China’s economy and markets are not only too large to ignore, but they are now so large that there is a small but growing group of investors who approach China as a specific investment allocation.

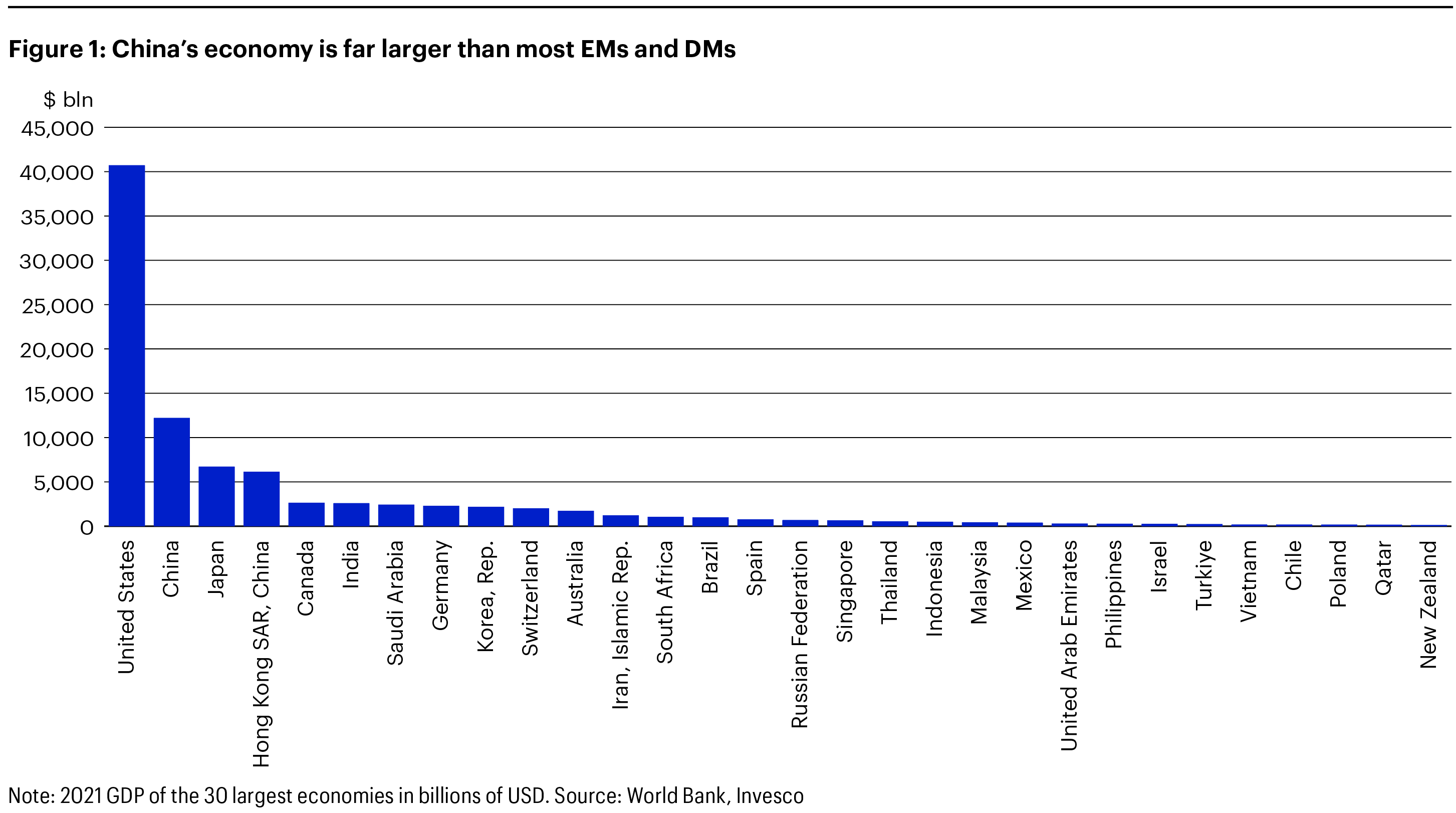

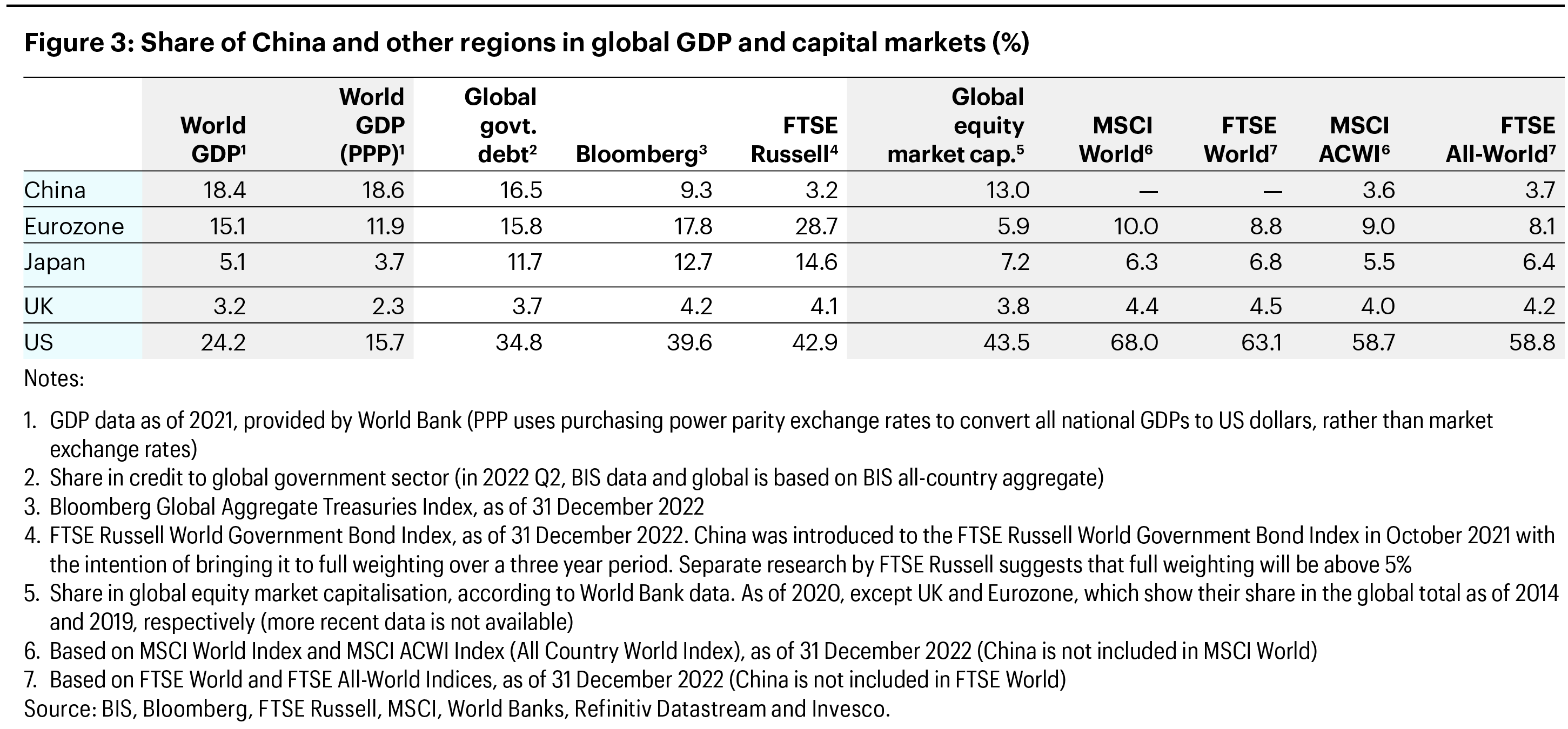

As Figure 1 shows, China’s nominal GDP at market exchange rates is the second largest in the world, already significantly larger than the Eurozone (EZ). With higher growth rates than the US, EZ, UK or Japan, China is poised to become the largest economy within this decade. On a purchasing power parity basis, which adjusts for different price levels for the same types of economic activity in different countries, China’s economy is already the largest in the world. With many restrictions to investing in China lifted and the inclusion of the country in commonly used global benchmarks, we suspect China will form an increasing share of investor portfolios over the coming years and decades. In short, China has grown so large that we think it merits the same consideration as the US and other large developed markets (DM) and that it should certainly be separated from the usual basket of emerging markets (EM) economies.

In other words, investors are increasingly viewing China as being in a class by itself, in the same way that investors treat the major DM economies like the US, EZ, Japan and the UK, dedicating substantial analytical and investment resources to their economies and financial markets.

We see both private and official institutional investors thinking about standalone country mandates for China. This rethink was flagged in investor interviews for the 2020 edition of the Invesco Global Sovereign Asset Management Study, which surveys sovereign wealth funds and central banks around the world annually. At Invesco, we already take this approach in many of our own research and investment processes. We formulate our Invesco annual global outlook on a foundation of our assessment of the three major global growth poles – China, the EZ and the US. We also regularly discuss the global economy and markets with many clients by focusing on these three economies as a basis for thinking about how most other national economies and global asset classes will evolve, with a few exceptions in both DM and EM categories (notably the UK, Japan and India where domestic dynamics are often more important).

