|

|

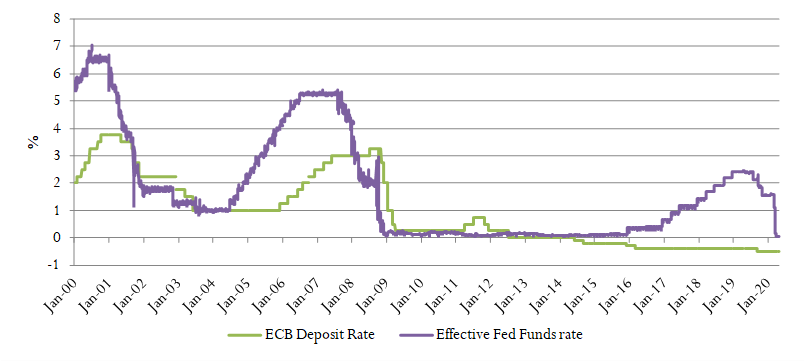

In what is perhaps his most famous novel, The Unbearable Lightness of Being, author Milan Kundera explores many of the deepest questions of happiness and meaning of life taking place in the background of the Prague Spring and subsequent Soviet invasion of Czechoslovakia in 1968. While the three main protagonists do their best to escape the destructive geopolitical events happening around them, this effort is in the end futile. European banks have resorted to similar futility in the face of long period of low rates. In the years following the Global Financial Crisis (GFC), central banks in developed economies (most notably Europe, the US and Japan) have kept the policy rates at or close to zero. This alignment began to change in 2015 with the US Fed starting to hike rates while the European Central Bank (ECB) and later the Bank of Japan (BoJ) policy rates have dipped into the negative territory for the first time, where they still remain. While the Fed and the Bank of England (BoE) have slashed rates following the outbreak of COVID-19, they have not yet joined the ECB and the BoJ in the negative interest rate policy (NIRP) territory. But that should be of little comfort to banks who know they have to prepare for an extended period of low interest rates ahead. In this report we examine what are the tools available to banks to make the best of what is not an ideal situation. |

Chart: ECB Deposit rate vs effective Fed funds rate

|

|

In theory, the bank management teams are expected to react to the low interest rate environment by actively managing their business lines. In practice, the actual response depends on whether or not the environment is perceived to be long-lasting. And this is perhaps where central banks themselves have been guilty of overoptimistic guidance – even if unintentially so. Based on central bank guidance, the normalization of rates has been a few quarters away for some time now – but in the case of the ECB we have not seen a rake hike in almost ten years. The discussion of normalization of rate levels may have given European bank management teams false hope that things were going to return back to normal, therefore postponing the necessary restructuring initiatives. Yet one can argue (admittedly with the benefit of hindsight) that the persistent low rate environment was all too predictable and hence bank management teams should have been preparing for rates to be ‘low for longer’ for quite some time. Ultimately it is the job of bank’s senior management teams to make long term strategic calls and they are, for the most part, very well compensated for this. Yet based on our research and works cited in this publication, their track record is at best mixed. Impact on business models and bank riskAccording to a Bank for International Settlements (BIS) 2019 study[1], low interest rates affect bank intermediation margins, though it is not necessarily a linear relationship. The impact of low rates depends on the sensitivity and adjustment speed of loan and deposit rates to market rates (re-pricing lag effect). For a given deposit rate, banks would tend to pass on lower interest rates to lending rates, particularly to customers with other financing options. All else equal, this compresses interest margins. Finally, since deposit rates are priced as a markdown on market rates, reductions in this markdown will squeeze the bank interest margin (retail deposit endowment effect), according to the BIS study. Lower interest rates also affect any profits generated in the non-retail segment[2]. Bank profits on security portfolios are expected to increase in low interest environments through higher stock and bond valuations[3]; this, of course, is just a one-off effect unless banks increase their exposure and trading activities. Bank fees and commissions, linked to lending and deposit activities (e.g. credit lines, transaction services) or investment banking-type activities (e.g. securities brokerage, trading, market making), may increase in low interest environments if there is more demand for such services. For a given level of risk, banks would have incentives to shift activities away from the loan segment to other businesses (e.g. securities underwriting, trading, or insurance). Banks may also reduce their lending activity and expand to other higher-yielding activities so as to meet the minimum profit constraints of shareholders if they prefer market share over profits[4]. For given macroeconomic conditions, lower interest rates should translate to lower loan losses. True, low rates may induce more risk-taking on new loans through the risk-taking channel[5]. But lower interest rates reduce the default probability of variable-rate loans, by decreasing debt servicing burdens. Since the stock of variable-rate loans is bound to be considerably larger than the flow of new loans, and the results of risk-taking are likely to take a long time to emerge, the overall impact of low interest rates on loan losses should be positive. Moreover, loan losses can also be lower because banks can more easily “extend and pretend” troubled loans given that the debt servicing cost is much more manageable in a low rate environment. Impact on funding structureZero interest rate policy (ZIRP) and NIRP may lead banks to rethink their funding structure. For example, in the past, deposits tended to be some of the cheapest sources of funding for a bank (especially checking / demand deposits on which banks paid zero interest in the past even when the policy rates were higher). But this is no longer the case in Europe as banks may borrow from the ECB under the Targeted Long Term Repurchase Operation (TLTRO) at a rate of negative 1% assuming they do not shrink their lending to the SME sector. In a low rate environment, every basis point is crucial and so banks need to continually re-evaluate their funding structure to get the most out of it, leaving no stone unturned. In part two, coming in October, we'll examine the impact of low rate on banks' risk appetite and equity values. |

