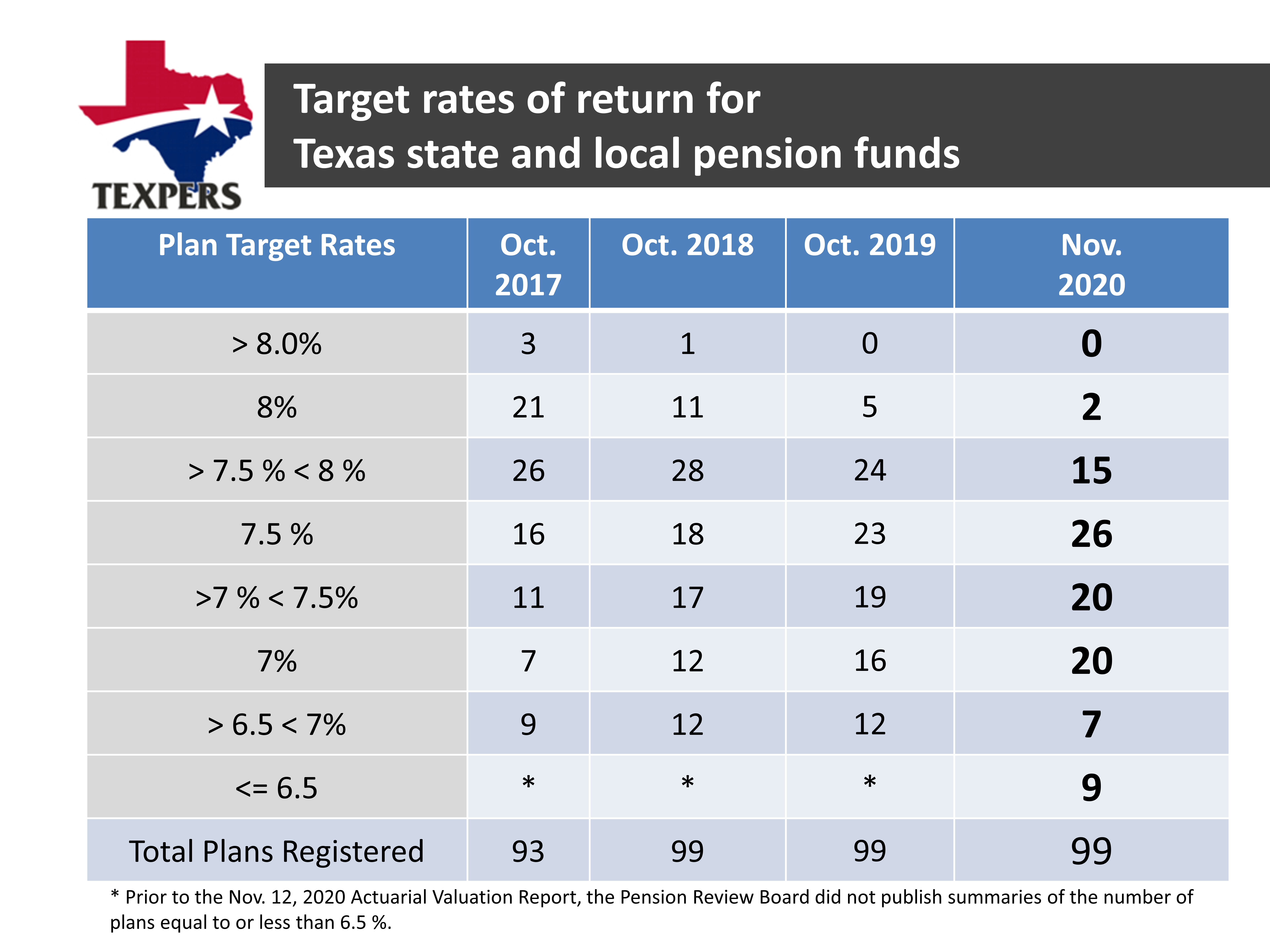

2020 SPECIAL REPORTTexas State and Local Pension Funds Hold Firm Despite COVID-19 PandemicPension funds for the retirement benefits of police, firefighters, and municipal employees show resilience in the face of COVID-19 challenges for investing and management The 99 state and local pension funds that report financial statistics to the Texas Pension Review Board combined in 2019-20 to nearly maintain the record-breaking achievements of 2018-19 in trend analysis of their aggregate amortization periods, according to a TEXPERS study of data released at the PRB’s Nov. 12, 2020 meeting. Forty-five pension systems for police, firefighters and municipal employees managed to remain in the PRB’s “recommended” amortization period of 0-25 years. Four systems moved into the infinite amortization category signaling a troubled fund, to bring the total there to 12, the largest amount since 2014. Four systems also seemed to move from the 0-15-year amortization period category to the 15-25-year category, a slight deterioration. The bulk of systems in the 25-40-year category remained the same as 2019 at 29. The amortization period, which can be compared roughly to the years left to pay on a home mortgage, is the PRB’s single “most appropriate” measure of public retirement systems’ health.* However, this report seeks to advise that amortization periods are certainly not the only measure of pension fund health, and the Pension Review Board in recent years has developed other tests to trigger “Intensive Reviews.” These PRB evaluations help detect whether certain signs might be warning of more worrisome amortization period changes ahead. Target Rates Continue Lower The Pension Review Board’s November 2020 Actuarial Valuation Report also confirmed pension funds’ continuing downward adjustment of target, or discount rates. Last year, for the first time in at least 10 years, no Texas pension fund reported a target rate of return above 8 percent. The trend continued in 2020 as only two systems had an eight 8 percent target. Even more indicative of this trend toward downward, more conservative revisions, there are nine pension systems with targets of 6.5 percent or lower. PRB staff noted that Texas’ 99 systems are at or nearing a 7.25 percent average.

Lowering system target rates helps pension systems manage their investments in more conservative ways, but sometimes require additional contributions from public employees and/or their governmental-employer sponsor. The Pension Review Board has informally advised systems that lowering target rates will help them align their forecasts to the guidance from industry experts that domestic and global capital markets will have generally lower returns for the foreseeable future. TEXPERS Summaries:

TEXPERS Executive Director Art Alfaro offered the following comments: “Holding steady near last year’s best-ever trend data for the aggregate health of Texas’ state and local pension funds is notable given the economic challenges caused by the COVID-19 pandemic. System governance and asset diversification paid off in this truly unusual test year.

“The continuing compelling finding of this report is the fact that amortization periods are holding mostly steady despite systems’ continuing efforts to lower their targets for investment returns. Pension systems are doing everything they can to present conservative estimates to their city sponsors so that every retirement benefit is secure.”

Art Alfaro may be reached for comment by emailing Joe Gimenez at [email protected] or calling him at 713.478.8034. A press release is available at http://www.texpers.org/2020_am_period_press_release and graphics are available at www.TEXPERS.org/2020_Am_period_charts. _______________________________________________________________________________________ * The PRB defines amortization period as “the length in time, in years, needed to pay for the unfunded actuarial accrued liability (UAAL) and reflects a system’s ability to pay its normal cost plus UAAL.” UAAL is the present value of benefits earned to date that are not covered by plan assets and normal cost is the portion of cost of projected benefits to the current year. See the PRB’s “Summary: Study of the Financial Health of Texas Public Retirement Systems,” December 2014, page 2. http://www.prb.state.tx.us/files/reports/financial_health_study_summary.pdf

|