Consensus for 75bps Increase in November, higher Terminal Rate in Intermediate Future

About a half a year has passed since we last updated you with our take on the bond market. Since then, the Federal Reserve has tilted even more hawkishly with 75bp rate increases in their attempt to combat inflation. Unfortunately, they have not made much headway, as August CPI data registered a gain of 8.3% year-over-year, with Ex Food and Energy CPI at 6.3%, both ahead of economists’ and market expectations. These high numbers are not what Fed Governors or the markets were hoping to see as the immediate reaction from both bonds and stocks was a quick sell-off. Making matters even more difficult is the reality that the “sticky” components of inflation, such as rent, posted its largest monthly increase in this cycle since 1986. Inflation on services also touched a new high, as medical care and transportation services helped drive gains. If not for drops in gasoline and other commodities, the latest inflation report would have been even hotter. We believe another 75bps rate increase is all but certain when the Fed meets later in September. While consensus is growing for an additional 75bps in November and a higher terminal rate in our intermediate future, the question becomes whether or not this scenario is fully accounted for in current prices.

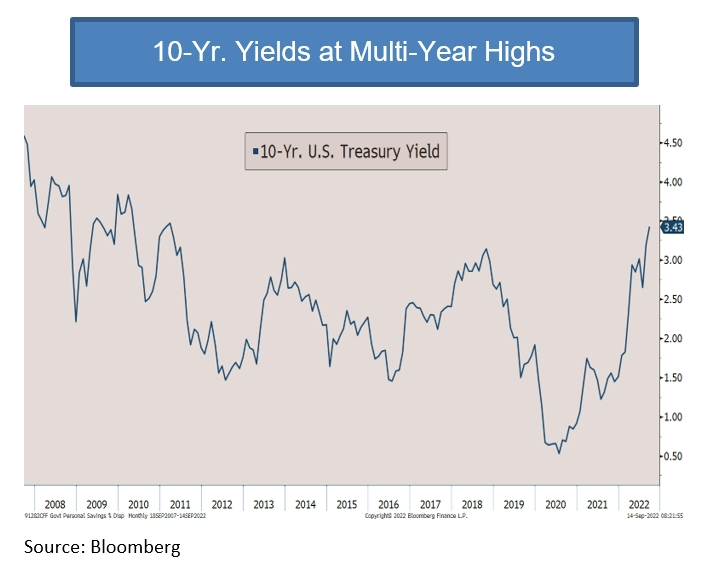

Rising interest rates are generally not kind to stock and bond prices, as investors were just reminded of on September 13, 2022 as the NASDAQ lost over 5%. It is the lag effect of these rate increases that have many worried, including Fed Chair Jerome Powel, who seems to recognize the dilemma we all face. Listeners of his Jackson Hole, WY speech were reminded that the road to lower inflation will not necessarily be smooth and there will be pain with a potential uptick in unemployment and some economic weakness. However, he indicated those outcomes are far better than what might happen if inflation is left unchecked. One could argue such a pragmatic tone has been lacking from the Fed. The market now seems to be paying attention as yields across the curve are moving higher while the Fed finds itself in a pickle.

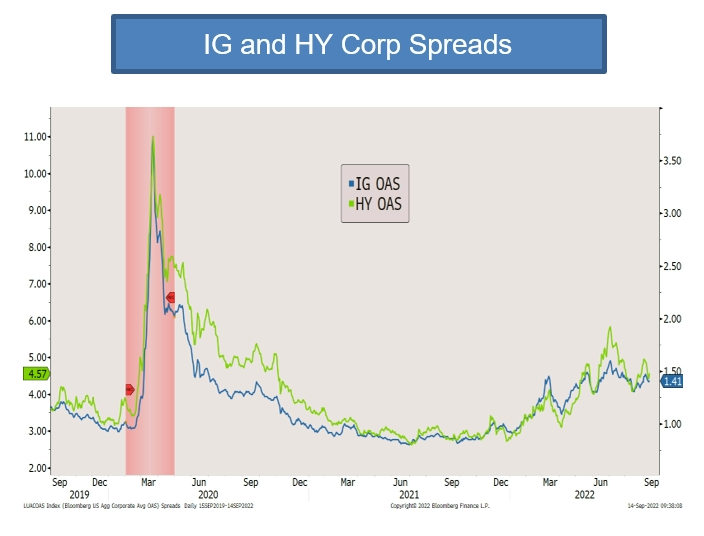

So far, the corporate bond market is taking the latest CPI data in stride, with Investment Grade benchmark bonds trading 1bps wider on spread basis (OAS), while High Yield names were off 15bps. The spread chart below highlights the added yield needed for an investor to buy a corporate bond versus a U.S. Treasury bond. Most consider these readings as a main barometer regarding the risk of buying a corporate bond and the general health of the economy and its prospects. The higher the spread, the more perceived risk there is in owning corporate bonds.

While one day does not make a trend, we expected more of a reaction from Investment Grade issues. Perhaps this is another sign that some investors are finding the risk/reward tradeoff in the bond market to be more appealing.

About the Author:Mark Anderson is the Chief Strategy Officer at National Investment Services. Disclaimer: National Investment Services is an Associate Member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of National Investment Services nor TEXPERS. These views are subject to change.