Convertibles securities' hybrid structure has historically made for a compelling asset class in virtually any market environment. An outright allocation to convertible securities has the potential to provide investors with the best of all worlds – favorable asymmetry of returns through participation in upside momentum along with an important measure of downside protection.

The Creditflux CLO Hedge Fund Index, an index of CLO debt and equity tranche investment managers, ticked down notably in February (-2.2%) and more significantly in May (-6.0%). These were on the back of a 22-month string of positive returns that began in April 2020, after the initial brunt of the Covid-19 crisis.

Read More

Consensus for 75bps Increase in November, higher Terminal Rate in Intermediate Future

About a half a year has passed since we last updated you with our take on the bond market. Since then, the Federal Reserve has tilted even more hawkishly with 75bp rate increases in their attempt to combat inflation. Unfortunately, they have not made much headway, as August CPI data registered a gain of 8.3% year-over-year, with Ex Food and Energy CPI at 6.3%, both ahead of economists’ and market expectations. These high numbers are not what Fed Governors or the markets were hoping to see as the immediate reaction from both bonds and stocks was a quick sell-off. Making matters even more difficult is the reality that the “sticky” components of inflation, such as rent, posted its largest monthly increase in this cycle since 1986. Inflation on services also touched a new high, as medical care and transportation services helped drive gains. If not for drops in gasoline and other commodities, the latest inflation report would have been even hotter. We believe another 75bps rate increase is all but certain when the Fed meets later in September. While consensus is growing for an additional 75bps in November and a higher terminal rate in our intermediate future, the question becomes whether or not this scenario is fully accounted for in current prices.

Read More

Following a Strong 2021, 2022 Has Been a Tough Year For the Global Economy

Coming off a strong year for corporate earnings and economic growth in 2021, the global economy has been hit with myriad headwinds in 2022. The unfathomable sequence of events occurring in Ukraine is certainly top of mind. Beyond the horrific human tragedy, there has been a significant ripple effect on global commodity prices. This has added to already mounting inflationary pressures from ongoing supply chain problems and has led central banks around the world to expedite their rate hike plans in an attempt to get inflation under control.

Read More

In its earlier stages, the asset-backed securities1 (ABS) market securitized a relatively narrow market segment focusing on consumer-centric financial assets and targeted a narrow group of investors. That is no longer the case. Over the past decade, ABS has evolved substantially, surpassing other financial products in its ability to provide an attractive and diverse universe of investment opportunities. Importantly, the evolution and growing sophistication of ABS allows skilled investment teams to tailor portfolios to a growing investor base with a broad range of investment goals.

Read More

The speed and extent of further monetary tightening in the United States is uncertain, and as a result, there are concerns about the impact of rate hikes on future fixed-income returns. But we do not believe investors should be concerned, and this may even be a buying opportunity.

Read More

CHICAGO and LONDON, 7 September 2022 – Northern Trust’s Capital Market Assumptions (CMA) Report, a multi-asset class, five-year investment outlook updated annually, expects global private equity to lead five-year annualized returns at 9.6%. Global high yield and U.K. equities are expected to lead bond and stock returns, at 7.5% each. Returns are expected to be within a global growth environment that slows to 2.6% annually.

Read More

TEXPERS has a section on its website where it publishes requests for proposals, those public documents that announce a project and invite proposals from service providers.

Read More

Administrators and trustees of public retirement systems must act in the best interests of their beneficiaries, exercise good faith in their duties, seek professional services, and supervise those to whom functions are assigned. To put it simply - you're a leader.

Read More

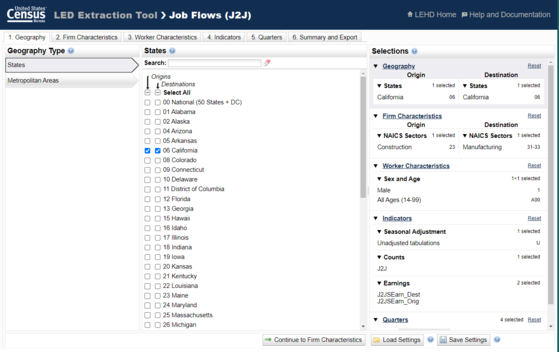

A newly revamped tool from the U.S. Census Bureau is available for TEXPERS members looking for job data.

Read More

Don't Forget to Celebrate Contributions of Our Hispanic Public Employees During National Observance

Hispanic Heritage Month in the United States runs from Sept. 15 to Oct. 15, celebrating the histories, cultures, and contributions of Hispanic citizens in the country.

Read More

On Sept. 20, 2022, Americans will celebrate National Voter Registration Day with a massive cross-country effort to register voters ahead of the midterm elections. Every eligible American voter should have the option to exercise their right to be heard at the ballot box. National Voter Registration Day is the right day to start by registering.

Read More

There are 1.07 million minority-owned firms in the United States with 9.3 million employees and $344.5 billion in annual payroll, according to the 2019 Annual Business Survey.

Read More

State Agency's Investments Committee Signals Intent to Request Funds to Report How Investment Portfolios are Structured

In its latest meeting, the Texas Pension Review Board's Investment Committee made it clear that it intends to request pension funds to report on how their investment portfolios are structured to meet real-time expectations for outflow benefit payments to retirees.