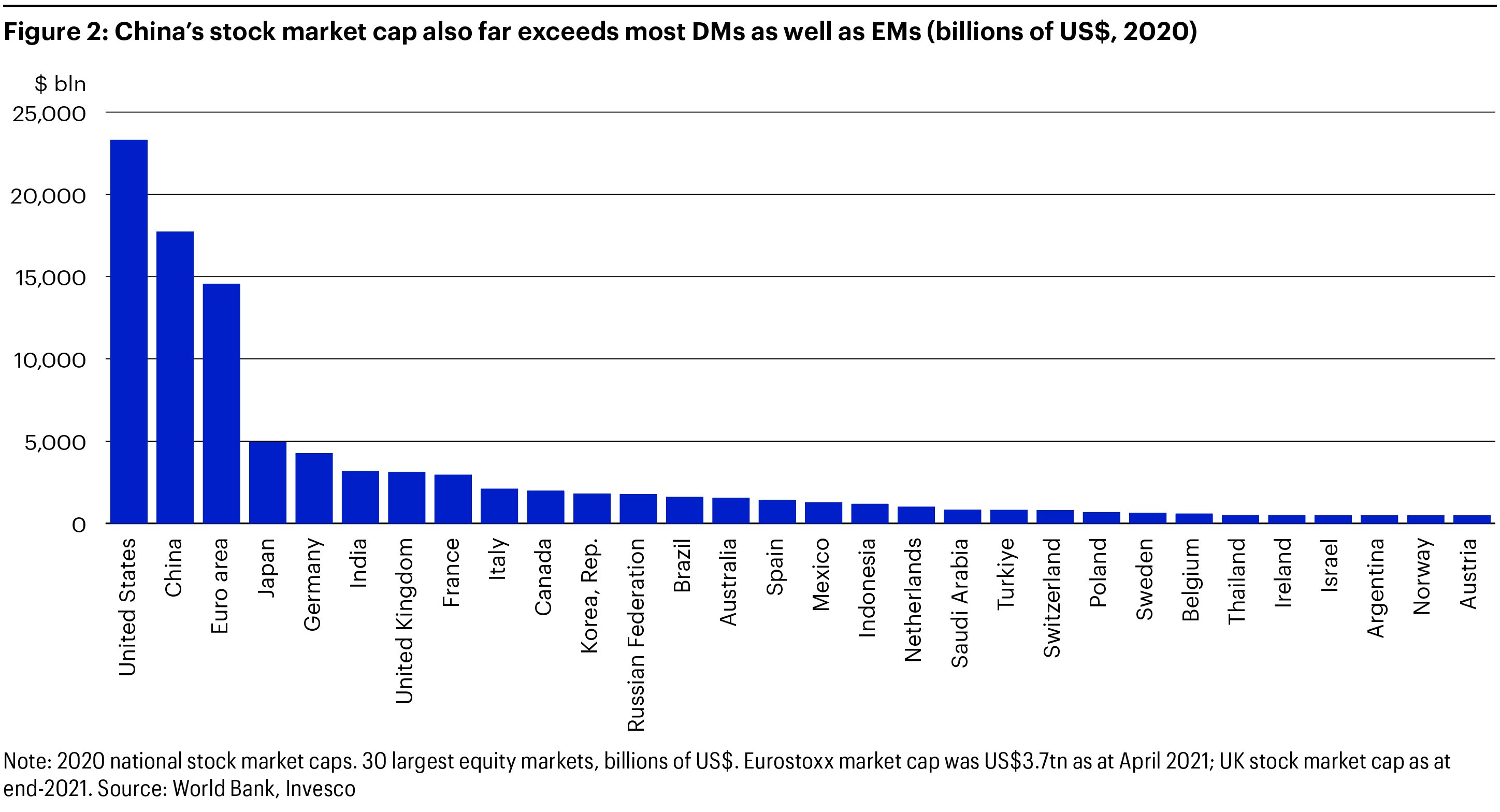

It remains true that China does not have a high per capita income in line with the US, EZ, UK or Japan. It is also true that restrictions on capital account convertibility – the right of residents and non-residents to freely trade currencies and assets at will with each other – remain in China. It is understandable that such restrictions may be a reason for some index providers to restrict China’s entry into the same indices as major DMs. However, China’s uniqueness as now the world’s largest trading nation, third largest bond market and second largest national equity market – yet with resident capital controls and other unique features not found in other major economies – is viewed by some investors as another reason for considering a standalone allocation to China.

We see the current and anticipated future importance of China and its financial markets justifying dedicated investment processes and teams. Further, many commonly used benchmarks understating the importance of China within global financial markets which may cause structural underexposure.

To read the full report, click here or contact Sam King at Invesco, [email protected].

About the Authors: Disclosures:Invesco Advisers, Inc. is an Associate Advisor member of TEXPERS. The views expressed are those of the authors and do not necessarily represent those of Invesco or those of TEXPERS. This information is intended for US residents. All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This is not to be construed as an offer to buy or sell any financial instruments. It is not our intention to state, indicate or imply in any manner that current or past results are indicative of future profitability or expectations. As with all investments there are associated inherent risks. Please obtain and review all financial material carefully before investing.

Disclosures:Invesco Advisers, Inc. is an Associate Advisor member of TEXPERS. The views expressed are those of the authors and do not necessarily represent those of Invesco or those of TEXPERS. This information is intended for US residents. All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This is not to be construed as an offer to buy or sell any financial instruments. It is not our intention to state, indicate or imply in any manner that current or past results are indicative of future profitability or expectations. As with all investments there are associated inherent risks. Please obtain and review all financial material carefully before investing.