The Economic Benefit of Public Pension Dollars in Small Towns and Rural Texas

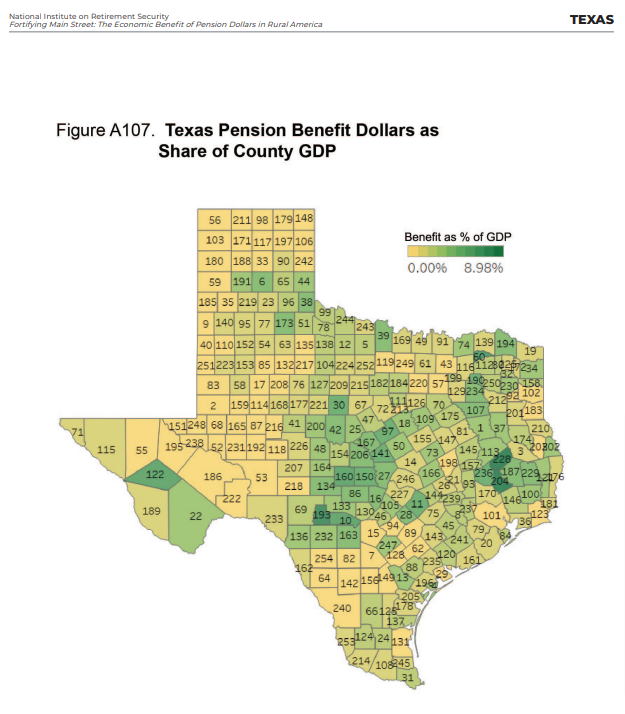

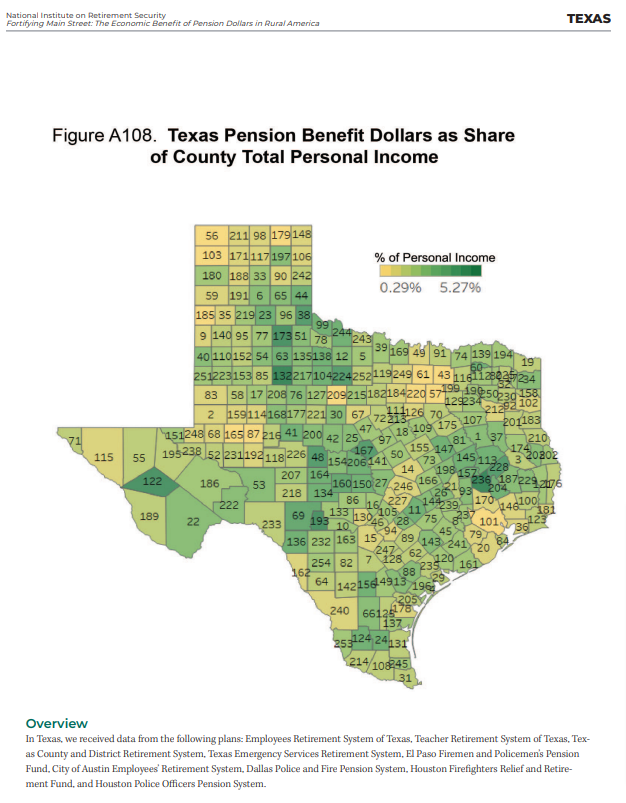

In 2018, public pension benefit dollars represented between 0.4% and 1.1% on average of Gross Domestic Product (GDP) for each county type in Texas. New research indicates that public pension plans have a particularly positive economic impact on small towns and rural communities.

The National Institute on Retirement Security released a study on July 12, 2022, titled Fortifying Main Street: The Economic Benefit of Public Pension Dollars in Small Towns and Rural America, that details the findings after studying 2,922 counties in 43 states across the United States. In its study, the nonprofit retirement security think-tank examined how less populated counties in the U.S. with smaller economies are affected by the flow of public pension benefits compared to more populated, urban counties with larger economies. The study included 254 Texas counties.

|

|

The key findings are as follows:

- Public pension benefit dollars represent between 1% and 3% of GDP on average in the 2,922 counties studied in the U.S.

- At 2% average Total Personal Income (TPI), rural counties in the Lone Star State have the highest percentage of residents receiving public pension benefits. This is in line with national data indicating that rural counties have the highest percentages of their populations receiving public pension benefits.

- Micropolitan, or small town, counties experience a greater relative impact in terms of both Gross Domestic Product (GDP) and Total Personal Income from pension benefit dollars than rural or metropolitan counties. Texas small town counties had benefits as a percent of TPI of 1.9% and benefits as a percent of GDP of 1.1%.

- Nationally, pension benefits impacted personal income in rural counties more than metropolitan ones, while pension benefits impacted GDP in metropolitan and rural counties reasonably closely. In Texas, rural counties saw an average percent of TPI of 2% versus 0.9% for metropolitan counties, while GDP for rural was 0.4% and metropolitan was 0.8%.

- State capital counties are outliers compared to other metropolitan counties, likely because they have a more significant number of public employees, write the study's researchers. In the study, the Texas capital of Austin is in Travis County. Although it is a metropolitan county, it differs from its metropolitan cohorts in Texas. The capital county has an average benefits as a percent of GDP of 1% vs. 0.8% average among its metropolitan peers and an average benefits as a percent of TPI of 1.2% vs. 0.9% among its peer group.

Tyler Bond, NIRS research manager and co-author of the study, says there are many outliers due to the sheer number of counties in Texas.

"Texas illustrates a number of the key findings from the research," Bond says. "While the six counties containing the six largest cities [Houston, Dallas, Fort Worth, Austin, San Antonio, and El Paso] in Texas have the greatest numbers of public pension benefit recipients, all six counties are below the state average in terms of both percent of GDP and percent of personal income. This would be expected given the size of the economies in those cities. Also, due to the sheer number of counties in Texas, especially sparsely populated counties in west Texas, there are some outliers in the data, and Texas sees a larger spread between low and high percentages among the different counties than most other states."

According to new data from the U.S. Census Bureau, population shifts and uneven growth have impacted small towns and rural communities. NIRS executive director Dan Doonan, who co-authored the report, says this, coupled with current economic trends, has put a lot of pressure on rural counties and small cities.

"Often, the largest employer in these smaller towns is a public entity like a school system or municipality that employs teachers, nurses, firefighters, and public safety officials," he says. "These public employees spend their career serving their communities at a time when a growing number of young workers are leaving their hometowns for job opportunities in urban areas. Eventually, public employees in rural and smaller communities retire and typically stay in their hometown. Retired public employees spend their pension income in their towns on goods and services like housing, food, medicine and clothing, which serves as a stable source of economic activity in smaller communities."

Doonan says NIRS' new research shows that pension benefit dollars have a significant economic impact on struggling small towns and rural communities. Through its prior research, Pensionomics 2021: Measuring the Economic Impact of DB Pension Expenditures, the Institute focused on the downstream economic impact of the spending of pension benefits.

County-level pension benefits are the focus of its Fortifying Main Street study. NIRS reports that new county-level data on Gross Domestic Product only became available recently, enabling new research areas.

Based on previous studies, NIRS researchers concluded that rural areas receive greater relative economic benefits from pension benefit dollars than cities. Cities likely receive more pension benefit dollars in absolute terms. Still, these are dwarfed by the size of the economy in large cities, according to the NIRS report.

Fortifying Main Street: The Economic Benefit of Public Pension Dollars in Small Towns and Rural America is authored by Doonan and Bond from NIRS, along with Nathan Chobo from Linea Solutions Inc.

A webinar regarding the report was held on Thursday, July 14, 2022. You can watch it here.