China weighed heavily on EM’s performance. In fact, without China, EM stocks gained 10% for the year, led by double-digit gains among several countries—including Saudi Arabia and India (Display).

We think the fallout from China and other challenges is now receding. And considering that EM performance can be skewed by one or two dominant countries, top-line returns don’t always tell the full story. The emerging-markets benchmark includes a diverse group of countries, each with different policies, currencies and cultures, on distinct timelines in their business cycles. Through this wider lens we see at least four positive developments suggesting that EM investors will likely see a better 2022.

1. Vaccinations Are Up and Virus Fears Are Down

Threats linger from omicron and other potential variants. And while some EM countries lag in vaccination rollouts, penetration rates are broadly improving.

Moreover, populations and governments are increasingly learning to live with the virus. And with more people better protected, we expect fewer restrictions on economic activity. This should give more EM economies elbow room to fully reopen and further recover.

Countries such as Thailand, Vietnam and Indonesia have also dramatically reduced infection rates. As a result, they, along with India, will likely embark on economic recoveries and put bank credit losses all but behind them. And with large and younger vaccinated populations, they’ve begun to accept COVID-19 and all its variants as just a new fact of life, avoiding a return to restrictive lockdowns.

2. China Pressures Are Abating

China’s 2021 woes stemmed from a combination of shrinking credit availability, acute debt in the property sector and restrictive regulatory forces. Heightened competition with the US in technology and cybersecurity was another burden.

One big scare came from China’s deleveraging drive, made possible by the strong economic backdrop earlier in the year. This rattled the property sector, which has far-reaching importance to China’s economic health.

Evergrande—China’s second-largest developer—defaulted, forcing authorities to step up support. Stock prices negatively reacted, but contagion has been contained so far by broad restructuring and a call on banks to boost real estate lending and ease debt restrictions to shore up market liquidity. While we expect China will continue to discourage speculation, shares of developers and property management companies could recover if investor sentiment improves from last year’s overly pessimistic response.

Regulation temperament has been another sticky concern. But after a crackdown on education and tech companies last summer, we think China’s focus is now on implementing regulations rather than more tightening. This was the theme of December’s Central Economic Work Conference, where minutes showed a shifting emphasis to economic stability and energy, as well as a steady emphasis on carbon (green) initiatives and away from regulation.

China recently started to loosen monetary policy and has ample room to ease further, in our view, after tightening for the past year. This should help stabilize the economic backdrop and support corporate earnings. The country’s credit impulse—the change in newly issued credit relative to GDP—seems close to an inflection point and is on the rise (Display).

3. Less Shock Effect from Fed Policy Tightening

While global markets prepare for US Fed rate hikes in 2022, most EM central banks have been there for some time. Throughout 2021, EM countries have raised rates 2,500 basis points cumulatively—some 84 increases in all, compared to just five in 2020, according to HSBC.

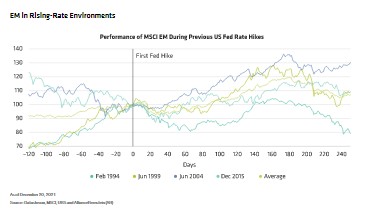

Although Fed tightening will be the chief headwind for global markets, most developing countries are out front and much better braced for it since they’ve already begun to adjust rates. EM stock performance has been mixed in the short term during rising-rate environments, dipping slightly in the first three months after the Fed begins tightening, and moving higher for at least the next six (Display).

The external positions for EM countries have improved too. This should help prevent a repeat of 2013’s “taper tantrum,” when liquidity dried up, funding costs rose and asset prices fell for countries with twin deficits—those with both fiscal and current account shortfalls. Today, basic balances—the sum of current account balances and foreign direct investment—are as robust as the early 2000s.

And unlike developed markets, we believe that inflation will likely be more transitory and less of a burden across EM economies, mostly because developing countries aren’t experiencing historic labor shortages and wage hikes. Current inflation data from several countries, including Brazil, indicate a possible stabilization.