| References:[1] Bank intermediation activity in a low interest rate environment, Bank for International Settlements, 30 August 2019[2] Borio, C, L Gambacorta and B Hofmann (2017): “The effects of monetary policy on bank profitability”, International Finance, vol 20, pp 4 63. Also available as BIS Working Papers, no 514, October 2015.[3] Bernanke, B and K Kuttner (2005): “What explains the stock market's reaction to Federal Reserve policy?”, Journal of Finance, vol. 60, no 3[4] Baumol, W (1959): Business behavior, value and growth, New York: Macmillan.[5] Borio, C and H Zhu (2012): “Capital regulation, risk-taking and monetary policy: a missing link in the transmission mechanism?”, Journal of Financial Stability, vol 8, no 4, pp 236–51. |

About the Author: Ivan Zubo is Head of Research with Financial Services Capital. He joined FSC in 2020 from HSBC where he oversaw the European banks credit research team. During his time at HSBC, he built a top ranked research practice as noted by various industry and investor surveys, including Euromoney Fixed Income Research Survey’s No. 1 ranking for four straight years from 2016-2019. Prior to HSBC, Ivan held positions at BNP Paribas, Morgan Stanley and Darby Private Equity. He earned his BBA from Southern Methodist University, majoring in Finance and his MBA from Columbia Business School. About the Author: Ivan Zubo is Head of Research with Financial Services Capital. He joined FSC in 2020 from HSBC where he oversaw the European banks credit research team. During his time at HSBC, he built a top ranked research practice as noted by various industry and investor surveys, including Euromoney Fixed Income Research Survey’s No. 1 ranking for four straight years from 2016-2019. Prior to HSBC, Ivan held positions at BNP Paribas, Morgan Stanley and Darby Private Equity. He earned his BBA from Southern Methodist University, majoring in Finance and his MBA from Columbia Business School. |

| Financial Services Capital is an Associate Member of TEXPERS. This Article is not an offer to sell, or an invitation for an offer to acquire, an interest in any investment, nor is it an invitation to apply to participate in any investment. This Article is not an offering or placement of interests in any investment in any jurisdiction, and should not be construed as such. Follow TEXPERS on Facebook, Twitter and LinkedIn as well as visit our website for the latest news about Texas' public pension industry. |

Sep

21

Share this post: