ABS Market Has Grown in Size and Evolved in Sophistication

In its earlier stages, the asset-backed securities1 (ABS) market securitized a relatively narrow market segment focusing on consumer-centric financial assets and targeted a narrow group of investors. That is no longer the case. Over the past decade, ABS has evolved substantially, surpassing other financial products in its ability to provide an attractive and diverse universe of investment opportunities. Importantly, the evolution and growing sophistication of ABS allows skilled investment teams to tailor portfolios to a growing investor base with a broad range of investment goals.

(1In this paper, references to ABS exclude real estate securitizations such as mortgage-backed securities.)

Market Evolution Overview

The origins of ABS reside in consumer-centric products, but the market has experienced multifaceted growth in both size and depth.

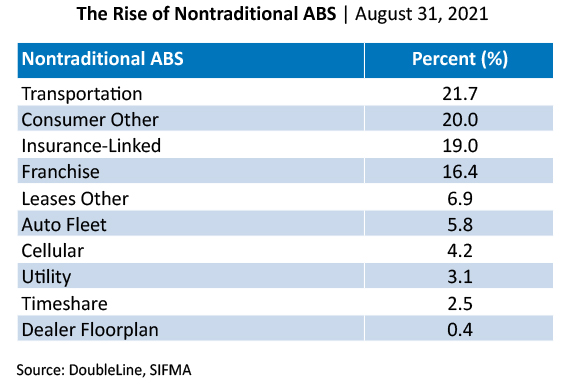

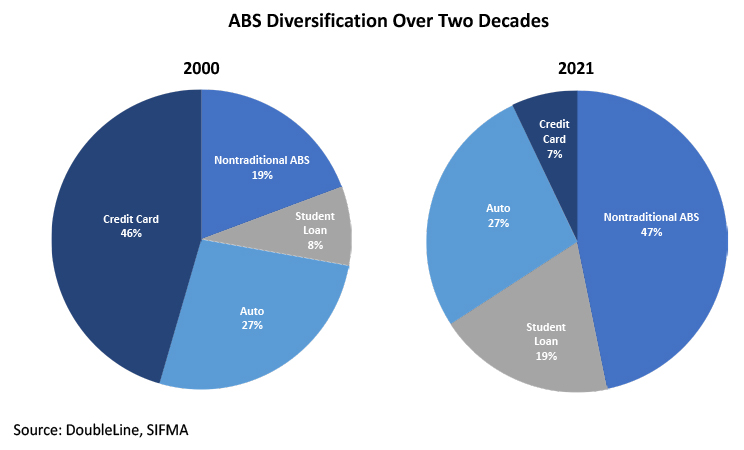

Consumer: In the consumer space, the industry continues to evolve and has demonstrated an ability to adapt with changing consumer trends. For example, the global drive for sustainable power has given rise to residential solar loan securitizations. Moreover, a digitally native generation of consumers increasingly favor technology-enabled companies over branch-based banks, leading to tremendous growth away from credit card and bank card ABS. With more diversification in the consumer-lending landscape, credit card securitizations only comprised 7% of the overall ABS market in 2021 while nontraditional ABS, which have experienced rapid growth, accounted for 47% of the market.

Commercial: Nontraditional ABS (almost half of the market currently) includes a broad cross-section of industries, including commercially related collateral pools. One characteristic of the growing ABS market is the emergence of transactions backed by real assets. For instance, commercial solar ABS, aircraft ABS and telecom ABS are collateralized by contracted revenue associated with the underlying project or equipment, and offer additional downside protection by being directly secured by the hard assets themselves. Emerging sectors with nonstandard assets require nonstandard underwriting approaches and, thus, both sector- and collateral-specific analytics and surveillance are required. Liquidity in early phase sectors might be challenging as well and should be considered before including in broader portfolio mandates.

Catalyst for Growth

Expansion and sophistication of the ABS space is spurred by the growing appetite from investors and issuers.