4. Valuations Are Compelling

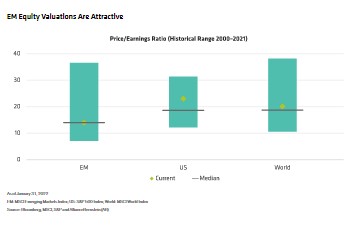

When global equity investors get edgy, EM often bears the brunt. But we believe that most of last year’s negative sentiment is now priced into the markets, with the MSCI EM trading at a price/trailing earnings ratio of 13.4x at the end of January, a 35% discount to developed market stocks. In our view, current low valuations provide an attractive entry point to EM stocks compared to developed markets, based on historical ranges (Display). About 40% of EM stocks are currently 30% below their 52-week highs, compared to 11% and 16% for US and World equities, respectively, as of January 31, 2022.

Compelling valuations are a good start. But quality, competitiveness, innovation and sustainability are other important gauges, along with the agility to navigate often-bumpy EM macro environments. Heading into 2022, companies with robust fundamentals will be well positioned to benefit from improving dynamics in EM, in our view.

In the technology sector, semiconductor manufacturers deserve attention, particularly in Taiwan. Financials across a wide array of countries are benefiting from a lending resurgence and improving credit quality, and consumer-discretionary companies, like internet and 5G providers, should continue to prosper as more EM consumers hop online to shop and game. We also expect a manufacturing pickup to ripple across EM, but especially in Vietnam and Indonesia, which filled the void created by the US-China trade standoff in recent years.

EM companies are as diverse as the countries, economies and markets where they operate. By developing differentiated insights, active investors can identify the most promising opportunities in changing market conditions to capture the recovery potential in EM stocks.

ABOUT THE AUTHORS: Henry S. D'Auria is the Chief Investment Officer of Emerging Markets Value Equities, a position he has held since 2002, and Portfolio Manager for the Next 50 Emerging Markets Fund. He served as co-CIO of International Value Equities from 2003 to 2012. Prior to that, D'Auria was one of the lead architects of the firm's global research department, which he managed from 1998 through 2002. Over the years, he has also served as director of research of Small Cap Value Equities and director of research of Emerging Markets Value Equities. D'Auria joined the firm in 1991 as a research analyst covering consumer and natural gas companies, and later covered the financial-services industry. He was previously a vice president and sell-side analyst at PaineWebber, where he specialized in restaurants, lodging and retail. D'Auria holds a BA in economics from Trinity College and is a CFA charterholder. Location: New York Sergey Davalchenko was appointed Chief Investment Officer of Emerging Markets Growth in February 2022. He has been a member of the portfolio-management team for Emerging Markets Growth since 2012 and has been the lead portfolio manager for the Emerging Markets Small Cap service since its inception in 2018. Before joining AB in 2011, Davalchenko was a senior international analyst at Global Currents Investment Management, a subsidiary of Legg Mason. Prior to that, he worked as a portfolio manager at Fenician Capital Management, where he was a partner. Davalchenko gained valuable on-the-ground experience through entrepreneurial work in emerging-market countries. He was also involved in various private equity transactions, primarily in Africa and Brazil. Early in his career, Davalchenko specialized in international equities in various analyst and portfolio-management roles for the State of Wisconsin Investment Board and Oppenheimer Capital. He holds a BS in finance from the University of Wisconsin. Location: New York Sammy Suzuki is Co-Chief Investment Officer of Strategic Core Equities. He was a key architect of the Strategic Core Platform and has been managing the Global, International and US portfolios since 2015, and the Emerging Markets portfolio since its inception in 2012. Suzuki has managed portfolios for nearly two decades. From 2010 to 2012, he also held the role of director of Fundamental Value Research, where he managed 50 fundamental analysts globally. Prior to managing portfolios, Suzuki spent a decade as a research analyst. He joined AB in 1994 as a research associate, first covering the capital equipment industry, followed by the technology and global automotive industries. Before joining the firm, Suzuki was a consultant at Bain & Company. He holds both a BSE in materials engineering from the School of Engineering and Applied Science, and a BS in finance from the Wharton School at the University of Pennsylvania (magna cum laude). He is a CFA charterholder and a member of the Board of the CFA Society New York. Location: New York DISCLAIMER:AllianceBernstein is an Associate Member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of TEXPERS nor AllianceBernstein. These views are subject to change. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.