Read More

Pension Fund Administrator Accepts Executive Position With International Consulting Firm

Fort Worth Employees' Retirement Fund Executive Director Benita Falls Harper has announced her departure from the Fund to accept a new position. Her service with the Fund will conclude following the Board's monthly meeting on Sept. 28, 2022.

Read More

Tiffany White is the new executive director of the Texas Emergency Services Retirement System, according to an announcement on the state pension fund's website.

Read More

TEXPERS' office is closed in observance of Labor Day on Monday, Sept. 5, 2022. Labor Day is an annual celebration of American workers' social and economic achievements. Don't forget the impact of public employees on local communities.

Read More

Nearly 270 people attended TEXPERS' Summer Educational Forum, Aug. 21-23, 2022, in El Paso, located in the far western corner of the Lone Star State, bordering Mexico.

Read More

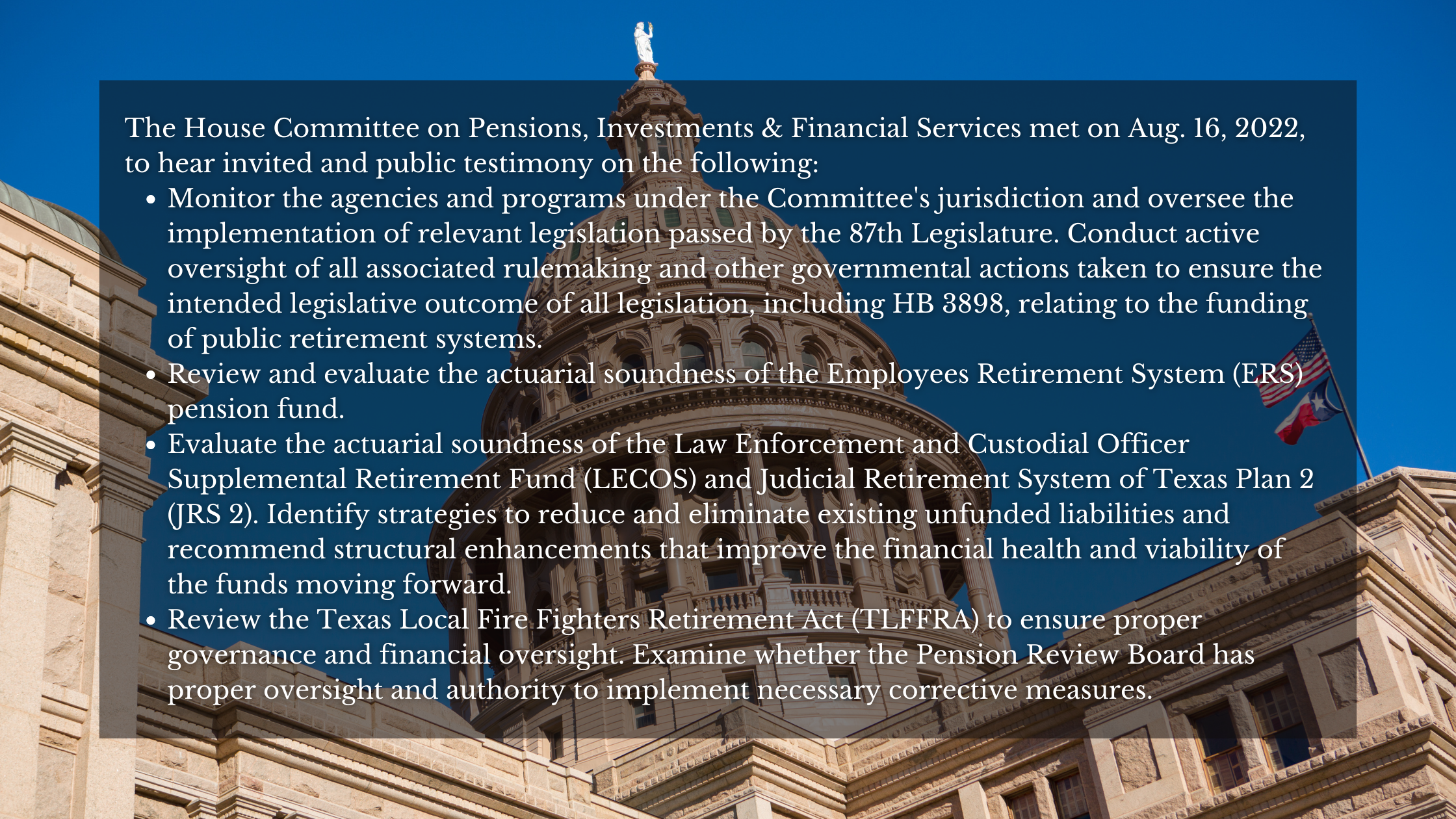

House Committee on Pensions, Investments & Financial Services Holds Aug. 16 Meeting

This report, compiled by TEXPERS legislative consultants and staff in attendance, is intended to give you an overview and highlight the discussions on the various topics taken up. It is not a verbatim transcript of the discussions but based on what was audible or understandable to the observer and the desire to get details out as quickly as possible with few errors or omissions.

Read More

Napier Park Global is Presenting as a Silver Sponsor During Upcoming Summer Forum

Napier Park Global is a Silver Sponsor of TEXPERS' 2022 Summer Educational Forum Aug. 21-23 in El Paso, Texas, and is sending Amit Sanghani, managing director and product specialist for the firm's global credit and real asset strategies.