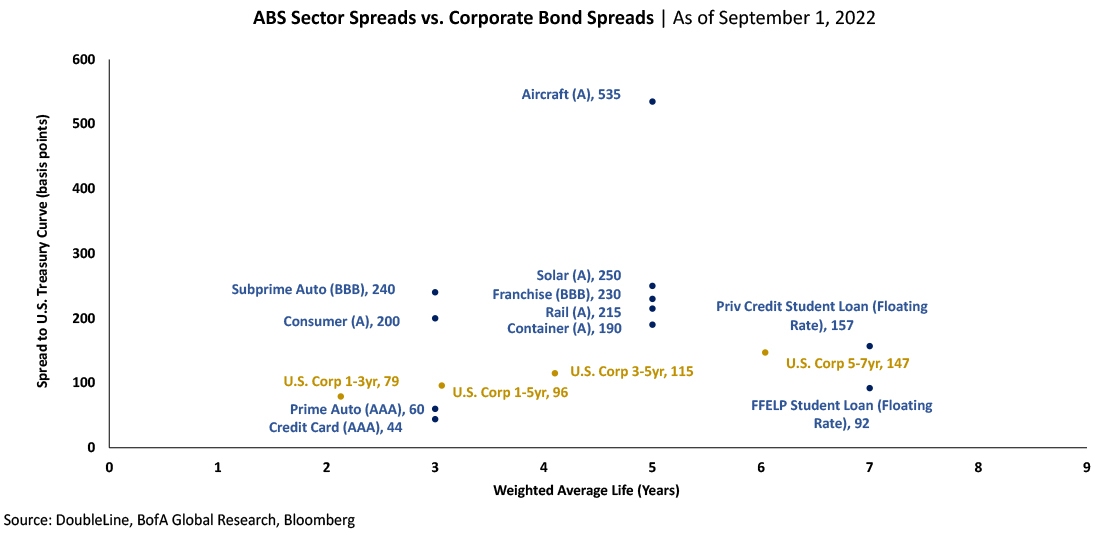

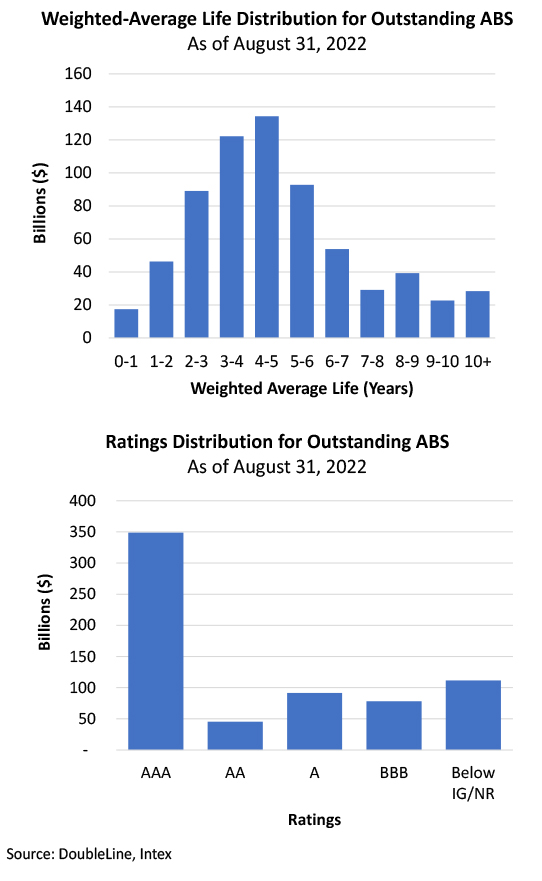

Investors are drawn to the growing diversification, which takes place not only in the form of broader underlying asset classes. Diversification is also present in the mix of structure, duration, and credit rating profiles. Investors can access a portfolio with a tailored fit to meet their investment goals and needs, or more specifically, to match varying risk appetites to a wide spectrum of duration and rating profiles. Consequently, the investor base is growing with asset managers, hedge funds and insurance companies increasing their allocations to ABS.

Another reason for the popularity of ABS is the benefit of direct security in the underlying cash flowing assets when compared to unsecured bonds. Pledged assets and related contracts offer more transparency into a defined stream of cash flows and allow for improved forward visibility of revenue streams versus unsecured corporate bonds. A clearly delineated security package improves recovery values in times of stress.

In addition to direct security, ABS offers structural protection because cash flows from the underlying assets are divided into tranches following a set payment waterfall. Investors with lower risk appetite can be exposed to the senior most tranches in the structure, while investors with higher risk tolerance can seek exposure to junior tranches. Similarly, investors with duration appetite can be exposed to long duration tranches and vice versa.

Finally, ABS offer investors incremental spread when compared to corporate bond counterparts, which can be attributed to the complexity in the analysis of underlying assets and structural nuances.

Corporate issuers are also taking advantage of the benefits of ABS technology. Unlike corporate bonds or loans, ABS allow off-balance-sheet treatment of assets whereby revenue-generating assets can be held in a bankruptcy-remote special purpose vehicle (SPV) protecting a corporate sponsor’s credit quality and preserving a nimble (i.e., asset-light) balance sheet. Anecdotally, corporations with an asset-light balance sheet held up well financially during the pandemic-induced downturn in 2020. ABS structures are also effective complementary sources of funding for corporations.

