Pension Review Board Creating New Rules for 'Plan-Friendly' FSRP Implementations

The Texas Pension Review Board committee creating rules for implementing House Bill 3898 accepted new, flexible proposals from the staff at its May meeting. The rules will be presented to the full Board on July 14 and the official public comment period will begin. Ultimate consideration of all comments and changes is planned for the October PRB meeting.

The Texas Pension Review Board is the state agency mandated to oversee public retirement systems at the state and local levels regarding their actuarial soundness and compliance with state reporting requirements.

The staff’s proposed rules attempt to address the untold number of situations in which pension funds may find themselves as they bring their amortization periods below 40-, 30-, and 25-years to comply with HB 3898.

The law, passed in the 2021 legislative session, has a trigger date of Sept. 1, 2025, and allows for the widely varying schedule with which pension funds conduct their actuarial valuation reports and implement plan reforms.

HB 3898’s changes sought to address PRB concerns that too much time was elapsing between the first signs of actuarial trouble and the development and implementation of Funding Soundness Restoration Plans.

PRB policy analyst Madilyn Jarman at the May meeting walked the PRB Actuarial Committee through many different scenarios in which systems in FSRP status, or those needing to bring their amortization periods below 30-years by Sept. 1, 2025, might find themselves.

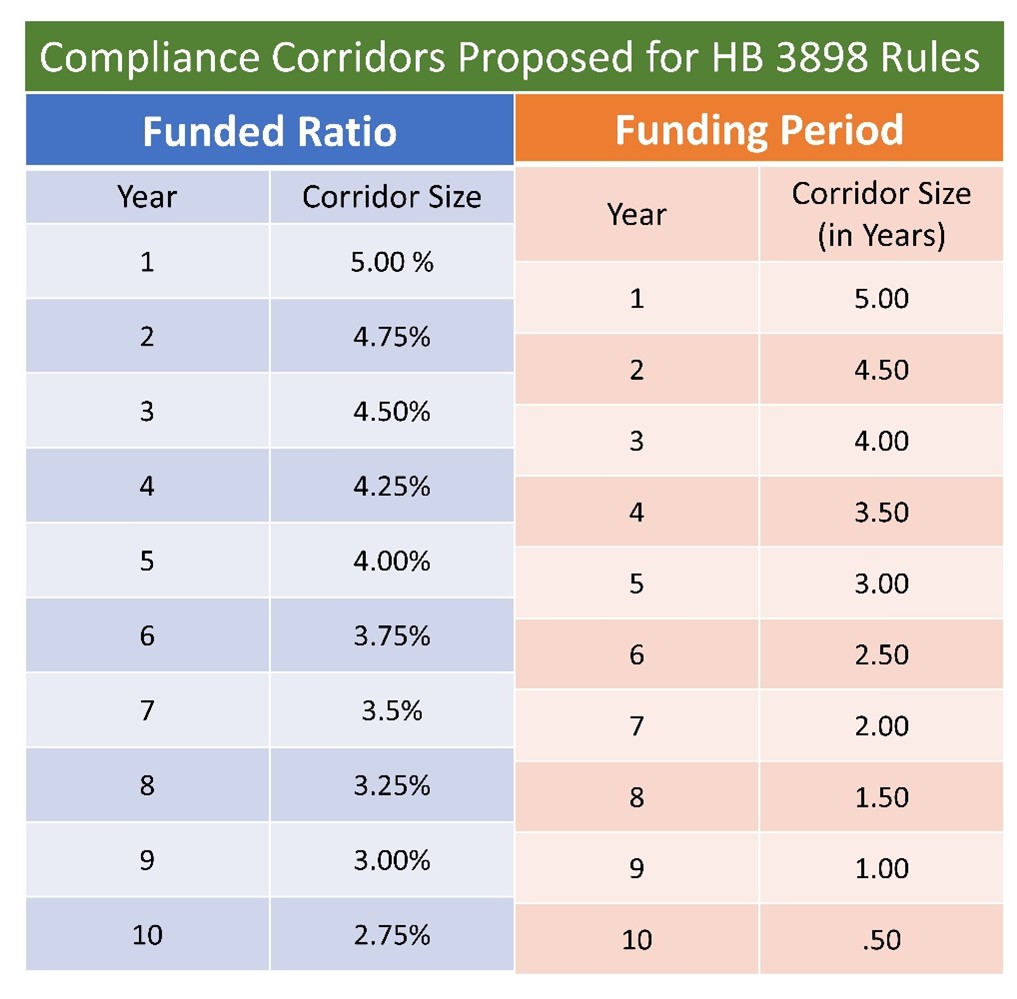

Jarman explained how the rules introduce new concepts, like “Compliance Corridors,” which recognize that it takes time for pension funds to adjust benefits, investment results, and contributions from members and their City sponsors. She described how the corridor is wide in the first years of implementation as the adjustments begin working. The rules draft presented by Jarman includes corridors for both funded ratios and amortization periods (see Figure 1).

Figure 1: The example chart above would use pension systems’ projections to create a compliance corridor unique to that system based on their funded ratio and amortization period. Source: “Policy for Determining and Promoting Compliance with Funding Soundness Restoration Plan Requirements (DRAFT),” preliminary draft of proposed rules, presentation of Pension Review Board staff at the May 18, 2022, Actuarial Committee.

But toward the end of 10 years, the corridor narrows, as the adjustments should have had the time needed to succeed or otherwise adjust to any negative market situations which may have occurred.

PRB actuarial committee members probed numerous possibilities that might affect pension systems that are already in an FSRP process, become subject to the FSRP requirements, fall short of their FSRP, or revise their FSRP and still are not moving in the right directions actuarially.

PRB staff actuary David Fee explained, for example, how the corridors would provide guidance as to when a system would be required to submit revised FSRPs. He also suggested that systems with adequate funding ratios and amortization periods could submit voluntary FSRPs that could use that corridor as guides to keep them from triggering a formal FSRP process.

Prior to the meeting, TEXPERS Legislative Committee member Tyler Grossman penned comments about the proposed rules, requesting that a “final rules product also preserves the ability of individual systems to work with their respective government sponsors to jointly determine [whether automatic risk-sharing mechanisms and/or adjustable benefit or contribution structures] need to be taken to fulfill [revised]-FSRP requirements consistent with each system’s governing statute and/or the plan sponsor’s charter.” Grossman is the executive director of the El Paso Firemen and Policemen’s Pension Fund.

Kolby Beckham, the chair of the Longview Firemen’s Relief & Retirement Fund, noted in comments that many funds are already paying 100% or more of the normal cost of their plan. Normal costs are contributions necessary, added to investment income, that pays for benefits earned each year. Beckham suggested that the normal cost being paid by members should be evaluated before automatic cost sharing would go into effect. He said, “Asking for members that are already paying 100% of their benefit to give more is not fair or equitable.”

PRB Vice-Chair Keith Brainard commented that the legacy FSRP laws combined with the new ones add complexity to the implementation.

“It would be a lot simpler if the PRB and its staff did not try to inject some amount of grace and flexibility into this. A lot of the additional flexibility we’re dealing with here is creating positive incentives for pension plans to do the right thing and to avoid taking a hit, frankly, from the statute.” The complexity is intended to be plan-friendly while complying with the new legal requirements, he added.

The July 14 PRB Meeting

The Texas Pension Review Board is holding a board meeting at 10 a.m. CST on Thursday, July 14, 2022, in the Reagan Building, Committee Room 120, located at 1400 Congress Avenue in Austin.

For those who cannot attend the in-person meeting, the meeting will stream online at https://house.texas.gov/video-audio/. Download the PRB Board meeting agenda here.

Those needing additional information may contact the Pension Review Board by calling 512-463-1739 or emailing [email protected].

About the Author:Joe Gimenez is a public relations professional who specializes in pension fund communications. He has assisted TEXPERS and several Texas pension funds in crisis situations and public affairs.