Conclusion

ABS has grown in size and evolved in sophistication over the past decade. The asset class is an attractive product to a wide-ranging group of investors with varying risk and duration appetites. ABS technology is well suited to adapt to changing investor preferences and will be utilized to find solutions for new and innovative corners of the marketplace.

Definitions

Asset-Backed Security (ABS) – Investment security, such as a bond or note, that is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties or receivables.

Basis Points (BPS) – Basis points (or basis point (bp)) refer to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% or 0.0001, and is used to denote the percentage change in a financial instrument. The relationship between percentage changes and basis points can be summarized as: 1% change = 100 basis points; 0.01% = 1 basis point.

Credit Rating – Refers to a quantified assessment of a borrower’s creditworthiness in general terms or with respect to a particular debt or financial obligation. A credit rating can be assigned to any entity that seeks to borrow money: an individual, a corporation, a state or provincial authority, or a sovereign government.

Duration – Measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Federal Family Education Loan Program (FFELP) – System (which was discontinued in 2010) of private student loans that were subsidized and guaranteed by the U.S. government.

Investment Grade – Rating that signifies a municipal or corporate bond presents a relatively low risk of default. Bonds below this designation are considered to have a high risk of default and are commonly referred to as high yield (HY) or “junk bonds.” The higher the bond rating the more likely the bond will return 100 cents on the U.S. dollar.

Off Balance Sheet (OBS) – “Off-balance-sheet (OBS) items” is a term for assets or liabilities that do not appear on a company’s balance sheet. Although not recorded on the balance sheet, they are still assets and liabilities of the company. Off-balance-sheet items are typically those not owned by or are a direct obligation of the company. For example, when loans are securitized and sold off as investments, the secured debt is often kept off the bank’s books.

Special Purpose Vehicle (SPV) – Is a subsidiary company that is formed to undertake a specific business purpose or activity.

Spread – Difference between yields on differing debt instruments, calculated by deducting the yield of one instrument from another. The higher the yield spread, the greater the difference between the yields offered by each instrument. The spread can be measured between debt instruments of differing maturities, credit ratings or risk.

Weighted Average Life (WAL) – Average number of years for which each dollar of unpaid principal on a loan, mortgage or bond remains outstanding.

About the Authors: Andrew Hsu, CFA, joined DoubleLine at its inception in 2009. He is a Portfolio Manager for the DoubleLine Total Return and ABS/Infrastructure Income strategies. Hsu is a permanent member of the Fixed Income Asset Allocation and Structured Products committees. Prior to that, he was responsible for analysis and trading of structured products, where his focus included residential MBS and ABS transactions. Hsu’s responsibilities have also included structuring and negotiating terms on new-issue transactions and forming strategic partnerships with issuing entities in order to participate in key transactions. Prior to DoubleLine, he worked at TCW from 2002, where he focused on credit analysis for structured product securities and co-managed two structured product funds centered on debt and equity investments. During that time, Hsu was actively involved with portfolio management decisions and investment analysis, including reverse engineering complex CDO/CLO structures. He holds a bachelor's degree in Finance from the University of Southern California and is a CFA® charterholder.

Andrew Hsu, CFA, joined DoubleLine at its inception in 2009. He is a Portfolio Manager for the DoubleLine Total Return and ABS/Infrastructure Income strategies. Hsu is a permanent member of the Fixed Income Asset Allocation and Structured Products committees. Prior to that, he was responsible for analysis and trading of structured products, where his focus included residential MBS and ABS transactions. Hsu’s responsibilities have also included structuring and negotiating terms on new-issue transactions and forming strategic partnerships with issuing entities in order to participate in key transactions. Prior to DoubleLine, he worked at TCW from 2002, where he focused on credit analysis for structured product securities and co-managed two structured product funds centered on debt and equity investments. During that time, Hsu was actively involved with portfolio management decisions and investment analysis, including reverse engineering complex CDO/CLO structures. He holds a bachelor's degree in Finance from the University of Southern California and is a CFA® charterholder.  Fifi Wong joined DoubleLine in 2009. She is Portfolio Manager on the Global Infrastructure Investment and Asset-Backed Securities team. Prior to DoubleLine, Wong was an Assistant Vice President at TCW where she was a Structured Products Risk Analyst. She holds a bachelor's degree in Mathematics/Economics from the University of California, Los Angeles. Disclosures: DoubleLine is an Associate Member of TEXPERS. Important Information Regarding This MaterialIssue selection processes and tools illustrated throughout this presentation are samples and may be modified periodically. These are not the only tools used by the investment teams, are extremely sophisticated, may not always produce the intended results and are not intended for use by non-professionals. DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available. This material may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a client’s account, or market or regulatory developments. Important Information Regarding Risk FactorsInvestment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. All investments involve risks. Please request a copy of DoubleLine’s Form ADV Part 2A to review the material risks involved in DoubleLine’s strategies. Past performance is no guarantee of future results. Important Information Regarding DoubleLineTo receive a copy of DoubleLine’s current Form ADV (which contains important additional disclosure information, including risk disclosures), a copy of DoubleLine’s proxy voting policies and procedures, or to obtain additional information on DoubleLine’s proxy voting decisions, please contact DoubleLine’s Client Services. Important Information Regarding DoubleLine’s Investment StyleDoubleLine seeks to maximize investment results consistent with our interpretation of client guidelines and investment mandate. While DoubleLine seeks to maximize returns for our clients consistent with guidelines, DoubleLine cannot guarantee that DoubleLine will outperform a client’s specified benchmark or the market or that DoubleLine’s risk management techniques will successfully mitigate losses. Additionally, the nature of portfolio diversification implies that certain holdings and sectors in a client’s portfolio may be rising in price while others are falling or that some issues and sectors are outperforming while others are underperforming. Such out or underperformance can be the result of many factors, such as, but not limited to, duration/interest rate exposure, yield curve exposure, bond sector exposure, or news or rumors specific to a single name. DoubleLine is an active manager and will adjust the composition of clients’ portfolios consistent with our investment team’s judgment concerning market conditions and any particular sector or security. The construction of DoubleLine portfolios may differ substantially from the construction of any of a variety of market indices. As such, a DoubleLine portfolio has the potential to underperform or outperform a bond market index. Since markets can remain inefficiently priced for long periods, DoubleLine’s performance is properly assessed over a full multi-year market cycle. CFA® is a registered trademark owned by CFA Institute. DoubleLine Group is not an investment adviser registered with the Securities and Exchange Commission (SEC). DoubleLine® is a registered trademark of DoubleLine Capital LP. You cannot invest directly in an index. © 2022 DoubleLine Capital LP

Fifi Wong joined DoubleLine in 2009. She is Portfolio Manager on the Global Infrastructure Investment and Asset-Backed Securities team. Prior to DoubleLine, Wong was an Assistant Vice President at TCW where she was a Structured Products Risk Analyst. She holds a bachelor's degree in Mathematics/Economics from the University of California, Los Angeles. Disclosures: DoubleLine is an Associate Member of TEXPERS. Important Information Regarding This MaterialIssue selection processes and tools illustrated throughout this presentation are samples and may be modified periodically. These are not the only tools used by the investment teams, are extremely sophisticated, may not always produce the intended results and are not intended for use by non-professionals. DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available. This material may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a client’s account, or market or regulatory developments. Important Information Regarding Risk FactorsInvestment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. All investments involve risks. Please request a copy of DoubleLine’s Form ADV Part 2A to review the material risks involved in DoubleLine’s strategies. Past performance is no guarantee of future results. Important Information Regarding DoubleLineTo receive a copy of DoubleLine’s current Form ADV (which contains important additional disclosure information, including risk disclosures), a copy of DoubleLine’s proxy voting policies and procedures, or to obtain additional information on DoubleLine’s proxy voting decisions, please contact DoubleLine’s Client Services. Important Information Regarding DoubleLine’s Investment StyleDoubleLine seeks to maximize investment results consistent with our interpretation of client guidelines and investment mandate. While DoubleLine seeks to maximize returns for our clients consistent with guidelines, DoubleLine cannot guarantee that DoubleLine will outperform a client’s specified benchmark or the market or that DoubleLine’s risk management techniques will successfully mitigate losses. Additionally, the nature of portfolio diversification implies that certain holdings and sectors in a client’s portfolio may be rising in price while others are falling or that some issues and sectors are outperforming while others are underperforming. Such out or underperformance can be the result of many factors, such as, but not limited to, duration/interest rate exposure, yield curve exposure, bond sector exposure, or news or rumors specific to a single name. DoubleLine is an active manager and will adjust the composition of clients’ portfolios consistent with our investment team’s judgment concerning market conditions and any particular sector or security. The construction of DoubleLine portfolios may differ substantially from the construction of any of a variety of market indices. As such, a DoubleLine portfolio has the potential to underperform or outperform a bond market index. Since markets can remain inefficiently priced for long periods, DoubleLine’s performance is properly assessed over a full multi-year market cycle. CFA® is a registered trademark owned by CFA Institute. DoubleLine Group is not an investment adviser registered with the Securities and Exchange Commission (SEC). DoubleLine® is a registered trademark of DoubleLine Capital LP. You cannot invest directly in an index. © 2022 DoubleLine Capital LP